Automotive MMI: U.S. Auto Sales Rev Up for 6.3% Year-Over-Year Jump in March

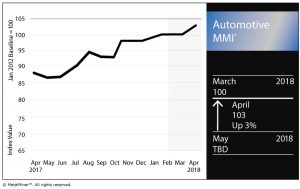

The Automotive Monthly Metals Index (MMI) jumped three points for an April reading of 103 after a month that saw the U.S. impose Section 232 tariffs of 25% and 10% on steel and aluminum imports, respectively, in addition to escalating trade tensions between the U.S. and China.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap jumped 3.1%, while LME copper continued its 2018 cooling down, dropping 2.5% month over month.

Chinese primary lead jumped 1.3%.

U.S. Auto Sales

According to monthly sales data release by Autodata Corp, it was a strong month for several of the top automakers in the U.S. market.

General Motors posted a 15.7% increase in sales year over year, and is up 3.8% in the year to date compared with the same time frame last year.

Ford Motor Co. saw its sales jump 3.5% year over year in March, but remains down 2.7% in the year to date.

Fiat Chrysler’s March sales jumped 13.6% year over year, and boasts an 0.8% increase for the year to date. Toyota’s sales jumped 3.5% in March year over year and is up 7.4% in the year to date. Honda also had a good month, posting a year-over-year sales increase of 3.8%; however, its year-to-date sales are down 0.8%.

Volkswagen, Mitsubishi and Mazda continued what has been a strong 2018 for each of them. Volkswagen’s March sales rose 13.5% year over year, while the German automaker’s year-to-date sales are up 9.9%. Mitsubishi jumped 21.7% in March and is up 22.7% in the year to date. Mazda, meanwhile, posted a 35.7% increase in March and is up 21.6% in the year to date.

In total, vehicle sales in March were up 6.3% year over year and are up 1.9% in the year to date. American consumers continue to prize light trucks, as sales of those vehicles rose 16.3% year over year in March and are up 9.8% for the year to date.

U.S.-China Trade Tensions Rise

Earlier this week, the Office of the United States Trade Representative released a list of 1,300 Chinese products that could be hit with tariffs (stemming from the administration’s Section 301 probe of Chinese trade practices).

Not long after, China announced it would place 25% tariffs on 106 U.S. products, including autos, Reuters reported.

Tesla and Tariffs

It’s been a rough couple of weeks for Tesla.

In late March, the fatal crash of a Tesla Inc. Model X led to a massive selloff, leading to an 8.2% drop in its stock and its lowest closing in almost a year, CNBC reported.

On top of that, the electric vehicle (EV) maker continues to struggle with the cold, hard reality of production timelines. CNBC reported that Tesla missed its quarterly goal of producing 2,500 Model 3s per week.

The stock price recovered Tuesday, but Wednesday’s news of $50 billion in tariffs from China — in retaliation to the U.S.’s own recent announcement regarding a potential $50 billion in tariffs on Chinese imports — is another hit to the EV firm.

According to Bloomberg, China accounted for 17% of Tesla’s 2017 revenue.

Actual Metal Prices and Trends

U.S. HDG rose 12.3% to $910/st.

Both palladium and platinum dropped on the month. Palladium fell 3.2% to $949/ounce. Platinum dropped 3.5% to $930/ounce.

U.S. shredded scrap jumped 3.1% to $361/st, while LME copper continued its 2018 cooling down, dropping 2.5% month over month to $6,720/mt.

Lower your aluminum spend – Take a free trial of MetalMiner’s Monthly Outlook!

Chinese primary lead jumped 1.3% to $3,017.83/mt.

Leave a Reply