The Raw Steels MMI (Monthly Metals Index) increased 7% this month, reaching 92 points. This reading is the highest since June 2012. The skyrocketing MMI came as a result of sharp increases in steel prices, the Section 232 release and President Trump’s comments regarding imposition of a 25% steel tariff.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Steel price momentum strengthened in February, moving sharply up for all forms of steel. Steel prices have reached more than three-year highs. However, some forms of steel are now even higher. Domestic HRC prices, currently at $762/st, haven’t seen these levels since June 2011.

[caption id="attachment_90758" align="aligncenter" width="580"]

Based on the long-term analysis, steel prices will likely continue to rise this year. Even if the seasonality for steel prices returns in Q2, steel price momentum appears strong.

Let’s Talk Spreads

Section 232 — and the price uncertainty it has unleashed — requires metal-buying organizations to pay more attention to what is called the spread. The spread refers to the price delta between domestic HRC and CRC prices and the spread of each with Chinese prices. Analyzing and understanding these spreads helps to determine by how much mills could increase steel prices (as well as how high they can go).

So, let’s take a look at some examples.

The Domestic HRC-CRC Spread

As with all the other forms of steel, CRC prices also increased again this month. The upward movement remains strong, even if the amount of the increases — and therefore the slope of the upward trend — appears softer (less sharp).

This does not come as a surprise, as the spread between CRC and HRC prices was extremely high. Now, the spread between CRC and HRC prices has returned closer to historical levels.

[caption id="attachment_90759" align="aligncenter" width="580"]

It is important to understand where the spread comes from. CRC (cold rolled coil) is HRC (hot rolled coil) plus one additional rolling process. As per the chart above, from 2011 to 2016 the price spread between the two has been around $100/st (plus or minus).

At the end of 2016, buying organizations could see a $201/st spread between HRC and CRC prices. The spread started to decline at the beginning of 2017, and has increased further in 2018. The domestic spread is currently at $124/st, much closer to its historical levels. (MetalMiner covered domestic spreads in our free Annual Outlook Report published in October 2017.)

A higher spread creates better margins for domestic mills. From a buying perspective, the previous anomaly only helps a buying organization that has not contracted for all of its CRC purchases (and can play a price arbitrage game by purchasing HRC and paying to roll it to CRC).

Chinese Spread

Chinese demand has always been positioned as one of the main drivers of global steel prices. Check out the correlation in the graph below between the domestic HRC and Chinese HRC prices. When Chinese prices increase, U.S. domestic prices tend to increase, too. The same is usually true when prices fall.

[caption id="attachment_90760" align="aligncenter" width="580"]

Even if short-term events (such as the release of the Section 232 report or President Trump’s comments) add support to steel prices in one country, the general trends tend to correlate.

This is exactly what happened with U.S. HRC prices.

The latest increase in HRC prices here in the U.S. came as a result of the Section 232 uncertainty and the announcement of the tariff. Not surprisingly, so far this month, HRC prices in China increased after trading sideways last month. Therefore, watching price reactions in China makes sense in order to better forecast price trends in the U.S.

An analysis of the spread between Chinese and U.S. prices allows buying organizations to better understand the price impacts the tariffs could have on domestic steel prices. In other words, the spread tells us how much domestic prices could rise before it is better to import steel from China.

What This Means for Industrial Buyers

The strong upward momentum for steel, together with the Section 232 outcome and President Trump’s comments regarding steel tariffs, drove steel prices to more than three-year highs. Buying organizations who have concerns about the Section 232 impact on the steel industry may want to read our Section 232 Report.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Raw Steel Prices and Trends

Category: Premium

Renewables MMI: U.S. Steel Plate Surges, Cobalt Could be Getting Costlier

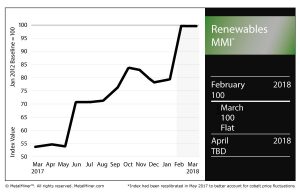

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index), after a significant surge last month, sat at 100 for the second consecutive month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within this basket of metals, the Japanese steel plate price rose, as did the price of Chinese and American steel plate. U.S. steel plate, in fact, rose 5.5% month over month.

U.S. grain-oriented electrical steel (GOES) coil also jumped in price.

As for the trio of rare and minor metals in this MMI, cobalt cathodes fell 1.1%, while silicon dropped slightly and neodymium made a small gain.

Cobalt Costs

According to a report by the Financial Times, changes to the mining code in the Democratic Republic of Congo will lead to higher costs for consumers of the metal.

