Renewables/GOES MMI: Northvolt produces battery cell with 100% recycled nickel, manganese, cobalt

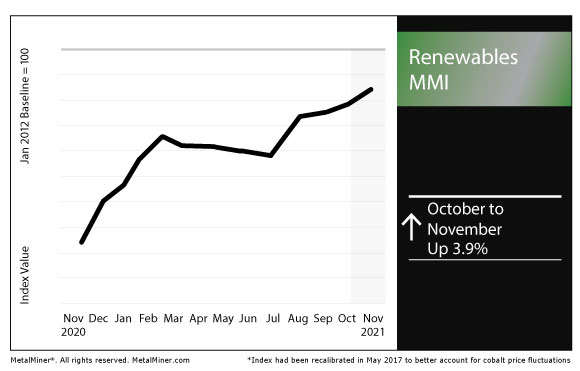

The Renewables Monthly Metals Index (MMI) rose by 3.9% this month.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

Want MetalMiner directly in your inbox? Sign up for weekly updates now.

Northvolt produces first battery cell with 100% recycled cobalt, nickel, manganese

In the battery market, Swedish firm Northvolt announced its recycling program, Revolt, produced its first battery cell with 100% recycled manganese, cobalt and nickel.

The cell features a nickel-manganese-cobalt cathode.

“What we have shown here is a clear pathway to closing the loop on batteries and that there exists a sustainable, environmentally-preferable alternative to conventional mining in order to source raw materials for battery production,” Northvolt Chief Environmental Officer Emma Nehrenheim said. “The recycling process can recover up to 95% of the metals in a battery to a level of purity on par with fresh virgin material. What we need now is to scale-up recycling capacities in anticipation of future volumes of batteries requiring recycling.”

The firm said it plans to scale up recycling capabilities to produce cells with 50% recycled material by 2030.

“To secure this, Revolt Ett, the company’s first giga-scale recycling plant under development adjacent to Northvolt Ett gigafactory in Skellefteå, Sweden, will be expanded beyond its initial design to enable recycling of 125,000 tons of batteries per year,” the firm added.

Construction on the expansion project will begin in Q1 2022.

Infrastructure bill to expand EV charging network

Elsewhere, the House of Representatives passed the Infrastructure Investment and Jobs Act on Nov. 5, sending it to the president’s desk. (President Joe Biden is scheduled to sign the bill today, Nov. 15.)

The bill included $550 billion in infrastructure investments. Among those, the bill includes $7.5 billion in funding to expand the nation’s electric vehicle charging network.

“U.S. market share of plug-in EV sales is only one-third the size of the Chinese EV market,” the White House said in a summary of the bill. “That needs to change. The legislation will invest $7.5 billion to build out a national network of EV chargers in the United States. This is a critical step in the President’s strategy to fight the climate crisis and it will create good U.S. manufacturing jobs.”

The investment will help progress toward the president’s goal of a nationwide network of 500,000 EV chargers.

Incremental gains for renewables power generation

Meanwhile, the Energy Information Administration (EIA) reported the U.S.’s share of electricity generation from renewables reached 20% in 2021.

The 2021 share came in about flat compared with the previous year. However, the EIA forecasts that share to rise to 22% in 2022.

The U.S. will add to its wind and solar power generation next year, the EIA added.

“We estimate that the U.S. electric power sector added 14.6 gigawatts (GW) of new wind capacity in 2020,” the EIA reported. “We expect 17.0 GW of new wind capacity will come online in 2021 and 6.9 GW in 2022.”

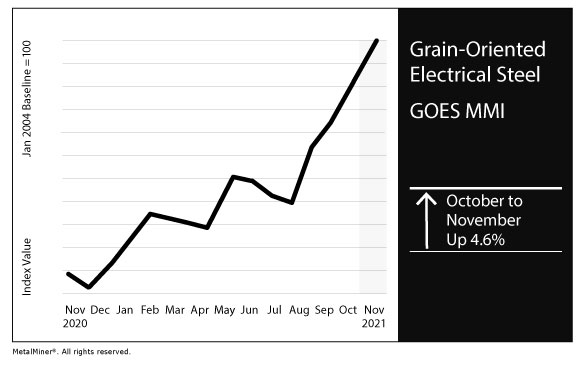

GOES MMI

The GOES MMI, the index tracking grain-oriented electrical steel, rose by 4.6% this month.

Earlier this month, four U.S. representatives sent the Biden administration a letter seeking protection against imports of electrical steel produced by Cleveland-Cliffs, cleveland.com reported.

“As Congress actively considers significant investments in America’s infrastructure, ensuring continued domestic supply of electrical steel is imperative,” U.S. Reps. Marcy Kaptur, Mike Kelly, Conor Lamb and Troy Balderson. “Grain Oriented Electrical Steel (GOES) is an irreplaceable material used in power and distribution transformers that will be needed to facilitate the modernization and greening of the electric grid.”

Cleveland-Cliffs is the only U.S. producer of grain-oriented electrical steel.

Citing rising imports from Canada and Mexico, the representatives called on the Biden administration to negotiate with the two countries to reduce imports and laminations and cores made of GOES.

Actual metals prices and trends

The Chinese steel plate price fell 1.5% month over month to 5,860 CNY as of Nov. 1.

The Korean steel plate price fell 7.3% to $963 per metric ton.

U.S. steel plate rose 3.6% to $1,790 per short ton. Meanwhile, the U.S. GOES price rose by 4.4% to $2,825 per metric ton.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply