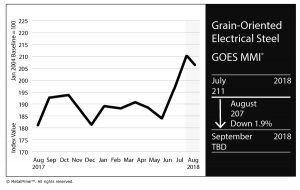

GOES MMI: GOES M3 Prices Slip in July

The headline news for grain-oriented electrical steel (GOES) involves the continued drop in total import levels into the U.S.

The U.S. had imported at least 2,500 metric tons per month since the start of this year, but after the announcement of tariffs, imports shrank to 411 metric tons in July.

However, some steel pundits speculate imports will begin to notch up, particularly for the wider steel market.

While total U.S. import volumes fell in July, Japan still held 59% of total import volume, up 1% from June’s import levels.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

In the meantime, companies continue to file exclusion requests.

Interestingly, only three companies have filed the bulk of exclusion requests for grain-oriented electrical steel and no firm received an approved exemption.

The only exclusions within the broader GOES HTS codes includes Nachi America Incorporated for hot-rolled M2 high speed steel sheet on the basis of insufficient domestic capacity.

Meanwhile, Electrical Mechanical Corporation filed approximately 34 exclusion requests for GOES M6 and M4, arguing that longer lead times from the sole domestic supplier, AK Steel (2-3 times longer) have led to increased manufacturing costs, delayed shipments and a weaker competitive position in the market.

So far, companies have filed nearly 25,000 exclusion requests and MetalMiner is aware of some companies obtaining exemptions — approximately 1,400-plus exemptions have been granted — but none have been for GOES.

AK Still Looking for Import Relief

In AK Steel’s most recent earnings report, on a trade update slide the company pointed to not only GOES products but also stated that it is, “Critical that downstream electrical steel products be adequately addressed.”

Next month, MetalMiner will address 301 exemptions, which also include GOES.

Exact GOES Coil Price This Month

The U.S. grain-oriented electrical steel (GOES) coil price fell from $2,914/mt to $2,857/mt. The GOES Monthly Metals Index (MMI) fell four points from 211 to 207.

Want to a see Cold Rolled price forecast? Get two monthly reports for free!

The GOES MMI® collects and weights 1 global grain-oriented electrical steel price point to provide a unique view into price trends over a 30-day period. For more information on the GOES MMI®, how it’s calculated or how your company can use the index, please drop us a note at: info (at) agmetalminer (dot) com.

Leave a Reply