According to the report, President Joseph Kabila on Wednesday said he would sign a new order after meeting with representatives from some of the big miners with business in the country, including Glencore, Molybdenum and Ivanhoe Mines.

Cobalt is used in batteries for electric vehicles (EVs), among other things, making it an especially prized material as EVs gain popularity. As such, with a majority of the world’s cobalt being mined in the DRC, political machinations in the country have a significant impact on the metal’s price.

According to the Financial Times, the code could see royalties on cobalt — plus other metals, like copper and gold — rise from 2% to 10%.

Senators Lobby for Electrical Steel Protection in 232

The Journal-News reported on a trio of U.S. senators who lobbied Trump to prioritize electrical steel in the Section 232 trade remedy process.

The only remaining maker of electrical steel in the country, AK Steel, was unlikely to benefit from the Section 232 trade remedy proposal, according to Sen. Rob Portman (R-OH).

In the senators’ letter, they requested the president add a trio of HTS codes to the duty order.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Rare Earths MMI: Toyota Develops Neodymium-Reduced Magnet

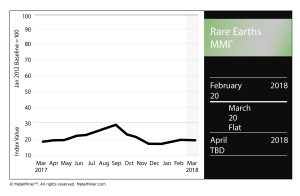

The Rare Earths MMI (Monthly Metals Index) held steady, notching a reading of 20 for our March MMI.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Chinese yttrium dropped slightly, while terbium metal picked up in price.

Europium oxide also dropped slightly, while dysprosium oxide picked up an extra dollar per kilogram.

New Toyota Magnet Not Dependent on Some Rare-Earth Minerals

According to a report by Ars Technica, a new magnet developed by automaker Toyota will not be dependent on some key rare-earth minerals.

Toyota announced it had invented a magnet — for application in electric vehicles — that uses much less of the rare-earth mineral neodymium. According to Toyota, it had developed “the world’s first neodymium-reduced, heat-resistant magnet.”

Of course, cost is a major restraining factor when it comes to electric vehicle (EV) growth. Materials needed for EV batteries, like neodymium, are costly, and many battery makers have sought to reconfigure the percentages of metals used in their batteries to phase out more cost-prohibitive materials (like cobalt, for example).

In addition to reducing the use of neodymium, the new magnet also completely phases out two other rare earth minerals.

“The newly developed magnet uses no terbium (Tb) or dysprosium (Dy), which are rare earths that are also categorized as critical materials necessary for highly heat-resistant neodymium magnets,” according to the Toyota statement. “A portion of the neodymium has been replaced with lanthanum (La) and cerium (Ce), which are low-cost rare earths, reducing the amount of neodymium used in the magnet.”

According to the announcement, the new magnet reduces the amount of neodymium used by as much as 50%.

Europium Market to Hit $308.9M by 2025

The global europium market is set to hit a value of $308.9 million by 2025, according to a recent report by Reportbuyer.

According to the report, consumer electronics, automotive, semiconductors, and energy and mining are the sectors leading the charge in the growth of europium.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Metal Prices and Trends

Construction MMI: Spending Flattens as Industry Awaits Tariffs Decision

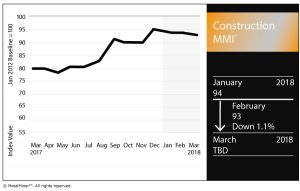

The Construction MMI (Monthly Metals Index) dropped one point this month, falling to 93 for our March reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals for the Construction MMI, Chinese rebar and H-beam steel prices dropped on the month. Meanwhile, U.S. shredded scrap steel rose 8.4% on the month, while European commercial 1050 sheet fell 3.0%.

Chinese aluminum bar also fell, dropping 1.0% month over month.

U.S. Construction Spending

Construction spending during January 2018 was estimated at a seasonally adjusted annual rate of $1,262.8 billion, up minimally from the revised December estimate of $1,262.7 billion, according to the Census Bureau.

The January figure, however, was up 3.2% from January 2017’s $1,223.5 billion.

Under the umbrella of private construction, residential construction was at a seasonally adjusted annual rate of $523.2 billion in January, 0.3% above the revised December estimate of $521.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $439.6 billion in January, 1.5% below the revised December estimate of $446.2 billion.

As for public construction, the estimated seasonally adjusted annual rate of public construction spending was $300.1 billion, 1.8% above the revised December estimate of $294.8 billion.

