Construction MMI: March Spending Up Year Over Year But Down 1.7% From February

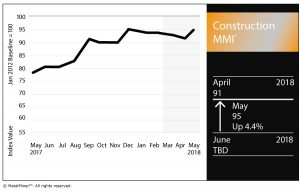

The Construction Monthly Metals Index (MMI) increased four points, up to 95 for our May MMI reading.

U.S. shredded scrap steel rose 3.0%. European aluminum sheet jumped 4.9%. Chinese aluminum bar jumped 8.2%.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. Construction Spending

The U.S. Census Bureau released its monthly report on U.S. construction spending earlier this week, covering spending in March.

The March figure, however, represents a 3.6% increase from the March 2017 estimate of $1,239.6 billion. Through the first three months of the year, construction spending is up 5.5% compared with the same period in 2017.

As for private construction, it came in at a seasonally adjusted annual rate of $987.5 billion, 2.1% below the revised February estimate of $1,009.1 billion.

Under the private construction umbrella, residential construction was at a seasonally adjusted annual rate of $536.8 billion in March, 3.5% below the revised February estimate of $556.5 billion. Nonresidential construction was at a seasonally adjusted annual rate of $450.7 billion in March, or 0.4% below the revised February estimate of $452.5 billion.

Meanwhile, public construction came in at an estimated seasonally adjusted annual rate of $297.2 billion, holding just about flat from the revised February estimate of $297.3 billion. Educational construction was at a seasonally adjusted annual rate of $73.1 billion, down 0.1%. Highway construction was $91.0 billion, up 1.2%.

Billings Increase Slows, According to ABI

According to the monthly Architecture Billings Index (ABI), put out by the American Institute of Architects, billings increased in March, albeit at a slower rate than previous months.

The billings ABI for March came in at 51 (anything greater than 50 indicates growth). The ABI has now posted increases for six consecutive months.

According to the ABI report, the March increase “indicates that the majority of architecture firms are still continuing to experience improving business conditions.”

This month’s report included polling of architecture firm leaders regarding the Trump administration’s Section 232 tariffs and their impact on architecture firms.

According to the report, 24% responded they had already seen “specific consequences” from the proposed tariffs.

“This share was highest for firms located in the West and Midwest regions of the country (32 percent and 28 percent reporting that they have seen consequences, respectively), as well as for firms with an institutional specialization (27 percent),” the report states. “Firms located in the Northeast were least likely to have already seen an impact, with just 13 percent of respondents from that region indicating such.”

Respondents also addressed the potential for future impacts. An overwhelming 91% said they expect to see an at least minor impact as a result of the tariffs.

Many respondents expressed concerns about rising costs of construction materials. According to the report, 53% agreed that it is “very likely” that construction costs will increase for most projects.

Want to see an Aluminum Price forecast? Take a free trial!

Broken down by four regions, growth was highest in the West, which boasted an ABI reading of 53.4. Trailing the West were the South (53.2), Midwest (50.7) and the Northeast (49.0) regions.

Leave a Reply