Freeport-McMoRan Reports Q2 Net Income Jump As Copper Price Continues to Fall

Miner Freeport-McMoRan Inc., the world’s largest publicly traded copper producer, announced its second-quarter earnings Wednesday.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The miner reported Q2 net income attributable to common stock of $869 million and $1.6 billion for the first six months of the calendar year. The figures compare with $268 million in Q2 2017 and $496 million for the first six months of 2017.

The miner reported copper sales of 989 million pounds in Q2 (1.982 billion pounds through the first half of the year). The miner, also a producer of gold, reported gold sales of 746,000 ounces in Q2 (1.345 million ounces through the first six months). In addition, Freeport reported sales of 24 million pounds of molybdenum (48 million pounds through the first six months).

“Our second quarter results reflect strong performance from our global operations and a continued focus on productivity, cost management and capital discipline,” President and CEO Richard C. Adkerson said. “During the first half of 2018, we generated $2.7 billion in cash flow from operations and capital expenditures totaled $0.9 billion, enabling further strengthening of our balance sheet and advancement of initiatives to build value for FCX shareholders.

“We achieved important progress during the quarter to reach a new long-term partnership structure with the Indonesian government, and we remain focused on completing negotiation and documentation of definitive agreements to restore long-term stability for our Grasberg operations.”

The miner’s share price dipped Wednesday, Bloomberg reported, as a result of operational issues at its Grasberg mine in Indonesia. After hitting $16.43 in the early part of the day, the price dropped 6.4% to $15.06 around noon. It rallied the rest of the day, closing at $15.86 (down 1.37% for the day).

In addition, the miner reported paying off $454 million in debt in April.

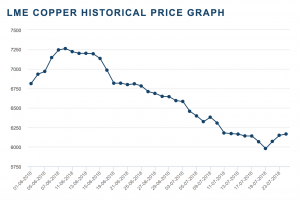

Copper Price Slumps

As a major copper producer, Freeport-McMoRan is eyeing the copper market’s recent slide.

The LME copper price has been falling fast since early June. After hitting $7,271.50 on June 8, the copper price proceeded to drop 17.6% and even dipping below $6,000/mt on July 17.

The price then bounced back slightly, moving to $6,166.50 as of July 24.

Adkerson referred to the slide in the copper price in tandem with the trade measures currently being undertaken by the U.S., in particular vis-a-vis China (the world’s top copper consumer).

As we sit here today, there is an anomaly between market sentiment and fundamentals in the marketplace,” Adkerson said. “We’re continuing to see real demand being very positive for our global business, including our business in China.”

Adkerson added that copper demand in the future will benefit from renewable-energy projects and electric vehicles.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

“Absent having some sort of global recession or a major setback in China, market deficits in copper appear to be inevitable,” Adkerson added.

Leave a Reply