Within that, educational construction was at a seasonally adjusted annual rate of $76.7 billion, 2.1% above the revised December estimate of $75.2 billion. Highway construction was at a seasonally adjusted annual rate of $92.6 billion, 4.4% above the revised December estimate of $88.8 billion.

Construction and Tariffs

Just like other metal-using sectors, the construction industry would also be impacted by President Trump’s announced steel and aluminum tariffs (especially steel).

Trump’s announcement came just over a month after Trump proposed $1.4 trillion in infrastructure investment over 10 years.

For a construction industry that saw spending flatten in January, a rise in materials costs would not be great news, should the tariffs become the law of the land.

According to Philip Gibbs, an analyst at KeyBanc Capital, the tariffs might give steel stocks a short-term “sugar high,” he told Reuters, but that unsustainable pricing could eat into demand from manufacturers.

The National Association of Homebuilders (NAHB) came out against the tariffs proposal, with the association’s chairman saying the tariffs would hurt consumers and make housing less affordable.

“It is unfortunate that President Trump has decided to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports,” said Randy Noel, chairman of the NAHB. “These tariffs will translate into higher costs for consumers and U.S. businesses that use these products, including home builders.

“Given that home builders are already grappling with 20 percent tariffs on Canadian softwood lumber and that the price of lumber and other key building materials are near record highs, this announcement by the president could not have come at a worse time.”

Of course, the metals world is still in wait-and-see mode regarding the tariffs, which have yet to become actual law.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Copper MMI: Prices Retrace as U.S. Dollar Firms

The Copper MMI (Monthly Metals Index) traded lower this month, falling two points to 87 for our March reading.

The Copper MMI fell for the second consecutive month, after the sharp increase in prices at the end of last year. In February, LME copper prices fell by 3.5%.

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

The LME copper short-term downtrend does not seem that bearish when looking at the two-year chart. Copper prices retraced this month again, but still hold above the blue dotted line, which represents the trend line (prices below that line might indicate a change in trend). In December, copper prices skyrocketed and breached the $7,000/st level, confirming long-term bullish sentiment remains intact.

[caption id="attachment_90695" align="aligncenter" width="580"]

Meanwhile, this month, a stronger U.S. dollar added downward pressure to commodities and industrial metals. Analysts also claim the latest “bearish” downtrend occurred due to increasing LME stocks.

MetalMiner analyzes copper supply from two different perspectives: copper stocks and global copper supply.

Copper Stocks

Copper stocks at the major metal exchanges totaled 537,722 tons at the end of November 2017, reflecting a decrease of 0.3% from stocks in December 2016. In particular, LME stocks fell by 41%, while SHFE stocks increased by 12% in 2017.

However, 2018 has come with some recoveries for LME copper stocks.

Copper stocks are at a current 324,900 tons. This means LME copper stocks are 13,075 tons higher than at the beginning of 2017, and 85,500 tons higher than at the beginning of 2016.These numbers show some recovery for LME copper stocks; this information has likely fueled trading sentiment this month.

CME stocks also increased at the beginning of the year. In 2015, CME stocks were just at 20,000 tons, compared to the current 209,000-ton level. Both of these numbers (CME and LME stock levels) have moved trader sentiment.

Global Copper Supply

The Indonesian unit of Freeport-McMoran’s copper mine and Amman Mineral Nusa Tenggara (AMNT) are waiting for last-minute ministry approvals to their application for an extension to continue with copper concentrate exports. Freeport’s export order for the Grasberg mine expires this month (copper mines have to reapply for export licenses every year).

Freeport had an export quota of 1.1 million tons of copper ore concentrate ending February 2018. Exports could stop this month, but mine production could continue.

Meanwhile, the Chinese Ministry of Environmental Protection has tightened the “allowable” impurities levels further. Therefore, instead of importing scrap, China now imports unwrought copper for downstream production.

Copper supply also looks threatened in Chile and Peru, particularly if workers go on strike since labor contracts expire soon. The powerful labor union at the Escondida copper mine cast doubt on the chances of starting talks on a new labor agreement with the company before formal negotiations commence in June.

Global copper supply still shows some uncertainty with possible copper supply shortages coming in 2018. Therefore, buying organizations may want to understand the global picture rather than just considering the trend based on stock levels and actual copper supply.

What This Means for Industrial Buyers

In February, buying organizations had some opportunities to buy some volume. As long as copper prices remain bullish, buying organizations may want to buy on the dips. For those who want to understand how to reduce risks, take a free trial now to the MetalMiner Monthly Outlook.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Copper Prices and Trends

Global Precious MMI: Will Drop in Platinum, Palladium Prices Continue?

