Don’t count on a commodities bear market forever

The inverse relationship between the strength of the U.S. dollar and the price of commodities has held good over time.

That relationship isn’t a constant, of course. Political, economic or supply-demand fundamentals can trump dollar strength at times of stress. However, as a broad measure, it can impact prices day to day, week to week and year to year.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

While stock prices are currently at all-time highs, commodity prices are as cheap today as they pretty much have been for decades — not historic lows, but relatively speaking commodities have not enjoyed the same boost from cheap money and asset-boosting policies like quantitative easing that stock prices have seen.

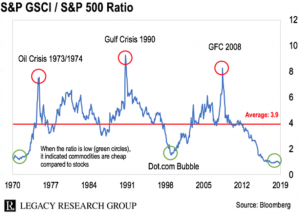

The below graph from Commoditytrademantra.com (via Bloomberg) illustrates how commodities are currently about as far below the average as they have ever been:

When the blue line on the chart is rising, commodities are getting more expensive relative to the S&P 500 – a good proxy for the U.S. stock market.

When the line is falling, commodities are getting cheaper relative to stocks. This position is not just due to dollar strength, of course. Supply-demand fundamentals are weighing on sentiment and many metals, energy commodities and foodstuffs are in surplus. The dollar, however, has been and remains relatively strong compared to major currencies, like the euro and the renminbi.

But as the chart suggests and a recent Financial Times article states, it is unwise to assume that we have entered a permanent bear market in commodities.

Dollar weakness alone could create support for prices this year. There are plenty of reasons — from deficit spending to political risk or the popping of a corporate debt bubble — for the dollar to weaken.

If that happens, commodities could rise.

The U.S. stock market would be likely to fall, since corporate margins are tight, the Financial Times suggests, saying there is not much room to buffer against rising energy and input prices. If the dollar weakens, all costs from overseas supply chains rise, too.

It doesn’t even have to be a dramatic fall in the dollar: a perceived significant weakness could be enough.

Keep up to date on everything going on in the world of trade and tariffs via MetalMiner’s Trade Resource Center.

It should be remembered, commodities and commodity prices are not just inputs for business, but tradable assets for speculators, too. Speculators, especially hedge funds, often move ahead of the market.

Don’t count out commodity prices as a dead duck just yet.

Leave a Reply