Construction MMI: Architecture Billings Show Signs of Slowing Down

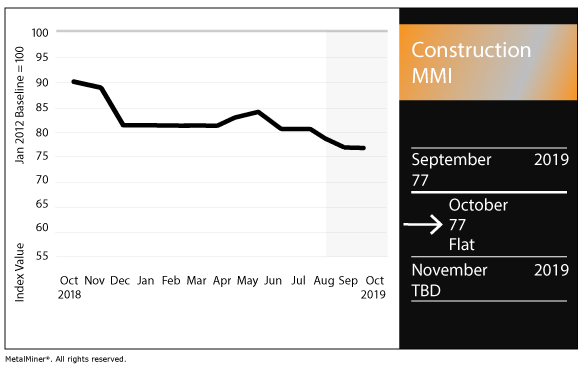

The Construction Monthly Metals Index (MMI) held flat this month, sticking at an MMI reading of 77.

Keep up to date on everything going on in the world of trade and tariffs via MetalMiner’s Trade Resource Center.

U.S. Construction Spending

According to the U.S. Census Bureau, U.S. construction spending in August reached a seasonally adjusted annual rate of $1,287.3 billion, up 0.1% from the revised July estimate of $1,285.6 billion.

The August total, however, was down 1.9% from the August 2018 estimate of $1,312.2 billion.

Meanwhile, for the first eight months of the year, construction spending was down 2.3% compared with the first eight months of 2018.

Broken down further, spending on private construction in August reached a seasonally adjusted annual rate of $955 billion, flat compared with July.

Under the umbrella of private construction, residential construction spending reached a seasonally adjusted annual rate of $507.2 billion, up 0.9% from July. Meanwhile, nonresidential construction spending reached $447.9 billion, down 1.0% from July.

As for public construction, spending in August reached $332.3 billion, up 0.4% from July. Under public construction, educational construction spending totaled $77.0 billion, up 1.4% from July. Highway construction spending reached $98.9 billion, up 0.6% from the July estimate.

ABI Slump Continues

The Architecture Billings Index (ABI), released monthly by the American Institute of Architects (AIA), serves as an indicator of architecture billings growth in the U.S.

The ABI has been mired in a slump, coming in flat for six consecutive months prior to the most recent reading.

The recently released August ABI, however, reflected a downturn.

The August ABI checked in at 47.2, down from 50.1 the previous month (any reading greater than 50 indicates billings growth, while a sub-50 reading indicates contraction).

In its most recent ABI report, the AIA called business conditions “disappointing” for U.S. architecture firms this year.

“The national ABI score for the month was just 47.2 (any score below 50 signifies a decline in aggregate design activity),” the AIA report stated. “Additionally, the national score for new design contracts, which measures new design work coming into architecture firms, was just 47.9 (again, any score below 50 signifies a decline in aggregate new design contract activity). So, architecture firms reported a rare double decline in both new work coming into their firms and design work that was being completed.”

By region, the Midwest was hit hardest, registering an ABI of 46.4 for the month. Billings contracted in the South (48.2) and Northeast (49.1), too, while the West showed billings growth (51.2).

According to the monthly survey of industry professionals included in the ABI report, business conditions are prompting some architecture firms to consider international opportunities.

“At present, only about 10% of U.S. architecture firms are currently working on international projects, while an additional 13% don’t have current projects, but have worked internationally within the past five years,” the report noted. “Another 13% of firms have plans to pursue at least some type of international work in the near future.”

Of the remaining nearly two-thirds, over half would at least consider an international project, according to the survey results.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Actual Metal Prices and Trends

The Chinese rebar price rose 3.6% month over month to $525.99/mt as of Oct. 1. The Chinese H-beam steel price fell 1.0% to $532.99/mt.

U.S. shredded scrap steel fell 13.6% to $254/st.

European commercial 1050 aluminum sheet rose 2.6% to $2,455.78/mt.

Chinese 62% iron ore PB fines rose 0.3% to $73.44/dmt.

Leave a Reply