Our Global Precious Monthly Metals Index (MMI), tracking a basket of precious metals from across the globe, floated back down 3.3% after a two-month uptrend.

Section 232 buying strategies – grab your copy of MetalMiner’s Section 232 Investigation Impact Report for only $74.99!

Last month, as my colleague Fouad Egbaria wrote, the platinum-palladium relationship began to reflect its traditional historical dynamic. This month, that trend continues for the two platinum-group metals (PGMs), with U.S. platinum falling 3.6% and U.S. palladium falling 4.2% — below $1,000 per ounce to start the month for the first time since November 2017.

The backdrop of President Trump announcing tariffs on steel and aluminum imports late last week — with more specifics yet to come, continuing an uncertain climate — has forced a broader commodity selloff, which has swept precious metals such as gold into its current, according to Michael Kosares, founder of gold broker USAGOLD, as quoted in a MarketWatch article.

“Once we get through the initial reaction, gold’s appeal as an inflation hedge will likely reassert itself,” he is quoted as saying.

Concerns arose over whether other industrial metals also would get hit as a result of the steel and aluminum tariffs announcement, including precious-metal workhorses platinum and palladium.

“The announcement raised fears there could be retaliation and hit the price of stocks and all industrial metals,” said Phil Flynn, senior market analyst at Price Futures Group, as quoted in the MarketWatch article. There’s also “fear that higher costs for cars could reduce demand” for the metals, according to the article.

So, where will the platinum-palladium trend go from here?

PGM Spotlight

Although both platinum and palladium may see a slightly extended cooldown in the near term, the longer term could see more price increases — especially for the latter metal.

Broader supply-demand market fundamentals look to underpin the two metals’ movements into the next year and beyond. According to Johnson Matthey, as reported by Reuters, platinum looks to be headed for another surplus in 2018. (Last year’s oversupply clocked in at 110,000 ounces.)

“Before accounting for investment, we expect global platinum consumption to rise slightly,” Reuters quoted Johnson Matthey as saying. “However, this will be matched by a modest increase in combined primary and secondary supplies, mainly due to rising recoveries from autocatalyst scrap,” it said. “Assuming that investment demand in 2018 is similar to last year, the market is likely to remain in modest surplus,” the firm added, according to Reuters.

On the palladium front, the market was expected to remain in deficit, Johnson Matthey said.

“Automotive demand, which rose 6 percent last year to 8.424 million ounces, was expected to hit another record high next year, in line with a rise in gasoline vehicle output,” according to the Reuters piece. “Supply, which declined 2 percent last year, was expected to rise slightly, but the market was set to remain in deficit after recording a shortfall of 629,000 ounces last year.”

The gradual but very real retirement of diesel engines across the European continent continued as well. A German court ruled that cities have the right to ban diesel cars from driving the roads in certain areas. If more diesel engines go extinct, with them will go corresponding PGM consumption for catalytic converters.

Want to see an Aluminum Price forecast? Take a free trial!

Key Price Movers and Shakers

Aluminum MMI: Markets React to 10% Aluminum Tariff Proposal

After last month’s increase, the March Aluminum MMI (Monthly Metals Index) fell two points for this month’s reading. A weaker LME aluminum price led to the retracement. The current Aluminum MMI index stands at 97 points, 2% lower than in February.

LME aluminum price momentum slowed this month. Despite the price retracement, trading volumes still support the current uptrend. The long-term uptrend remains in place.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_90675" align="aligncenter" width="580"]

Domestic Aluminum Market

February brought much uncertainty to the domestic aluminum market with the release of the Trump administration’s Section 232 reports and recommendations vis-a-vis aluminum and steel imports. That release, together with President Trump’s announcement last Thursday of a 10% aluminum tariff on all imports have activated price warning systems for all aluminum and aluminum products.

LME aluminum reacted to the news, increasing only slightly.

Additional information about Trump’s announcement, combined with specific buying strategies, can be found in the MetalMiner team’s Section 232 Investigation Impact Report.

On top of that, the U.S. Department of Commerce announced its final determination on the Chinese aluminum foil import case initiated in March 2017. The aluminum foil investigation includes all Chinese aluminum imports, and the anti-dumping margins vary from 48.64 to 106.09%, while the countervailing margins vary in the 17.14-80.97% range. This case may also add some support for LME aluminum prices in the short term.

