Automotive MMI: U.S. auto sales begin slow recovery but remain depressed

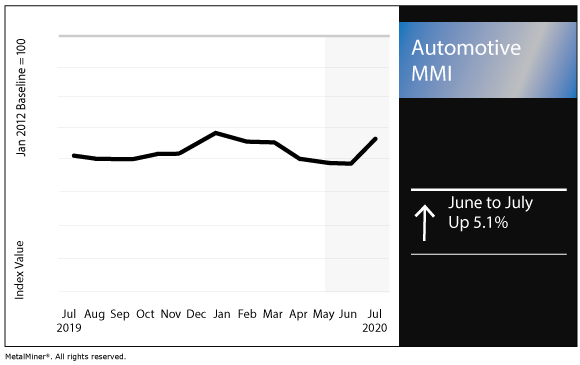

The Automotive Monthly Metals Index (MMI) picked up by 5.1% this month.

U.S. auto sales

U.S. auto sales continued to slump last month and over the second quarter overall, even as the U.S. auto sector restarted production in late May after an approximately two-month suspension.

General Motors reported second-quarter deliveries of 492,489 vehicles, down 34% year over year.

Sign up today for Gunpowder, MetalMiner’s free, weekly e-newsletter featuring news, analysis and more.

“Our resilient sales reflect an improving demand curve, and the strong efforts of GM and our retailers in unprecedented times,” said Kurt McNeil, U.S. vice president of sales operations. “GM entered the quarter with very lean inventories and our dealers did a great job meeting customer demand, especially for pickups. Now, we are refilling the pipeline by quickly and safely returning production to pre-pandemic levels. Having an appropriate mix of the right vehicles combined with the benefits of enhanced shopping technologies such as Shop. Click. Drive., positions us for success in the second half of 2020.”

While some parts of the country have managed to slow down the rate of coronavirus cases, other parts of the country are seeing spikes (including Texas, Florida and Arizona). As such, it remains to be seen if parts of the country are headed for yet another round of lockdowns.

GM’s Chief Economist Elaine Buckberg commented on the improvement in sales on the heels of the easing of lockdown measures since March.

“After falling into a deep recession in March, the U.S. economy has begun to recover as it reopens,” Buckberg said. “Auto sales are benefiting from historically low interest rates that make now an attractive time to buy a vehicle for many customers. We expect continued sales recovery as businesses ramp back up, but recognize that the path forward may not be linear, as rising infections in many states may lead to steps backward in the reopening process.”

Ford, meanwhile, reported second-quarter sales declined 33.3% (with retail sales down 14.3%).

Amid the challenges posed by the pandemic, Ford has adjusted its sales strategy.

“Ford, along with its dealer network, made a rapid shift to online and remote sales,” the automaker said in its quarterly sales report. “As a result, Ford retail share grew an estimated full percentage point to 13.3 percent – Ford’s best retail share quarter in five years.”

Honda, meanwhile, reported its Q2 sales fell 27.9%, while its June sales fell 15.5%.

“We’ve returned to business with April to June sales stronger than we could have expected, with the pace of recovery accelerating in the second half of the quarter,” said Dave Gardner, executive vice president of auto sales at American Honda Motor Co., Inc. “We’re running a bit lean on inventory, but our dealers have been remarkably nimble in adapting to one of the greatest challenges our industry has ever seen and our production team is working extra days this week to supply our customers. Now, we anxiously anticipate the arrival of the all-new Acura TLX to bring some real excitement to Acura showrooms.”

Nissan sales plunged 49.5% in the second quarter.

FCA US LLC reported Q2 sales fell 39% year over year.

“This quarter demonstrated the resilience of the U.S. consumer,” Head of U.S. Sales Jeff Kommor said. “Retail sales have been rebounding since April as the reopening of the economy, steady gas prices and access to low interest loans spur people to buy. Our fleet volume remained low during the quarter as we prioritized vehicle deliveries to retail customers. As a result, we have built a strong fleet order book, which we will fulfill over the coming months.”

According to the latest forecast from J.D. Power and LMC Automotive, June retail sales are forecast to be down 5.7% from a year ago, while total sales are projected to be down 25.1%.

“The industry continues to show signs of recovery in June, with retail sales down only 6% compared with the J.D. Power pre-virus forecast,” said Thomas King, president of J.D. Power’s data and analytics division. “This represents a significant improvement from May when retail sales were off 20% from the pre-virus forecast. The combination of pent-up demand, states relaxing coronavirus-related restriction and elevated incentives are all providing a tailwind for the industry.”

China sales bounce back for second straight month in May

Meanwhile, in China, which has begun to emerge from the economic doldrums of the coronavirus pandemic, saw automotive sales in May increase for a second straight month.

According to the China Association of Automobile Manufacturers, May sales jumped 14.5% year over year. SUV sales in May were up 20.1% year over year.

China’s April sales were up 4.4%.

Meanwhile, March sales were down 43.3% year over year.

Lower your metal spend. Trial MetalMiner’s monthly metal buying outlook now.

Actual metals prices and trends

The U.S. HDG price fell 1.9% month over month to $730/st as of July 1.

LME three-month copper jumped 12.8% to $6,043.50/mt.

U.S. shredded scrap steel fell 3.3% to $259/st.

The Korean 5052 aluminum coil premium jumped 2.9% to $2.86/kg.

Leave a Reply