The Renewables MMI (Monthly MetalMiner Index) began showing signs of a possible reversal month-over-month, edging up 3.42%. Renewable resources, meanwhile, continue to see significant global investment. MetalMiner noted in its Raw Steels MMI that steel prices found a bottom month-over-month. This impacted the renewable resources index heavily. After all, much of the index consists of […]

Category: Environment

India Passes $2.3 Billion Renewable Energy Bill

India has a new plan to reach its renewable energy goals, but it isn’t going to be cheap. However, if India wants to attain its net zero carbon emissions goal by 2070, the country needs to accelerate its efforts. For starters, it can’t just decarbonize the energy sector, but also other industries such as steel, […]

Renewables/GOES MMI: Steel Plate Drops While Battery Metals Hold Strong

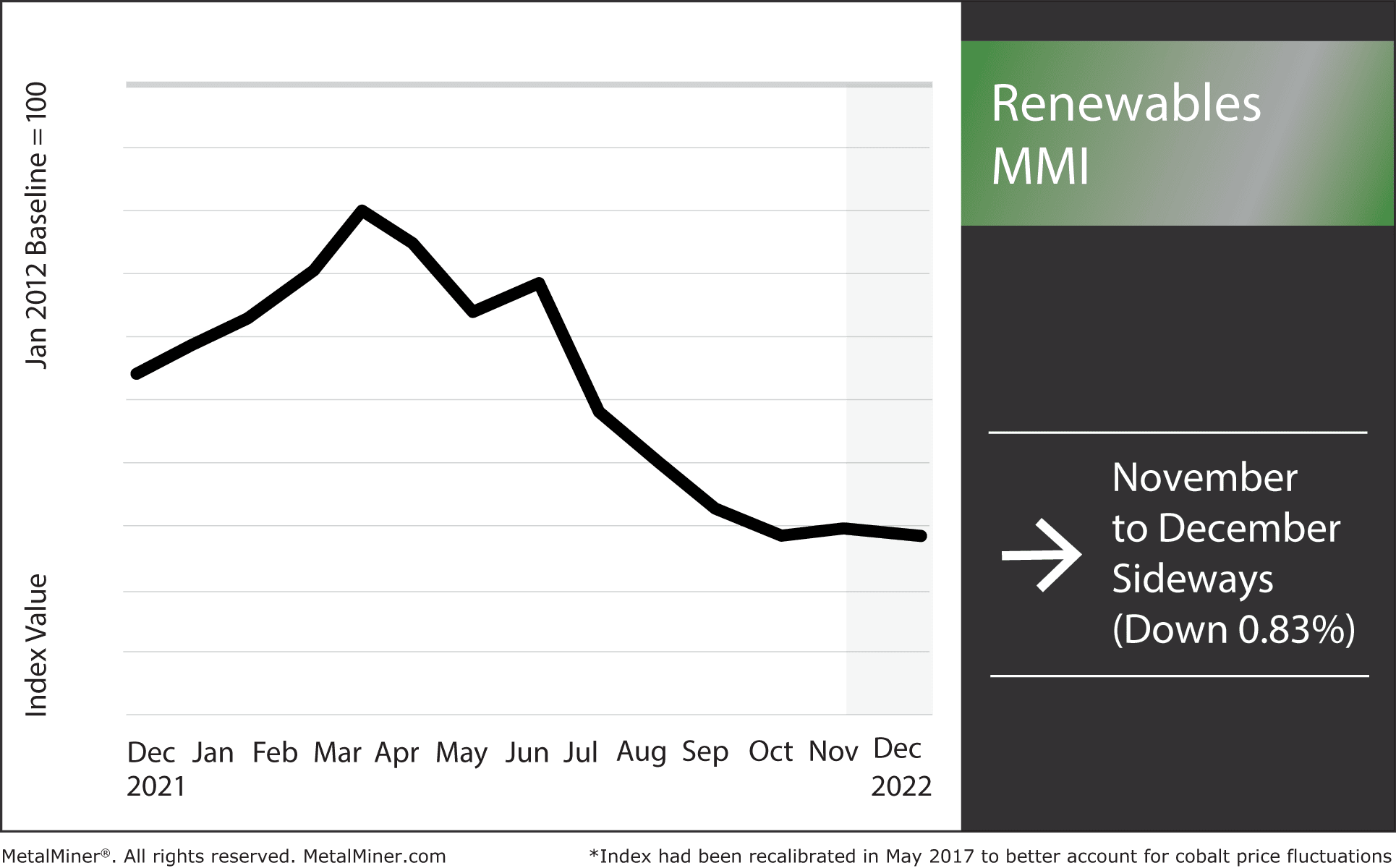

The December Renewables MMI (Monthly MetalMiner Index) traded sideways, practically in a straight line. Overall, metal prices within the index only dropped 0.83%. This sideways trend contrasts sharply with the steep drop renewables saw just six months ago. Battery metals within the index, such as cobalt and silicon, held a steady sideways trend, only rising […]

Rare Earths MMI – Chinese Supply Stifled and “Dirty” Mining

The September Rare Earths MMI (Monthly MetalMiner Index) fell drastically by 9.87%. Alternatives to Chinese Rare Earths In last month’s MMI, MetalMiner reported how nations all around the globe were searching for alternatives to rare earth exports from China. After all, the ongoing Chinese property crisis and limited industrial output continue to strain the country’s […]

US Charges Towards Green Energy

The US seems well on its path to green energy. President Joe Biden recently signing into law the biggest clean energy investment in US history. The package includes $370 billion in subsidies for solar and wind energy development, electric vehicles, etc. Taking a cue, the United States Steel Corporation (U.S. Steel) and Shell US Gas […]

France Takes Emergency Measures to Promote Renewable Energy

Rare earths and renewable energy are two sectors that almost every country races to dominate. One of these nations, France, takes serious strides towards this goal. Recently, the French government announced an emergency measures package to hasten renewable energy development. Rising infrastructure costs recently pushed the French government towards this decision. Along with the rest […]

Renewables/GOES MMI: Renewable Resources and the “Surprise Climate Bill”

The Renewables MMI (Monthly Metals Index) continued its downward trend this month, falling an additional 7.10% between July and August. However, this trend is not likely to continue if the US senate passes the so-called “surprise climate bill.” Were this to happen, it would put fresh focus on renewable resources, likely causing the MMI adopt […]

Battery Metals For EVs: Demand Surges, but Can Recycling Keep Up?

With the surge in demand for electric vehicles, the need for EV batteries and battery metals such as cobalt and lithium has risen dramatically. However, can the US (along with other nations) keep up with this rising battery metal demand while maintaining recycling efficiency? It’s a good question, but it doesn’t have a simple answer. […]

Copper MMI: LME copper prices slide ahead of Fed rate hike

Copper prices rebounded sharply after declines in early May. While prices continue to find a bottom on a macro scale, they remain sideways in the short term. As a result, copper has been unable to establish a clear direction, either bullish or bearish.The Copper Monthly Metals Index (MMI) fell by 2.89% month over month. Copper […]

On the heels of COP26, India aims to expand renewable energy projects

In line with India’s commitment at the COP26 summit in Glasgow last year, the country aims to reach net-zero by 2070. Furthermore, India seeks to meet 50% of its energy needs by 2030 through renewable sources and expand non-fossil fuel power generation capacity to 500 GW in this decade. In light of these targets, the […]