Aluminum MMI: SHFE, LME arbitrage influenced by weaker U.S. dollar

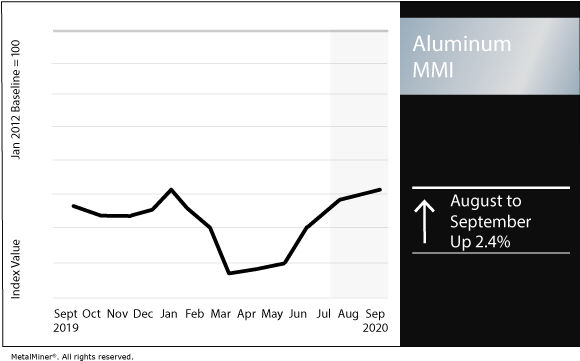

The Aluminum Monthly Metals Index (MMI) increased by 2.4% for this month’s MMI value.

Want more from MetalMiner? We offer exclusive analyst commentary in our weekly, monthly, or quarterly updates – all metals, no sales fluff. Sign up today.

SHFE, LME arbitrage

LME and SHFE aluminum prices traded sideways this past month.

The LME price reached $1,818/mt on Sept. 1, a level it had not reached since January 2020.

Meanwhile, the SHFE price reached CNY 14,960/mt on Aug. 24. However, the SHFE aluminum prices continued to move higher than the LME price.

Throughout the month, SHFE prices were approximately $360/mt to $415/mt higher than the LME price. Some of the arbitrage has occurred due to the weakening of the U.S. dollar, which makes the Chinese price appear higher.

Chinese imports remain high

The price arbitrage between the LME and the SHFE continues.

China became a net importer for the first time in July. The country imported 440,000 tons in July, according to the General Administration of Customs.

July imports rose by 35.5% from the previous month and by 570% from July 2019.

The arbitrage and increase of aluminum imports in China led to the decline of LME warehouse stocks to 1.55 million tons by the end of the month.

On the other hand, Chinese exports are down 11% from August 2019 (despite a slight increase in August). However, exports reached a four-month high at 395,424 tons. The downtrend is mostly due to weak demand overseas, as most countries are still in the early recovery phases of the coronavirus pandemic, while China seems to be ahead.

Strong demand signals in China

China remains the largest aluminum producer and consumer. Since China is the largest driver of aluminum, its “new infrastructure” stimulus package — which includes railway systems, ultra-high voltage power lines and electric vehicle charging points — should support aluminum demand in the medium- to long-term.

Additionally, Chinese domestic vehicle sales increased 11.6% year over year to 2.19 million units in August, the China Association of Automobile Manufacturers reported Sept. 11. This is only expected to increase throughout September and October, traditionally peak season for sales.

Besides government stimulus policies, the expansion of new electric vehicle charging points might increase buying interest. The association also reported production rose 6.3% year over year to 2.12 million units in August.

August marked the fifth consecutive month of year-over-year increases for both output and sales.

Actual metals prices and trends

The Chinese aluminum scrap price declined 1.2% month over month to $1,963.42/mt as of Sept. 1. LME primary three-month aluminum rose 4.4% to $1,798/mt.

Korean commercial 1050 aluminum sheet rose 2.9% to $2.86/kg, while its European equivalent rose 5.4% to $2,582/mt.

Chinese aluminum billet and aluminum bar rose 1.8% to $2,183/mt and $2,280/mt, respectively.

Chinese primary cash aluminum rose 1.0% to $2,154/mt. Indian primary cash aluminum increased 5.9% to $1.99/kg.

See why technical analysis is a superior forecasting methodology over fundamental analysis and why it matters for your aluminum buy.

Leave a Reply