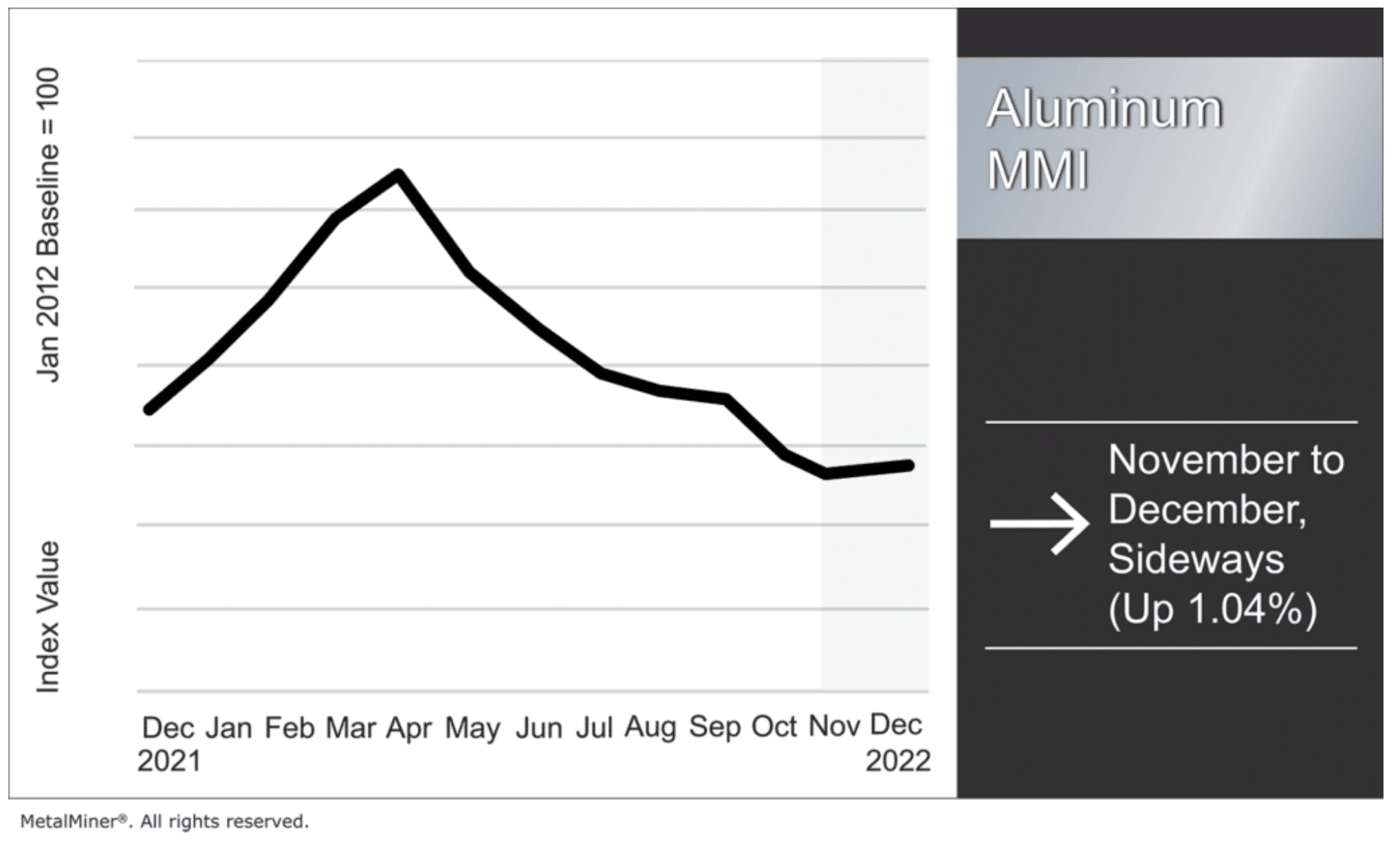

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]

Tag: china aluminum

China Reacts Strongly to WTO’s Ruling of Trump Administration Metal Duties

In the latest US steel news, a WTO ruling has sparked a new war of words between the United States and China. Last weekend, the WTO finally ruled on the 25% taxes on global steel imports and 10% import tariffs on aluminum imposed under former US President Donald Trump. The WTO dispute settlement panel ruled […]

Aluminum Supply Suffers From Industrial Shut-Downs

Thing may appear better in China than they are, at least as far as the country’s metals and minerals markets are concerned. However, China still remains the go-to destination for European steel and aluminum supply. Energy-sensitive European factories and aluminum smelters remain stranded due to the ongoing Russian-Ukrainian war. Western Europe’s gas and electricity supplies […]

Aluminum MMI: Aluminum Prices Consolidate 39% Beneath March Peak

After seeing a short-term bullish rebound in July, aluminum prices began to modestly decline again in early August. All in all, the rebound was insufficient to suggest a bullish reversal. As such, global aluminum prices remain within a macro downtrend despite recent directional uncertainty. The Aluminum Monthly Metals Index (MMI) dropped by 2.4% month over […]

Aluminum Prices: Is China Turning on the Stimulus Taps?

It is not an idle question. For the last two decades, China’s infrastructure spending has been the engine of demand growth for steel, copper, and aluminum prices. So when the South China Morning Post reported that local governments sold 1.94 trillion yuan (US$289 billion) worth of bonds in June to fund infrastructure spending and boost […]

Construction MMI: Indices and Demand Decline for Another Month

The Construction MMI (Monthly Metals Index) extended its decline from last month. Altogether, the index fell 10.69% from June to July. China is Poised to Inject Big Money into Infrastructure News recently broke that China’s State Council is preparing to increase credit lines across the board, providing an additional 800 billion yuan to fund […]

Aluminum MMI: Aluminum Prices Plummet to 12-Month Low

Aluminum prices continue to display a macro downtrend. Shorter-term trading ranges are forming but also breaking quickly, signaling further bearish sentiment. Simultaneously, breakouts to the downside seem to indicate a lack of bullish strength and support. Altogether, the Aluminum Monthly Metals Index (MMI) dropped by 8.06% month over month. The MetalMiner Insights platform includes global […]

Aluminum MMI: Aluminum Prices Trade Sideways After Decline

Aluminum prices declined overall in May. However, near the end of the month, they appeared to hit bottom and began to trade sideways. Conflicting macroeconomic and geopolitical factors continue to pressure markets, resulting in unclear direction and price trends. Overall, the Aluminum Monthly Metals Index (MMI) dropped by 6.21% month over month. Shanghai Lockdowns Return, […]

Big Trouble in Big China: Lack of Metals Demand

Metal processors and traders throughout China are facing a grim reality today. Thanks to major economic shifts both within the country and without, metals demand has plummeted. Of course, it’s not great news for the world’s biggest metals manufacturer. But what does it mean for the rest of the world? A Hard Few Years with […]

Rolled Aluminum Anti Dumping Suspension on China by European Commission Ends

The EU has announced an end to the temporary suspension of anti-dumping duties on rolled aluminum products into the block. The suspension was set to expire in July. The news comes hot on the heels of last week’s announcement that the UK would establish provisional duties for six months while it carries out an anti-dumping […]