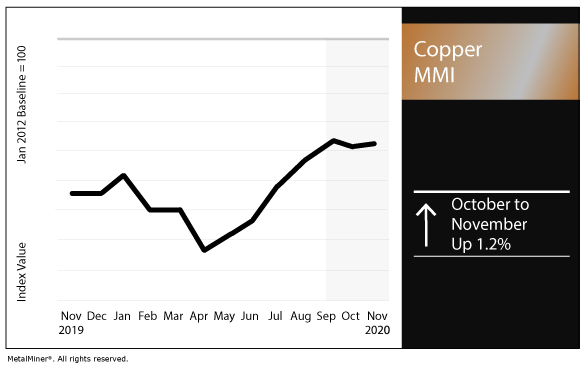

Copper MMI: Copper price reaches 28-month high

The Copper Monthly Metals Index (MMI) increased 1.2% this month, as copper prices surged to a 28-month high in October.

Copper price gains

Copper prices reached a 28-month high at $6,901.50/mt on Oct. 22. The price has lost support since, potentially due to surging global coronavirus infections and stalled U.S. stimulus negotiations.

Copper is a good indicator of economic growth and concern. However, the copper price reacted mildly to the U.S. election. The LME price moved up 1.2%.

Sign up today for Gunpowder, MetalMiner’s free, biweekly e-newsletter featuring news, analysis and more.

Future copper demand

Analysts at Goldman Sachs believe that structural underinvestment, policy-driven demand and macro tailwinds from a weakening dollar and rising inflation risk may create a bullish outlook for 2021.

They estimated a Biden win would increase U.S. copper demand by 2% over the next five years. In addition, it predicted copper prices, which fell back to $6,800 on a general metals pullback last week, to be at $7,000 in three months. Furthermore, the investment bank predicts copper to hit $7,250 in six months and $7,500 by this time next year.

Besides the increase of electric vehicle demand, according to the International Energy Agency (EIA) energy investment is shifting away from fossil fuels, with renewables growing 80% by 2030.

Solar and wind energy projects are benefiting from government support and monetary policies. The expansion of transmission and distribution of those forms of renewable energy will require large amounts of copper.

Unofficial Chinese ban on Australian copper

Chinese customs officials informally warned Chinese importers that Australian goods, including copper concentrate, will be targeted for extensive inspections until the diplomatic row between both countries is solved.

Usually, Australia does not export much copper concentrate to China, representing only 5% of its imports. However, due to the pandemic effect on South America, China increased its imports from Australia. This has left Chinese smelters with no bargaining power and very low spot TC/RCs.

Traders believe that the impact on concentrate and refined supply will be limited. However, the diplomatic row is occurring during the global TC/RC negotiation season, which will translate into a lower 2021 benchmark TC/RC.

Updated prices and warehouse stock correlation

Last month, MetalMiner carried out a correlation analysis between LME copper prices and LME copper warehouse stock levels.

The preliminary correlation analysis found an 86.06% inverse correlation between LME copper prices and warehouse stock levels, at least for 2020.

That means when prices rose, stock inventories decreased, and vice versa. This shows that for the past year, in the case of the copper market, prices and warehouse stocks followed market demand.

However, when we expanded the correlation analysis time frame, the MetalMiner analysis confirmed the correlation does not hold.

Technical analysis, focused on price movement and volume to scrutinize supply and demand fundamentals, remains the best approach to price forecasting. Technical analysis focuses on price trends, market discount and historical data rather than fundamental information (as supply and demand does).

Actual copper prices and trends

LME copper prices increased by 2.3% over the last month.

Japan’s primary cash price increased 2.5% month over month to $6,999/mt.

U.S. producer copper grade 110 increased by 0.8%, resulting in a $0.03/lb increase to $3.86/lb. Meanwhile, copper grades 102 and 122 increased by 0.7% and 1.0%, resulting in a $0.03/lb and $0.04/lb increase to $4.08/lb and $3.87/lb, respectively.

The Indian copper cash price decreased by 0.4% to $7.04 per kilogram.

Korean copper strip increased by 4.5% to $9.25 per kilogram.

China’s copper prices increased by 1.2% to $7,643/mt.

Do you know the five best practices of sourcing metals, including copper?

Leave a Reply