GOES MMI: GOES M3 Prices Fall Slightly as Imports Rise

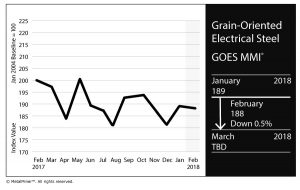

The GOES MMI (Monthly Metals Index), which tracks grain-oriented electrical steels (GOES), fell one point to 188 as other flat-rolled steel products saw a price increase.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Meanwhile, imports continue to grow, but none of the growth has come from China. In fact, Japan and the U.K. supplied the bulk of the imports in January. Buying organizations continue to report to MetalMiner they import grades of electrical steel not currently produced by the sole domestic producer, AK Steel. (See the latest import data below.)

AK posted a Q4 loss but CEO Roger Newport made a number of comments regarding electrical steels during the most recent earnings call that indicated why the company supports strong Section 232 import measures:

“As we previously stated, we strongly believe that the ongoing high level of imports is a threat to the national security of our country…

Imports of grain oriented electrical steels, also known as GOES have more than doubled year-over-year and these imports are coming primarily from Japan, Korea and China. In my opinion this surge of GOES imports stems from a deliberate effort on part of these and other countries to beat the clock on any future 232 remedies and also by the Chinese trade protection causing Korea and Japan to send products to the United States.”

Unlike other steel products, such as tubular goods, cold-rolled steel, hot-dipped galvanized steel, solar panels and washing machines, MetalMiner is not aware of a single circumvention case for grain-oriented electrical steels.

Meanwhile, Bank of American Merrill Lynch analyst Timna Tanners double downgraded AK Steel on weak first quarter guidance and “lack of catalysts” to improve margins.

In Other Producer News…

ThyssenKrupp and Tata Steel have finally announced a joint-venture in Europe with the goal of becoming “a leading European flat steel provider and position it as a quality and technology leader,” according to a ThyssenKrupp press release. Both ThyssenKrupp and Tata have GOES production capability.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month

The U.S. grain-oriented electrical steel (GOES) coil price fell slightly this month from $2,608/mt to $2599/mt. The MMI value fell one point to 188.

The GOES MMI® collects and weights 1 global grain-oriented electrical steel price point to provide a unique view into price trends over a 30-day period. For more information on the GOES MMI®, how it’s calculated or how your company can use the index, please drop us a note at: info (at) agmetalminer (dot) com.

Leave a Reply