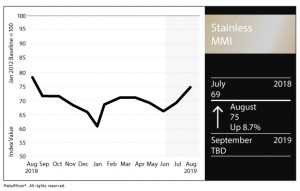

Stainless MMI: Index Jumps Six Points on Nickel Price Surge

The Stainless Steel Monthly Metals Index (MMI) jumped six points for an August reading 75 on the back of strong nickel price gains.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

Within the Stainless MMI basket, LME nickel prices increased the most once again this month, recording a 13% increase. Rather than correcting back to pre-spike levels, traders continued to buy into the market.

In addition to the price rise, stock levels have also risen as a result of Chinese stockpiling activities ahead of the Indonesian export ban.

Very recent rumors of Indonesia possibly pushing up a raw ore ban created a fresh round of speculative buying activity during this past week, which gained even more steam in the first week of August.

The new export ban regulations, initially announced in 2017, will take effect by 2022. This most recent round of nickel price escalation through speculation may also spur a new round of Chinese direct investment into Indonesia (aimed at securing future stocks of the metal ore).

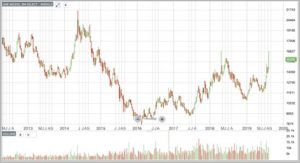

Looking at a longer-term chart, nickel prices previously spiked at various points in time. After a steep period of rising prices, we should expect to see a quick correction followed by a period of time with higher prices.

For example, it appears that a speculative price spike took the price away from fundamentals back in 2016, as called out by the rectangular box in the chart below. In that case, the price stayed higher for about six weeks before dropping back.

Should a steady uptick in positive trading volume continue, that would indicate the uptrend will continue. During the past week or so, we have seen lower trading volume; however, volumes still look relatively strong.

Global Demand Outlook Declines

According to Outokumpu’s Q2 results, the company saw weaker stainless steel demand heavily impacting declining sales, which dropped by around 8% compared to Q2 2018.

Difficult competitive conditions in Europe hurt sales, with that market struggling against cheap Asian imports. Permanent safeguards became effective in February, but import penetration increased back to 30%. In addition, a new quota period started July 1.

While import levels into the U.S. remain low, the company reports ongoing distributor destocking will limit volume upside in the Americas in the short term. Further, the company expects challenging conditions to continue through 2019.

The International Stainless Steel Forum (ISSF) released Q1 production figures in early July showing a 2.5% year-on-year decline in global stainless steel melt shop production.

In Europe, the decline reached 5.7%. Asian production outside of China also declined by an estimated 5.7%. The U.S. saw a decline of 2% and Chinese production declined by 1.5%.

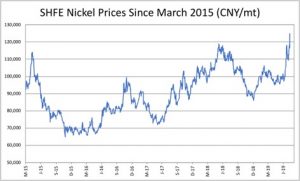

SHFE Nickel Prices Jump

SHFE prices also reacted to the rumor regarding Indonesia’s consideration of moving up its ore export ban.

SHFE nickel prices reached a new high for 2019, in addition to a new longer-term high.

While prices increased recently, prices were much higher at previous points in time.

Most notably, nickel prices surged past $50,000/mt, or roughly around CNY 500,000/mt, and then sank back down to around $10,000/mt during a three-year period from 2006-2009, according to data from the International Nickel Study Group (INSG). At the start of that period, prices were similar to current prices and jumped about 400% in around 1 1/2 years (at the the midpoint of the aforementioned period).

On the way back down, prices stalled at the $30,000/mt level for a year during a period of historically low stocks.

Domestic Stainless Steel Market

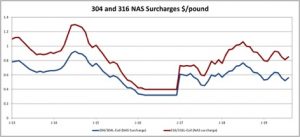

Stainless 304 and 316 NAS surcharges nudged back up in early August, still maintaining sideways movement.

Weaker demand outweighed higher nickel prices this month as surcharges reversed.

What This Means for Industrial Buyers

MetalMiner’s stainless steel price index hit a one-year high. Industrial buyers need to stay alert for the right opportunity to buy, as nickel prices may be at a short-term speculative high that still seems to be going strong. As ingot prices rise, expect premiums to follow.

For buying guidance, including resistance and support pricing levels by metal, industrial buying organizations can request a free two-month trial to our Monthly Metal Buying Outlook report.

Buying organizations will want to read more about our longer-term steel price trends in our Annual Outlook.

Actual Stainless Steel Prices and Trends

Nickel prices registered double-digit increases this month, extending last month’s sizable gains.

The LME primary 3-month nickel price increased by 13.1% to $14,380/mt. China’s primary nickel price increased by 11.7% to $16,367/mt. India’s primary nickel price increased by 11% to $14.50/kg.

The U.S. 316 and 304 Allegheny Ludlum stainless surcharges increased this month by 4.9% and 7%, respectively, to $0.88/pound and $0.59/pound.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

Chinese Ferro Alloys FeMo lumps also jumped by 11.7% this month, while FeCr lumps increased by 0.6%, reversing mild declines for both prices last month. Other Chinese prices in the index moved sideways, with only mild price movements of under 0.5%.

Korean prices for 430 CR 2B stainless steel coil and 304 CR 2B stainless coil decreased by 5.8% and 4.5%, respectively, to $1,221/mt and $2,149/mt.

Leave a Reply