Copper MMI: Uncertain demand after coronavirus outbreak reverses copper price gains

The Copper Monthly Metals Index (MMI) dropped six points this month to 70, a new long-term low, although close in value to October 2019’s reading of 71.

Metal prices fluctuate. Key is knowing when and how much to buy with MetalMiner Outlook. Request a free trial.

LME copper prices rallied as January progressed then dropped precipitously later in the month due to demand uncertainty stemming from the coronavirus outbreak in China.

Markets reacted strongly to the news of the potential for a pandemic originating from Wuhan, the capital city of the Hubei province, which serves as a major production center. The province is still mostly on lockdown as of press time.

As a key beacon of the industrial metals complex, copper prices reacted to the developments in China.

However, prices stabilized and moved sideways once hitting around the $5,500/mt price level, indicating price support remains and lower prices may only be temporary (although stronger demand could be delayed until Q2 2020).

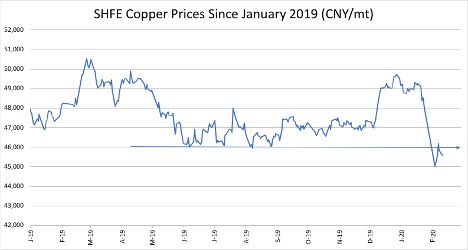

SHFE copper prices dropped steeply in late January

Just a few weeks ago, SHFE copper prices still showed some potential toward a price rally.

All price gains seen since mid-year subsequently retraced, with the price hitting a new low at around CNY 45,000/mt.

The price rebounded slightly, then dropped once more near the CNY 46,000/mt level. If demand becomes significantly repressed in the coming weeks, this could become SHFE copper’s stiff point of resistance for the short term, given that this price point served as a support level for several solid months in mid-2019.

Chinese copper smelter production continues, but fabricators report production stoppages

Copper smelter production in China generally continued, due to the nature of production methods, which makes it costly to shut down temporarily.

On the other hand, as copper fabricators have mostly stopped production during the mandated closure periods, copper cathode inventories have grown.

Some copper buyers recently invoked force majeure, as reported by MetalMiner’s Stuart Burns. With the situation at hand, this action could become more frequent over the next several weeks.

China’s copper treatment charges rise to an eight-month high

The treatment and refining charges (TC/RCs) that smelters charge miners to process the metal increased to $62.50/ton, as reported by Reuters. The elevated charges come as a result of to abundant stocks of concentrate on hand at smelters, with demand for the refined metal lower at this time.

What this means for industrial buyers

Copper price increases thoroughly stalled out in January, yet prices found support fairly quickly and may have already bottomed out, despite the coronavirus situation at hand.

Improve metal purchase timing and mitigate price risk — trial MetalMiner’s monthly metal buying outlook

Actual copper prices and trends

Copper prices mostly fell during January.

The LME primary three-month price dropped by 10% month over month to $5,588/mt as of Feb. 1. Japan’s primary cash price registered a similar decline, falling 9.2% to $5,832/mt.

U.S. producer copper grades 110 and 122 fell by 8.6%, both now at $3.30 per pound. U.S. producer copper grade 102 fell by 8.1% to $3.50 per pound.

China’s copper bar price dropped 8.3% to $6451/mt, while copper wire dropped 8% to $6,475/mt, The primary cash price decreased 7.8% to $6,499/mt.

Indian copper cash prices fell by a milder 3.5% to $6/kg, while Korean copper strip fell by 0.4% to $8.10 per kilogram.

China’s copper #2 scrap price increased by 0.4% — the only increase in the index this month — to $5,536/mt.

—

Mitigate metal price risk with the MetalMiner Monthly Outlook — request your free trial now.

Leave a Reply