Rare Earths MMI: Lynas Malaysia rare earths processing plant continues to operate at reduced rates

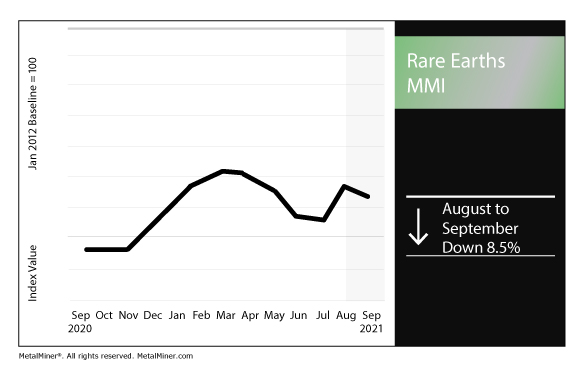

The Rare Earths Monthly Metals Index (MMI) dropped 8.5% for this month’s reading.

Want MetalMiner directly in your inbox? Sign up for weekly updates now.

Lynas updates on Malaysian operations

Lynas Rare Earths Ltd. last month offered an update on its processing operations in Malaysia.

The plant is operating at reduced rates due to the COVID-19 pandemic.

“The Lynas Malaysia plant continues to operate at reduced rates in line with our commitment to the health and safety of our people and in compliance with the Malaysian Government’s Standard Operating Procedures (SOPs),” Lynas said in a release. “As the vigorous 3rd wave of COVID-19 in Malaysia persists, Lynas continues to maintain strict health and hygiene protocols, including COVID-19 testing for all staff and contractors prior to entry to the site.”

Furthermore, Malaysian regulatory authorities extended the deadline for “satisfaction of the licence condition related to the commencement of construction of the Permanent Disposal Facility (PDF) for WLP residue” by six months. The deadline is now March 2, 2022.

“This recognises the constraints presented by current COVID-19 conditions,” Lynas said. “We continue to engage productively with the relevant government and regulatory authorities to progress the approvals for the PDF.”

The company’s processing operations in the country has been the source of outcry from environmental activists. Activists have appealed a court’s decision to dismiss their request for review of the decision to renew the company’s operating license in 2019.

Lynas said it plans to defend the appeal. Malaysian authorities granted the operation a three-year license renewal in February 2020.

Lynas reports FY 2021 results

In other Lynas news, the firm reported its financial results for the fiscal year ending June 30, 2021.

The firm reported FY 2021 EBITDA of $235.3 million, up from $59.7 million in FY 2020.

Lynas touted several measures executed as part of its Lynas 2025 growth plan. Among them, the firm established two new exploration drill holes below the Mount Weld mine’s current pit floor. The exploratory efforts revealed “significant and continuous intersections” of rare earths minerals below the current life of mine, the miner said.

Meanwhile, in news relevant to the U.S. audience, Lynas continued planning for its rare earths separation facility in the U.S.

“In line with Lynas 2025 growth plans for downstream processing closer to our customers, planning continues for the proposed U.S. Rare Earths Separation Facility,” the company said. “Lynas signed contracts for two separate funding grants from the U.S. Government during the year, one for Phase 1 work for a U.S. based Heavy Rare Earths (HRE) separation facility and another for the development of a commercial Light Rare Earths separation plant in the United States.”

Chinese rare earth exports

Meanwhile, China, which controls a majority of global rare earths mining production and processing capacity, sent rare earths exports of 3,955 tons in July, the General Administration of Customs reported.

In addition, exports through the first seven months of the year totaled 27,781 tons. The seven-month total jumped 22.2% year over year. Furthermore, in terms of U.S. dollar value, the value of the 2021 exports jumped by 72.6% year over year.

Actual metals prices and trends

The Chinese yttrium price held flat at $33.28 per kilogram. Meanwhile, the terbium oxide price fell 8.0% month over month to $1,200 per kilogram.

Neodymium oxide fell 1.6% to $95,583 per metric ton.

Europium oxide was unchanged at $30.18 per kilogram. Meanwhile, dysprosium oxide fell 4.1% to $395 per kilogram.

More MetalMiner is available on LinkedIn.

Leave a Reply