Global Precious MMI: Precious metals retrace after Trump’s announcement on stimulus

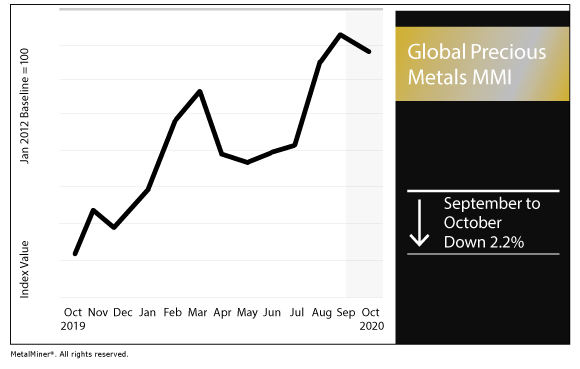

The Global Precious Monthly Metals Index (MMI) retraced 2.2% for this month’s index reading, as the gold price and the silver price both lost previous gains.

The MetalMiner 2021 Annual Outlook consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast that can be used when sourcing metals for 2021 — including expected average prices, support and resistance levels.

Gold price rally loses steam

Amid global economic uncertainty, precious metals like gold have benefited.

The gold price surged as high as $2,063 per ounce in August. The price proceeded to trade sideways for about a month before dipping from mid-September onward, falling to nearly $1,860 per once in late September.

Prices dipped Tuesday after President Donald Trump tweeted he would end negotiations over another federal stimulus package.

Central bank sellers

Central banks are some of the largest holders of gold reserves.

In that vein, the World Gold Council reported central banks switched from net buyers to net sellers in August.

“Global central banks sold a net 12.3 tonnes (t) during the month, continuing this year’s trend of a slower pace of accumulation compared to recent years,” the World Gold Council reported. “Purchases were concentrated amongst regular buyers: Kyrgyz Republic (5t), India (4t), Turkey (3.9t), UAE (2.4t), Qatar (1.6t), Mongolia (1.3t), and Kazakhstan (1.3t).”

However, the Council noted Uzbekistan reduced its gold reserves by nearly 32 tonnes.

Fed releases September meeting minutes

In other news impacting precious metals, the Federal Reserve on Wednesday released minutes for the Sept. 15-16 meetings.

“While the economic outlook had brightened, market participants continued to see significant risks ahead,” the minutes release reads. “Some noted concerns about elevated asset valuations in certain sectors. Many also cited geopolitical events as heightening uncertainty.”

Furthermore, absent a new stimulus package, the release explained “growth could decelerate at a faster-than-expected pace in the fourth quarter.”

As for currencies, the Fed noted the depreciation of the dollar. Traditionally, the price of gold and the U.S. dollar correlate inversely.

“In line with the modest improvement in risk sentiment, the staff’s broad dollar index declined moderately, on net, with the dollar depreciating more against EME currencies,” the Fed stated. “The Chinese renminbi was boosted by better-than-expected Chinese economic data and was the most notable contributor to the decline in the staff’s trade-weighted dollar index, along with the Mexican peso.”

The U.S. dollar index did gain in September, rising as high as 94.64 before retreating. The index stood at 93.63 as of Wednesday afternoon.

Heraeus: balanced market for palladium

Elsewhere, German precious metals processor Heraeus Precious Metals, in a Sept. 1 release, said the palladium market will be close to balanced for the first time since 2009.

“Supply was less affected by the pandemic than demand, which brings the market closer to equilibrium,” Heraeus said in its forecast. “Due to the remote location of the Nornickel mines, Russian palladium production will remain largely unaffected this year.”

Much of palladium demand comes from the automotive sector. As we’ve noted previously, the Chinese automotive sector has gained momentum over the last four months. According to the China Association of Automobile Manufacturers, Chinese automotive sales in August rose 11.6% year over year.

“Palladium demand comes mainly from the automotive industry, which is the strongest consumer with 81 percent – the metal is used in exhaust catalytic converters for gasoline engines,” Heraeus said.

As for platinum, however, Heraeus said it “should hold its ground despite a market surplus.”

Actual metals prices and trends

The U.S. silver price retraced last month, falling 17.6% month over month to $23.20 per ounce as of Oct. 1.

The U.S. platinum bar price fell 4.5% to $884 per ounce. Meanwhile, the U.S. palladium bar price rose 3.3% to $2,204 per ounce.

Chinese gold fell 3.7% to $59.53 per gram. Meanwhile, the U.S. gold bullion price fell 4.2% to $1,885.20 per ounce.

We’re offering timely emails with exclusive analyst commentary and some best practice advice –sign up today.

Leave a Reply