MW Aluminum Premiums on the Rise

U.S. Midwest aluminum premiums moved again at the beginning of March and are currently trading at $0.16/pound. The U.S. Midwest Premium has now reached the same levels from March 2015; the pace of the increases appears to have accelerated since the Section 232 report release.

[caption id="attachment_90677" align="aligncenter" width="580"]

The Section 232 outcome and President Trump’s comments around possible import remediation measures have caused increased volatility in the U.S. Midwest premium.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

In bullish markets, buying organizations still have many opportunities to forward buy. Therefore, adapting the right buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to read MetalMiner’s Section 232 special coverage.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Automotive MMI: Sales Lag, Auto Stocks Drop After Tariffs Announcement

The Automotive MMI (Monthly Metals Index) stood pat this past month, holding at 100 for the second consecutive month.

Within the basket of metals, U.S. HDG steel rose 5.8% on the month, while U.S. shredded scrap steel jumped 8.4%. Palladium continues to outpace platinum — atypical of the two metals’ historical relationship — and Chinese primary lead dropped 3.8%.

Section 232 buying strategies – grab your copy of MetalMiner’s Section 232 Investigation Impact Report for only $74.99!

Meanwhile, LME copper continued to cool off, dropping 3.5% month over month as of March 1.

U.S. Auto Sales

February was a slow month for a lot of U.S. automakers.

General Motors saw its U.S. sales drop 7.0% year over year, while its year-to-date sales (i.e. through the end of February) are down 3.2%, according to recently released Autodata Corp sales data.

Ford Motor Company, too, had a slow month, posting a 6.8% drop year over year and a 6.6% year-to-date decline.

Fiat Chrysler‘s numbers dropped 1.4% year over year and are down 6.8% in the year to date.

Toyota, on the other hand, had another good month in 2018, posting a 4.5% increase year over year. Toyota’s sales are up 10% in the year to date. Volkswagen also had a strong month, increasing 8.4% year over year and 7.7% in the year to date. Albeit on smaller volumes, Mitsubishi (18.8%) and Mazda (12.7%) also managed strong year-over-year sales jumps in February.

Light trucks continue to be a favorite in the U.S. market. Light truck sales jumped 3.8% year over year, and are up 5.9% in the year to date. Meanwhile, sales of passenger cars dropped 12.6% year over year last month, and their year-to-date sales have dropped 11.9%.

Tariffs Talk

President Donald Trump’s announcement Thursday that his administration plans to impose tariffs of 25% on steel imports and 10% on aluminum imports have sent shock waves throughout the world. Downstream producers, trading allies (like Canada and the European Union) and even U.S. politicians have expressed the hope that the president might reconsider. (For the MetalMiner team’s full analysis of the Section 232 announcement, visit our dedicated Section 232 Investigation Impact Report page).

Naturally, downstream producers, including major automakers, reliant on imports of steel and aluminum are apprehensive. In the marketplace, investors are apparently feeling the same way.

As CNBC reported, a number of automakers saw their stocks drop after Trump’s announcement (which has yet to be officially enacted as policy). GM closed 4% lower, while Ford and Toyota closed 3% lower apiece, according to the report.

The U.S. Motor and Equipment Manufacturers Association (MEMA) came out in strong opposition to the tariffs proposal.

“The tariffs announced today will be detrimental to the motor vehicle parts supplier industry and the 871,000 US jobs it directly creates,” said Steve Handschuh, MEMA president and CEO, in a prepared statement. “We have voiced repeatedly that while we support the administration’s focus on strong domestic steel and aluminum markets, tariffs limit access to necessary specialty products, raise the cost of motor vehicles to consumers, and impair the industry’s ability to compete in the global marketplace. This is not a step in the right direction.”

While those in the steel and aluminum industries have argued price increases that would arise as a result of the tariffs would not be severe, downstream producers, including automakers, have balked at that suggestion.

In another policy arena, the tariffs announcement also has an effect on the ongoing renegotiation talks focusing on the 24-year-old North American Free Trade Agreement (NAFTA). Throughout the proceedings, which began last August and have now gone through seven rounds, the U.S. has sought to win tighter rules on rules of origin for automotive materials, among other concessions.

Canada, the top exporter of steel and aluminum to the U.S., has expressed significant concern about the prospective tariffs. The Washington Post reported that Canada is “flabbergasted” at the tariffs proposal, according to Douglas Porter, the chief economist at the Bank of Montreal.

