World Steel Association Releases 2018 Steel in Figures Report

The World Steel Association (worldsteel) 2018 World Steel in Figures report offers a sweeping view of the industry, including historical data on steel production, apparent steel use and more.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The report, released on Tuesday, is part of what can be seen as a generally positive time for global steel.

“I am hopeful that our positive outlook for steel demand will remain,” said Edwin Basson, director general of worldsteel, in a release. “The Short Range Outlook for the next 18 months suggests 2018 growth of 1.8% followed by 0.7% in 2019. Steel demand is benefitting from the broad and favourable global economic momentum affecting both the developed and developing world at the same time. The worldsteel programmes in the automotive, construction, packaging and rail sectors all aim to maintain the role of steel as a versatile product without which modern society cannot remain sustainable.”

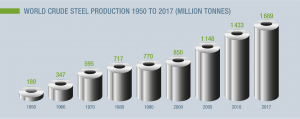

Going back to 1950, the report shows the rise of global crude steel production. In the last 17 years alone, global crude steel production has nearly doubled.

In Basson’s foreword to the report, he referred obliquely to rising trade tensions around the world.

“To say that the steel industry is experiencing interesting times would be an understatement,” Basson wrote. “However, progress is being made at various levels. At the recent meeting of the Global Forum for Steel Excess Capacity (GFSEC), a G20 initiative, six important principles were agreed by ministers of G20 countries. All are focused around ensuring that a level playing field should exist for steelmakers in all countries and that markets should remain free and fair for steel to be traded between countries.”

According to the report, in 2017 the top crude steel producers were (with tonnage, in millions, in parentheses):

- ArcelorMittal (97.03)

- China Baowu Group (65.39)

- NSSMC Group (47.36)

- HBIS Group (45.56)

- POSCO (42.19)

By country, China’s share of steel production has jumped significantly from 2007 to 2017, rising from 36.3% to 49.2%. The NAFTA bloc’s share declined from 9.7% to 6.8%. The European Union’s share also dropped, from 15.6% to 10.0%

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

The full worldsteel report can be downloaded here.

Leave a Reply