Renewables MMI: EPA Deal Opens Door to Potential Missouri Cobalt Mining

The Renewables Monthly Metals Index (MMI) held flat this month, sticking at an MMI reading of 103.

Cobalt in … Missouri?

The St. Louis Post Dispatch reported an EPA agreement could open the door to cobalt mining at the site of an old lead mine.

On April 3, the EPA announced it had reached an agreement with Missouri Mining Investments, LLC, to “perform a removal action at Operable Unit 2 of the Madison County Mines Superfund Site in Madison County, Missouri. Operable Unit 2 consists of the Anschutz Subsite, also known as the Madison Mine.”

“Missouri Mining Investments plans to begin cobalt mining at the mine upon completion of the cleanup,” the EPA said in a prepared statement. “Under EPA oversight, Missouri Mining Investments will conduct supplemental characterization work, prior to developing a more detailed plan to consolidate and cover mine waste and contaminated soil at the site, and remove contaminated sediments from the Metallurgical Pond and other surface water ponds and streams within the property boundary.”

Cobalt Futures

Speaking of cobalt, MetalMiner’s Belinda Fuller touched on LME cobalt futures earlier this week.

As Fuller notes, 2019 could be a banner year for LME cobalt futures volume.

“The London Metal Exchange (LME) cobalt contract launched in February 2010 and the exchange recently launched a new cobalt contract tied to Fastmarkets’ standard-grade cobalt price (the go-to benchmark on cobalt pricing for industrial buyers),” she noted.

She added that after fluctuations in the early years of the LME cobalt contract, volumes spiked beginning around November 2016.

Nucor Announces $1.3B Investment for Kentucky Steel Plate Mill

In other news, steelmaker Nucor Corporation announced late last month it would make a $1.35 billion investment toward building a new steel plate mill in Brandenburg, Kentucky.

The mill is expected to have an annual capacity of 1.2 million tons, according to a company release, and is expected to be fully operational in 2022.

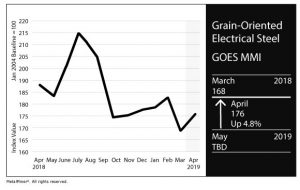

GOES

The GOES MMI, the index for grain-oriented electrical steel (GOES), gained eight points for an April reading of 176.

The GOES coil price rose 4.4% to $2,423/mt.

Actual Metal Prices and Trends

The price of Japanese steel plate fell marginally on a month-over-month basis to $771.64/mt as of April 1. Korean steel plate rose 2.2% to $599.87/mt. Chinese steel plate rose 0.4% to $645.03/mt.

U.S. steel plate held flat at $997/st.

The U.S. grain-oriented electrical steel (GOES) rose 3.1% to $2,432/mt.

The Chinese neodymium price fell 4.8% to $55,490.40/mt, while silicon fell 0.3% to $1,534.37/mt. Chinese cobalt cathodes dropped 0.3% to $99,063.40/mt.

Leave a Reply