Wondering how your stainless steel prices compare to the market? Benchmark with MetalMiner

Actual Metal Prices and Trends

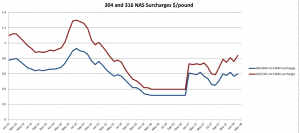

Stainless Steel MMI: LME Nickel Price, Stainless Surcharges Both Rise

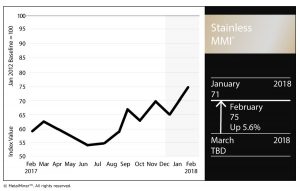

The Stainless Steel MMI (Monthly Metals Index) jumped four points again this month for a February reading of 75.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

In January, skyrocketing LME nickel prices drove the Stainless Steel MMI. Nickel prices have climbed above the $13,000/mt level. 304 and 316 surcharges increased this month, returning to their previous levels.

LME Nickel

Nickel prices increased sharply during January. However, prices decreased slightly in early February. As reported previously by MetalMiner, nickel price volatility has increased over the past few months. Therefore, nickel prices may prove quite tumultuous from a short-term perspective and are trading within the orange-dotted band in the chart below.

[caption id="attachment_90272" align="aligncenter" width="580"]

The long-term nickel price uptrend also remains strong. Prices have moved toward June 2015 levels and already breached our October 2017 long-term resistance levels, as per our Annual Outlook. Therefore, nickel prices remain in a strong uptrend and could continue increasing in the coming months.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month. Surcharges remain above last year’s lows (under $0.4/pound); they remain in an uptrend, even if their pace has slowed. However, buying organizations may want to look at surcharges closely to reduce risks, either via forward buys or hedging.

[caption id="attachment_90273" align="aligncenter" width="580"]

FerroChrome vs. Chrome Metal

Two months ago, MetalMiner reported on the anomaly between ferrochrome and chrome metal prices.

[caption id="attachment_90274" align="aligncenter" width="580"]

Ferrochrome (FeCr) is a chromium and iron alloy containing 50% to 70% chromium by weight. Historically, Ferrochrome and chrome prices correlate tightly but the high iron ore prices caused ferrochrome to spike. However, both prices (ferrochrome and chrome) have fallen back to their historical trading pattern of moving together.

What This Means for Industrial Buyers

Stainless steel momentum appears in recovery, similar to all the other forms of steel. As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips. To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

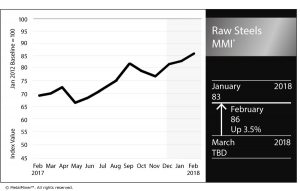

Raw Steels MMI: HRC Prices Hit Highest Level in More than Two Years

The Raw Steels MMI (Monthly Metals Index) inched three points higher this month, reaching 86 points.

Steel price momentum appears to have continued as prices increased sharply in January. February has already signaled a continuation of this uptrend, with HRC prices breaching the $700/st level. HRC prices have reached the highest levels in more than two years and could continue to climb.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

[caption id="attachment_90232" align="aligncenter" width="585"]

The spread between HRC and CRC prices fell this past month, returning to the $140/st level. Since the beginning of 2016, the spread between HRC and CRC prices increased to around $200/st. The spread has returned to normal levels, with HRC prices increasing more than CRC prices.

President Trump has yet to release results from the Section 232 investigation. Commerce Secretary Wilbur Ross sent his Section 232 steel report to Trump last month; the president has 90 days as of Jan. 11 to act on the report’s findings and recommendations.

Global Steel Sector

According to the World Steel Association (WSA), global production of crude steel increased by 5.3% during 2017. The world map below reflects some of the changes in steel production by country and the impact on total steel output.

[caption id="attachment_90233" align="aligncenter" width="585"]

Chinese global production of crude steel increased by 5.7%. However, China’s exports fell to 75.4 million tons last year from the previous 108.5 million tons. Japanese production of crude steel decreased by only 0.1%, while U.S. crude steel production increased by 4%.

According to Eurofer, European steel demand could increase by 1.9%. In 2017, European steel imports fell by 1% due to defensive trade measures.

Shredded Scrap

Shredded scrap prices increased again in January, shifting the latest short-term downtrend to an uptrend. The long-term uptrend remains in place, and scrap prices have now moved together with U.S. steel prices.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit mid- and long-term purchases. Buying organizations with concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our Monthly Outlook will include a detailed analysis of the Section 232 outcome.

For more efficient carbon steel buying strategies, take a free trial of MetalMiner’s Monthly Outlook!

Actual Raw Steel Prices and Trends