Stainless MMI: Stainless steel market tight, nickel shows volatility

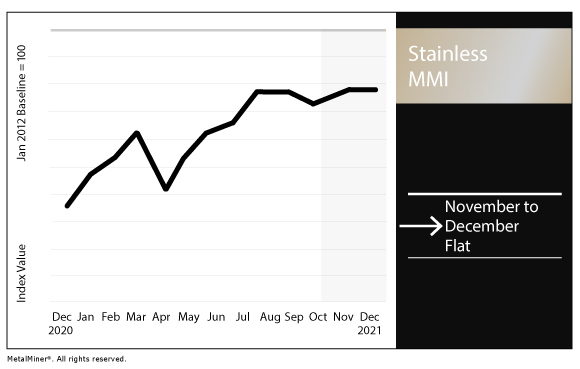

The Stainless Monthly Metals Index (MMI) held flat this month, while the stainless steel market is tight.

Nickel prices appear to have consolidated following the late November spike. As with other base metals, nickel has started to show a high degree of volatility and uncertainty that would suggest a breakout of the current trading range is imminent.

Multiple bearish indicators, including decreased buyer volume as well as bearish wedge formations, lead to the probability of further breakdowns in price should nickel prices fail to sustain a bullish breakout above October’s high.

Indonesia expands stainless output

As the year winds to a close, Indonesia is on track to overtake India as the world’s second-leading stainless steel producer, according to data released by the U.K.-based research institute MEPS. Production during 2021 is expected to surpass 4.5 million tons. COVID-19 lockdown measures and oxygen rationing to steelmakers impacted Indian production in Q2. Production had returned on pace by the third quarter.

Meanwhile, as a result of power shortages and production cuts throughout the year, Chinese output remained constrained. Production in South Korea and Japan, however, is set to grow by 12% and 20%, respectively.

European output is expected to reach 7.06 million tons. U.S. total is expected to expand by 16% year over year to 2.5 million tons. In spite of this climb, U.S. flat-rolled stainless supply continues to be constrained, with no additional capacity on the horizon.

In total, forecasts for global stainless steel output in 2021 have reached 56.8 million tons to reflect 11.6% year-over-year growth. For 2022, global output is expected to expand by an additional 2.5% to 58.2 million tons.

Cut-to-length adders. Width and gauge adders. Coatings. Feel confident in knowing what you should be paying for metal with MetalMiner should-cost models.

Nickel Mines acquires majority stake in Indonesia project

Following a recent $525 million deal, Nickel Mines of Australia is set to acquire a 70% stake in the Oracle Nickel project. As part of the terms, the company will invest $154 million into construction that will add four rotary kiln electric furnace lines. Construction will begin no later than February 2023. Upon completion, the project will have an annual nameplate capacity of 36,000 tons per year of contained nickel in nickel pig iron.

The deal is part of the Nickel Mine’s larger goals to become one of the world’s top 10 producers of nickel. Recently, the company increased its stake by 30% in the Angel Nickel project, bringing its total interest to 80%. That project, also in Indonesia, will begin no later than October 2022.

Nickel price hit seven-year high

Nickel prices spiked to a seven-year high Nov. 24.

LME three-month nickel prices reached $21,050/mt as nickel continued to decline in LME warehouse stocks over recent months, which has fostered bullish sentiment. The price surge and subsequent retracement saw elevated LME buyer volumes on both the upside and downside. That is an indicator of market uncertainty, as both buyers and sellers look to take control over the trend direction.

Meanwhile, as LME inventories fall, refined nickel imports to China have grown. Imports during the first 10 months of the year advanced by 96% year over year. China’s domestic supply was limited throughout 2021 due to multiple factors that include the energy crisis. Additionally, a maintenance outage at the leading producer Jinchuan Group and the operator Jilin Jien Nickel’s switch from nickel cathode to nickel sulphate production have exacerbated market tightness.

Actual metals prices and trends

The Allegheny Ludlum 304 stainless surcharge remained unchanged month over month at $1.14 per pound as of Dec. 1. The Allegheny Ludlum 316 surcharge remained unchanged and held at $1.64 per pound.

Chinese 316 cold rolled coil prices dropped by 6.56% to $4,412 per metric ton as of Dec. 1. Meanwhile, 304 cold rolled coil fell by 12.55% to $3,047 per metric ton. Chinese primary nickel increased by 3.07% to $23,527 per metric ton.

LME three-month nickel rose by 4.22% to $20,125 per metric ton.

Indian primary nickel increased by 3.09% to $20.69 per kilogram.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply