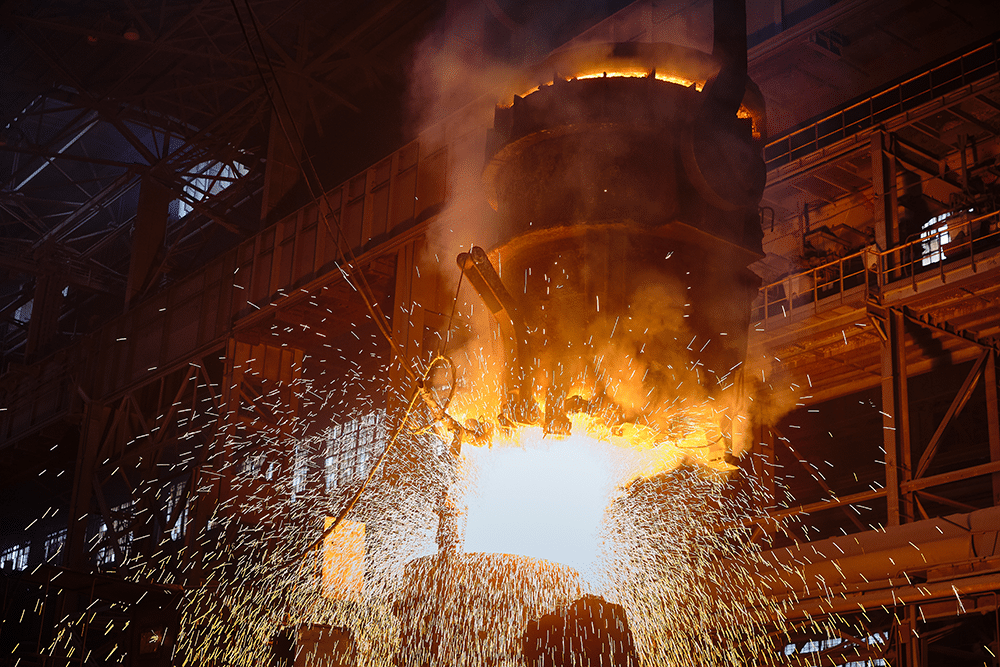

Data from the World Steel Association (Worldsteel) released on January 25 indicates that global crude steel production remained largely unchanged year on year. Indeed, steel market analysis says poured liquid steel totaled 1.88 billion metric tons last year, which is similar to the volume poured in 2022. The association also stated that crude steel production […]

Category: Ferrous Metals

Automotive MMI: Hot-Dipped Galvanized Prices Flatten, EV Market Moving Too Quickly?

All components of the Automotive MMI moved sideways or down month-on-month. Moreover, January saw prices flatten out across the steel market, causing hot-dipped galvanized steel prices to trend close to support zones. Meanwhile, China’s wavering economy continues to prove a concern for global markets because the country is such a large steel demand driver. Many […]

Is China’s Surge in Crude Oil, Coal, and Iron Ore Imports Really a Sign of Economic Strength?

News coming out of China indicates the country set new records in 2023 for the import of crude oil, coal, and iron ore. The revelation caught many by surprise, but analysts caution that this may not really signify a robust demand for these essential materials. Nor does it indicate that there has been any reversal […]

Steel Manufacturing: Uncertainty Looms as Liberty Steel Ostrava Workers Delay Return

Workers at flats producer Liberty Steel Ostrava in the Czech Republic did not return to work on January 16, despite local media reports stating that workers agreed to resume working on this date. The Daily Denik noted that there were a couple of other “return dates” set for the steel manufacturing plant, including January 3 […]

