Aluminum prices continued to slide throughout June but appeared to find a bottom in early July. Prices started to form relief patterns in the short term, rising following bearish price action over recent months. Meanwhile, cooling inflation data saw market sentiment improve. The U.S. dollar index, which has an inverse correlation to metal prices, dropped […]

Tag: LME aluminum

Do High Russian Aluminum Volumes Call the LME’s Integrity into Question?

(Editor’s Note: This article has been edited and updated since it’s earlier publication to reflect the LME position on Russian origin materials) It’s no news that the London Metal Exchange (LME) has seen a big rise in Russian aluminum inventories in its warehouses. However, the surge in Russian metal remains a source of concern. After […]

Aluminum MMI: Aluminum Prices Sideways Amid LME’s Russia Problem

Aluminum prices continue to lack enough strength to form either bearish or bullish trends. Since aluminum prices have yet to break out of range meaningfully and there is no established uptrend or downtrend, the market remains highly risky. Altogether, the Aluminum Monthly Metals Index (MMI) dropped 3.19% from May to June. Russian Aluminum in LME […]

Aluminum Prices and Global Market: a 2022 Review

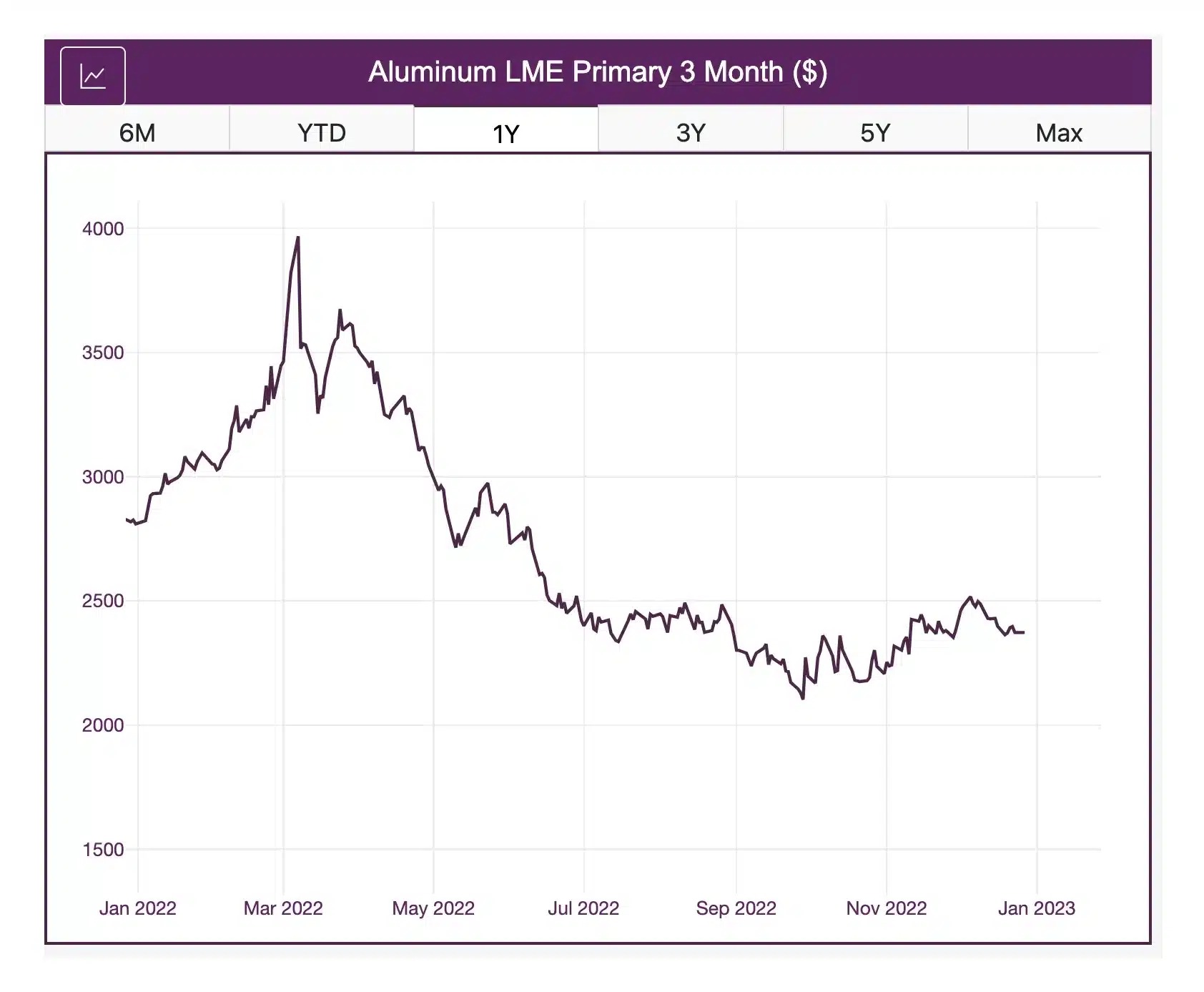

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low […]

Latest Updates on LME Aluminum: Potential Russian Prohibition

Last week, speculators bought up aluminum amid a $100/ton spike following news that LME aluminum may soon exclude Russian materials. The LME continues to review a ban that would keep Russian aluminum, nickel, and copper from the exchange. A Reuters post illustrated the seriousness of the move, stating that Russia’s Nornickel accounted for 7% of global […]

Aluminum prices, stock and delivery premiums veer in different directions

So far this year, on LME aluminum trading, inventory levels have directly correlated with price direction. Aluminum demand has outstripped supply causing falling inventory levels, and many assume prices are due to rise, except they’re not. According to a Reuters report, LME inventories fell steadily this year with total inventory down by 479,000 metric tons […]

Aluminum MMI: Aluminum Prices Trade Sideways After Decline

Aluminum prices declined overall in May. However, near the end of the month, they appeared to hit bottom and began to trade sideways. Conflicting macroeconomic and geopolitical factors continue to pressure markets, resulting in unclear direction and price trends. Overall, the Aluminum Monthly Metals Index (MMI) dropped by 6.21% month over month. Shanghai Lockdowns Return, […]

Aluminum MMI: US reinstates tariff on aluminum imported from UAE

The Aluminum Monthly Metals Index (MMI) increased by 2.1% this month, as LME aluminum prices traded sideways and the US reinstated the Section 232 aluminum tariff on imports from the United Arab Emirates. U.S. aluminum reinstates aluminum tariff on UAE On Feb. 1, President Joe Biden reinstated the 10% aluminum tariff on imports from the […]

Are we in for a repeat of longer LME aluminum load-out queues, rising physical delivery premiums?

A recent Reuters article doesn’t say so in as many words but certainly suggests conditions are fertile for warehouse operators to incentivize metal deliveries again and, in the process, queues could form at exit.

Aluminum MMI: Index Near Three-Year Low as LME Aluminum Trades Sideways

The Aluminum Monthly Metals Index (MMI) remained flat this month at 82, with the majority of prices in the index increasing mildly, offset by a few declining values. The current index value remains near a three-year low. Free Partial Sample Report: 2020 MetalMiner Annual Metals Outlook LME aluminum prices generally moved sideways in October but […]