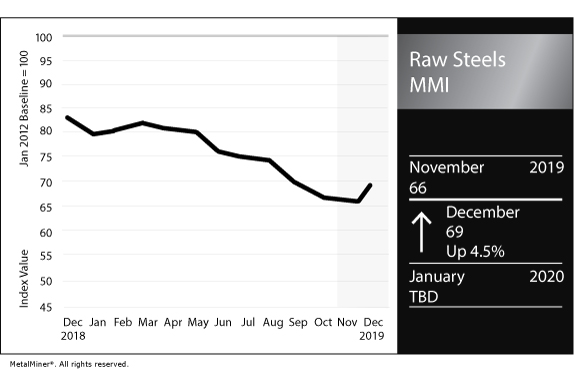

Raw Steels MMI: Steel price increases boost the index

The Raw Steels Monthly Metals Index (MMI) showed some strength this month with a three-point increase, rising to 69 from 66 last month.

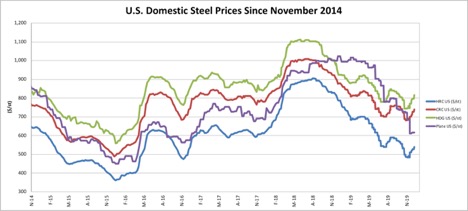

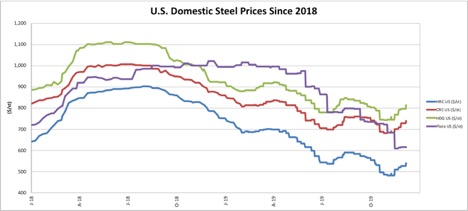

U.S. steel prices rebounded in November when recent mill prices increases took effect.

Once again, plate price increases have lagged behind the other forms, (similar to July, when plate prices failed to gain):

However, plate prices now look in line with historical norms, in terms of relative values across key types. Plate prices may now begin to move with other prices, rather than on a unique trajectory.

U.S. capacity utilization slipped below 80% during late November. The rate stayed lower during the week ending Dec. 7, when capacity utilization totaled 78.7% based on production of 1.82 million tons. During the same period last year, production totaled 1.86 million tons based on a capacity utilization of 79.4%.

Year-to-date capacity utilization through Dec. 7 totaled 80.1%, with 90.74 million tons produced. This represents a 1.9% increase compared to last year’s production of 79.06 million tons during the same period (based on a capacity utilization of 78.2%).

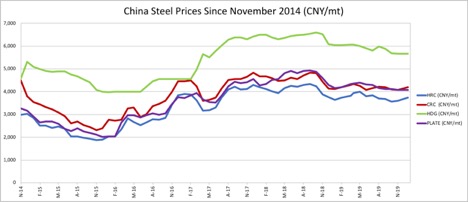

Chinese HRC, CRC steel prices show slight gains

Chinese HRC and CRC prices increased during November — by roughly 6% and 4.5%, respectively — bringing prices back to September levels.

HDG and plate prices held flat, however, keeping prices among the four key forms sideways overall.

Nippon Steel to potentially shutter two blast furnaces; Japanese fiscal stimulus package likely to boost demand

In order to better align fixed production costs with domestic demand, Nippon Steel may close two of 15 blast furnaces in operation across the country by March 2024.

Demand for steel slowed for the Japanese producer due to decreasing domestic population, higher export barriers, and trade issues, according to management team discussions with the press.

Typically, the company exports more than 40% of output. Recently, however, export levels suffered due to the desire of other Asian countries to boost domestic steel production, in addition to increased Chinese exports.

The Japanese government recently announced a $122 billion fiscal stimulus package that will likely boost demand levels due to infrastructure development targeting natural disaster mitigation.

Major merger on the horizon for Cleveland-Cliffs, AK Steel

Cleveland-Cliffs Inc. recently announced its intent to purchase AK Steel Holding Corp. for $1.1 billion.

As detailed in a recent MetalMiner article, the deal provides Cleveland-Cliffs with built-in demand for pellet production, while also entering Cleveland-Cliffs into steel production.

Cleveland-Cliffs now derives around 23% of annual income from AK Steel, the company’s largest customer with the exception of ArcelorMittal SA.

The agreement still faces antitrust vetting. Completion of the deal is expected during H1 2020.

U.S. economic indicators remain positive overall

While growth remains somewhat constrained as 2019 comes to a close, the U.S. economy continues to maintain momentum overall.

According to the most recent Beige Book report released by the Board of Governors of the Federal Reserve System, based on data collected through Nov. 18, economic activity in aggregate expanded modestly from October through mid-November, at a similar pace as the previous reporting period.

Most districts reported increases in auto sales. Also, an increasing number showed improved manufacturing activity, but the majority still reported flat activity.

Residential home sales were flat to higher across districts, while residential construction improvements expanded to more areas.

Nonresidential construction continued to increase modestly, while the energy sector showed modest deterioration in activity.

The Federal Reserve Bank of Atlanta’s GDPNow model estimate of GDP growth jumped by 0.5% to 2.0% on Dec. 6 based on recent data inputs.

GDPNow provides a running forecast of the official estimate in advance to its release and is based only on mathematical results of the model.

What this means for industrial buyers

Improved demand appeared to push up prices this month.

So far, however, price increases look fairly mild, with some recent momentum attributed to pushed-forward Q1 2020 demand.

It’s still too soon to tell if price increases will continue from here.

Buying organizations interested in tracking industrial metals prices with ease will want to request a demo of the all-new MetalMiner Insights platform.

Buying organizations seeking more insight into longer-term steel price trends may want to read MetalMiner’s Annual Metal Buying Outlook.

Free Partial Sample Report: 2020 MetalMiner Annual Metals Outlook

Actual raw steel prices and trends

LME billet three-month prices increased the most among index values this month, rising by 9.3% month over month to $262/st as of Dec. 1.

The U.S. Midwest HRC futures spot price dropped 0.4% to $493/st, while the Midwest HRC futures three-month price increased by 7.5% to $590/st.

U.S. shredded scrap prices increased 4.4% to $235/st.

All Chinese prices in the index increased. Coking coal increased the most, by 6.4% to $264/mt, while HRC increased by 6.3% by $530/mt. Steel billet increased by 2.9% to $510/mt, while slab rose by 2% to $519/mt.

Iron ore prices remained essentially flat, with a mild 0.1% increase to around $64 per dry metric ton.

Korean scrap prices registered a third double-digit monthly decrease, down by 11.5% to $72/mt. Korean pig iron prices also dropped this month, falling 1% to $364/mt.

Leave a Reply