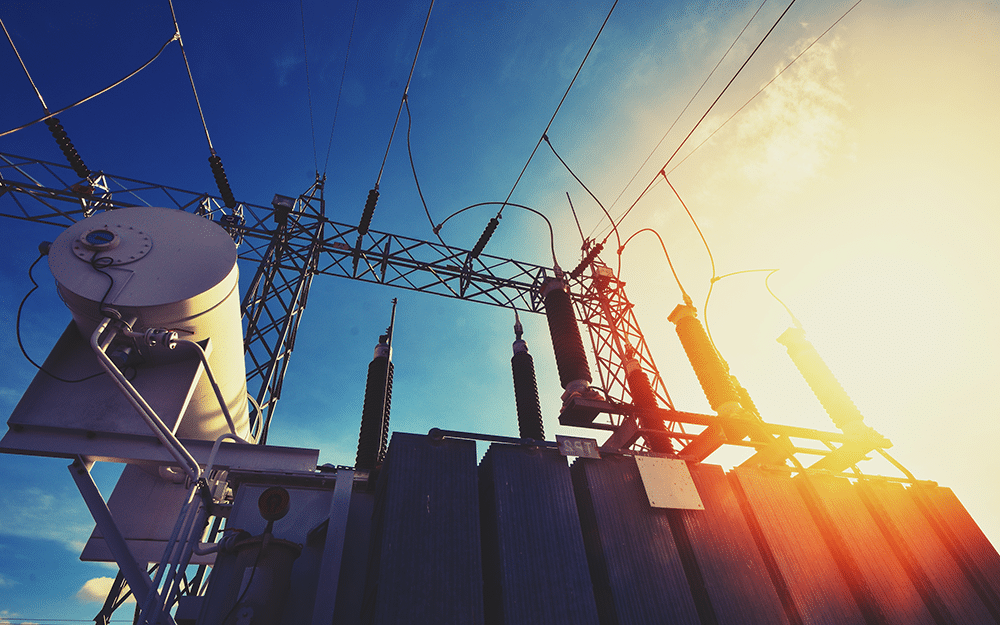

Renewables/GOES MMI: U.S. Transformer Shortage Pain Continues into 2024

The Renewables index began 2023 fairly sideways. However, it broke that trend in Q3 and Q4 when it edged downward. Numerous components of the index, including silicon and cobalt, experienced market oversupply. This caused prices to drop and pulled the index down with it. Grain oriented electrical steel also experienced market volatility in Q3 and […]

India US Trade Leaders Ease Duties, Forge Steel & Aluminum Export Harmony

India US trade is primed to shift. Both countries seem eager to enter a new period of trade harmony, as India’s Ministries of Mines and Steel, along with the Department for Promotion of Industry and Internal Trade (DPIIT), recently set up an in-house system to oversee the export of steel and aluminum products to the […]

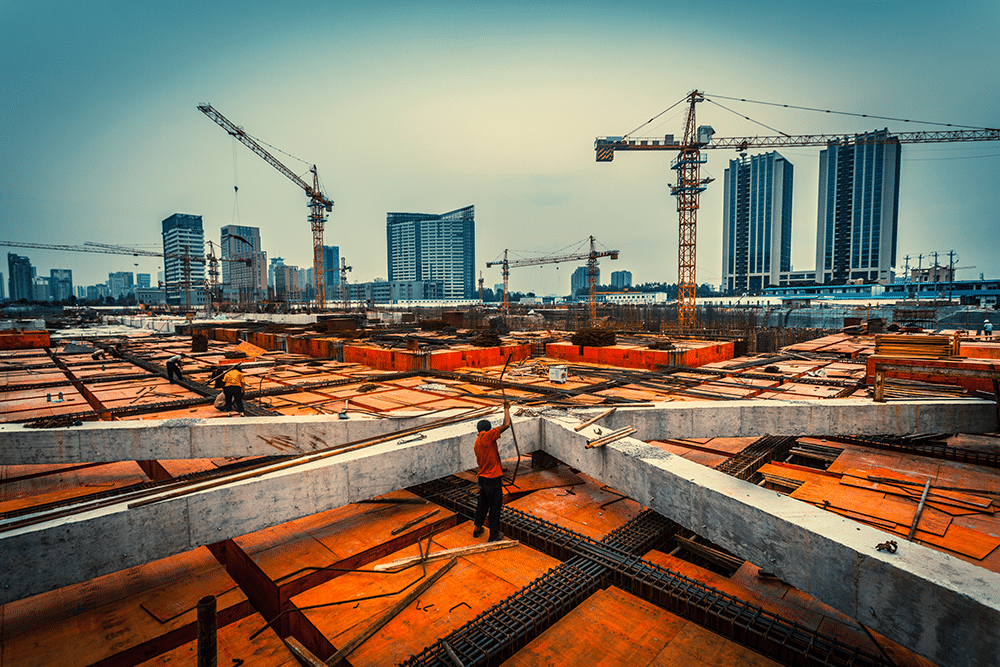

Construction MMI: Construction News Puts Infrastructure on Top for 2023

After a mostly sideways 2023, the Construction MMI (Monthly Metals Index) also entered 2024 sideways with only a small 2.5% increase. Furthermore, all index components except for European aluminum commercial 1050 sheet and shredded scrap steel moved in a sideways price trend. Meanwhile, construction news sources indicate that infrastructure projects proved to be the top-performing […]

Raw Steels MMI: Steel Prices Weak Amid Backwardation

The Raw Steels Monthly Metals Index (MMI) rose 3.25% from December to January. U.S. flat rolled steel prices closed the year decidedly bullish. A nearly 14% month-over-month rise saw HRC prices easily outperform all base metals both during the month and throughout 2023 as a whole. Meanwhile, plate prices saw an upside correction after prices […]

Automotive MMI: Index Rises & Outlook for 2024

While the index remained sideways for most of 2023, the automotive industry itself witnessed its fair share of shifts. For instance, the UAW strike forced numerous changes on the automotive industry while impacting automobile sales and production to varying degrees. Meanwhile, steel price hikes also caused the overall index to fluctuate and shift. All in […]

UK to Impose Carbon Tax for Steel and Aluminum Production

HM Treasury recently announced that the UK plans to enact a carbon tax on certain metals and natural resource imports into the country by 2027. The December 19 announcement said that steel, aluminum, and iron ore will be subject to the tax. This tax is currently known as the Carbon Border Adjustment Mechanism (CBAM). “Goods […]