The November Rare Earth MMI (Monthly MetalMiner Index) broke its short-term downward trend and traded sideways month-over-month. Altogether, the index dropped a modest 0.97%. Rare earths managed to hold their steady trend over most of 2022. This was due to high demand for EV’s, electronics, and rare earth magnets. Indeed, the global market for all […]

Category: Sourcing Strategies

Renewables MMI: Battery Metal Markets Hold Sideways Trend

The October Renewables MMI (Monthly MetalMiner Index) dropped yet again, but by less than in previous months. All in all, prices fell by 3.28%. The demand for battery metals due to the growing EV market largely kept the index afloat. Still recovering from August’s steep drop, Cobalt traded sideways between September 1 and October 1, […]

Could Metal Recycling Help Alleviate Supply Chain Shortages?

Faced with supply chain shortages, metal squeezes and smelter shutdowns, metal buyers and manufacturers continue to look for supply solutions. Some theorize that recycling and reusing metals could help. However, global construction and metal markets currently need more than the current metal recycling industry can provide. Is there a way that metal manufacturers can achieve […]

The Microchip Craze – Supply Shortages, Sources, Materials and Imports

Microchips, along with their parts and components have become a huge part of modern life. They’re used in computers, machinery, phones and many other electronics and appliances we use on a daily basis. Of course, various metal parts and components are integral to the manufacturing of these microchips. How has the microchip industry been impacted […]

Base Metal Prices Contradict the Changing Supply Scenario

Given the state of the world, one would expect base metal prices to show every sign of a resurgence. Certainly, analysts have been bullish about a supply squeeze for months because sky-high natural gas prices forced record electricity costs across Europe. Just this week, the FT reported that Aluminum and Zinc smelters continue to close […]

Aluminum MMI: Aluminum Prices Consolidate 39% Beneath March Peak

After seeing a short-term bullish rebound in July, aluminum prices began to modestly decline again in early August. All in all, the rebound was insufficient to suggest a bullish reversal. As such, global aluminum prices remain within a macro downtrend despite recent directional uncertainty. The Aluminum Monthly Metals Index (MMI) dropped by 2.4% month over […]

UK Hopes to Get Ahead of Rare Earths Supply Problem

By: Sohrab Darabshaw Rare earths have seen a surge in demand all around the world. After all, these minerals are key components of everything from solar panels to electric car batteries to defense equipment. And with Russia’s invasion of Ukraine disrupting much of the supply chain, the need for rare earths has become even more […]

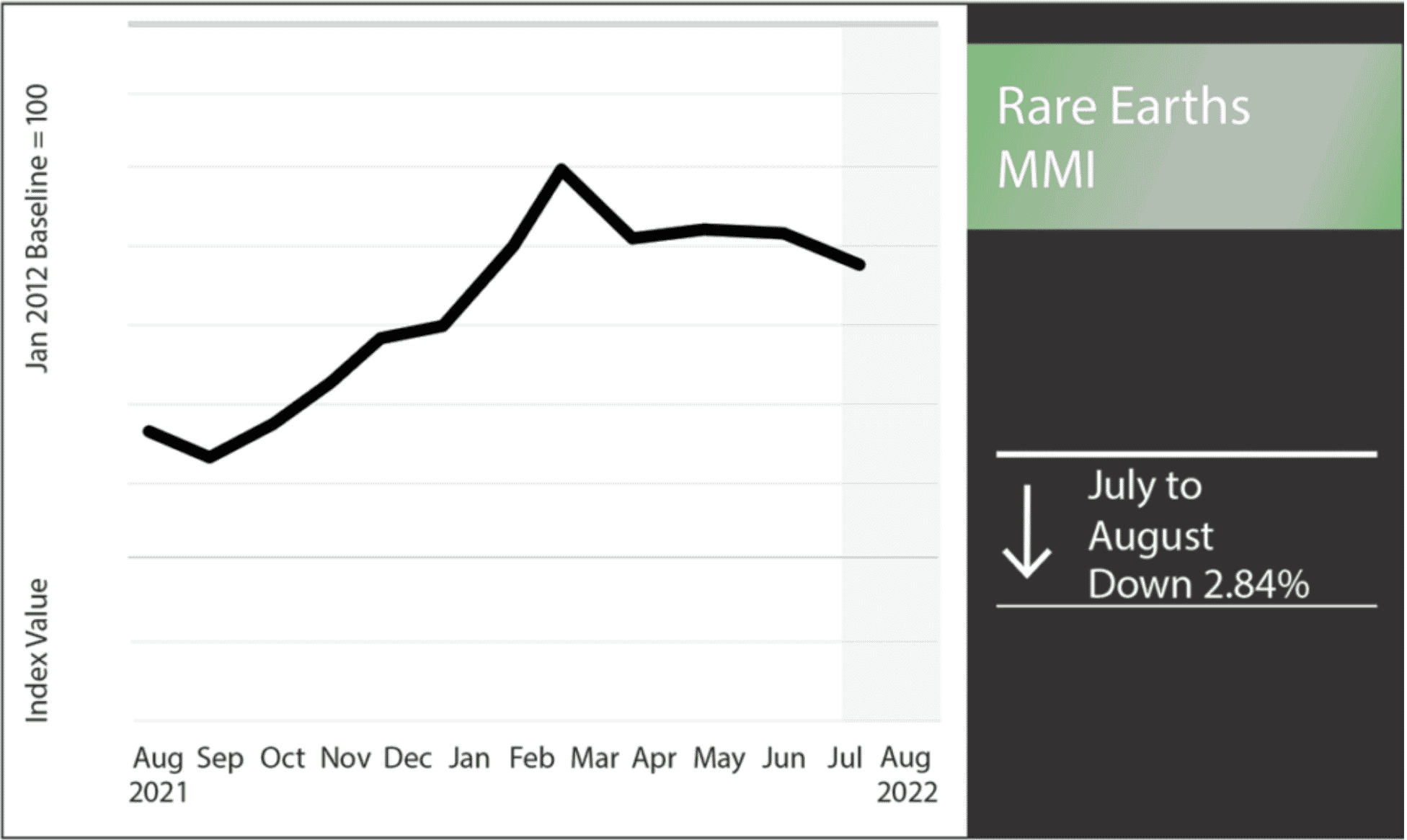

Rare Earths MMI: Rare Earth Prices Slide Further as World Looks for New Supplies

The Rare Earths MMI (Monthly MetalMiner Index for rare earth metals) extended its decline in July, dropping another 2.8%. This is a significant move for rare earths prices, and reinforces the subtle downtrend that began back in April. Now more than ever, countries are frantically searching for ways to separate their rare earths supply from […]

Tesla Shows Why Procurement Needs To Keep An Eye On Cash Flow

Recently, the MetalMiner team shared a laugh over BMW’s announcement that it would introduce a “subscription service” in certain markets for the use of their cars’ heated seats. While some of us remain avid BMW aficionados, whether or not customers will pay for the right to warm their seat remains unclear. This brings us cash […]

Buying Strategies in Falling Aluminum and Steel Price Markets

Recent key shifts in macroeconomic indicators could significantly impact both aluminum and steel prices. Historically, the best way for companies to protect themselves during times of uncertainty is to change buying strategies. Most commodities have traded in a bull market for the past one and a half years. This has allowed companies of all sizes […]