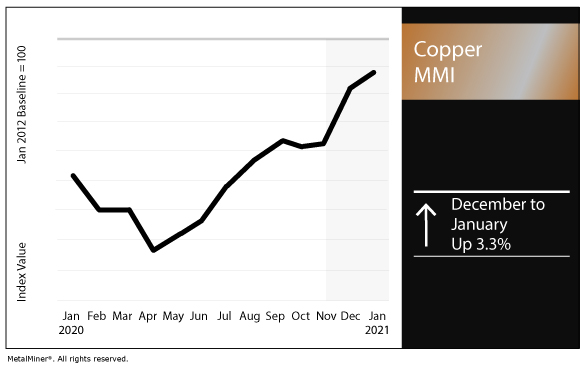

Copper MMI: Prices pick up after a slow December

The Copper Monthly Metals Index (MMI) increased 3.3% this month, as copper producers have faced challenges that are impacting supply.

After a slow December, copper prices continued to increase the first week of January. Prices surpassed the $8,000/mt mark.

However, copper prices remain volatile. As the pandemic continues to develop, the U.S. dollar remains around 90, future demand is uncertain and supply is strained.

Supply constraints from copper producers

Major copper producers are experiencing supply constraints.

On Christmas Eve, MMG declared force majeure on its Las Bambas copper mine in Peru as the local community continued to block a nearby road in protest, making it impossible for the company to transport its concentrate to the port to be shipped. The blockage started Dec. 12, but production continued.

Las Bambas represents approximately 2% of global copper production.

Meanwhile, on Jan. 4 the Mongolian Government informed Rio Tinto — through the miner’s partly-owned subsidiary Turquoise Hill Resources — that if the Oyu Tolgoi underground expansion did not prove to be more profitable, it would terminate their 2015 agreement on fiscal terms.

The expansion would make Oyu Tolgoi the fourth-largest mine in the world by 2030. As such, a shutdown would represent a significant supply disruption.

Large disruptions mean supply constraints, which in the long term support prices even more.

Does copper content call to you? We’re rolling out more on LinkedIn.

Low TC/RCs

Members of the China Smelters Purchase Team (CSPT) lowered treatment and refining charges to $53 per tonne and 5.3 cents per pound for the first quarter of 2021. These charges represented a 8.6% cut compared to the previous quarter.

Similarly, the annual TC/RC benchmark, set by Chinese smelters and Freeport-McMoRan, declined for the sixth consecutive year. The benchmark settled in at $59.50 a tonne and 5.95 cents per pound.

The TC/RC declines come as no surprise.

Mine supply remains tight (as mentioned above). Furthermore, smelting capacity continues to increase, particularly in China. This mix forced smelters to accept lower charges in order to secure raw material.

TC/RCs are a good indicator of raw material available in the market. When primary material is widely available, TCs go up. Meanwhile, when primary material is scarce, smelters lower their TCs. This can affect market sentiment and, ultimately, the price.

Copper scrap

Goldman Sachs reported 2021 could mark the beginning of a copper price supercycle due to the skyrocketing demand boost that the economic recovery might trigger.

As previously mentioned, supply might be tight in the following years. However, scrap might be able to offset supply constraints for at least a year.

ED&F Man Capital Markets’s analyst Ed Meir reported that in previous supercycles, scrap was not abundant and that this time around it will play an important role.

Currently, copper scrap represents about a third of global demand.

Actual copper prices and trends

LME copper prices increased marginally by 1.0% over the previous month to $7,757/mt.

Japan’s primary cash price increased 2.6% month over month to $8,098/mt.

U.S. producer copper grades 110 and 112 increased by 5.6%, resulting in a $0.23/lb increase to $4.36/lb. Meanwhile, copper grade 102 increased by 5.3%, resulting in a $0.23/lb increase to $4.58/lb.

Indian copper cash prices increased by 5.9% to $8.32 per kilogram.

Korean copper strip rose by 4.3% to $9.65 per kilogram.

China’s copper prices increased by 3.0% to $8,995/mt.

Stay up to date on MetalMiner with weekly updates – without the sales pitch. Sign up now.

Leave a Reply