Rare Earths MMI: China merger forms rare earths giant

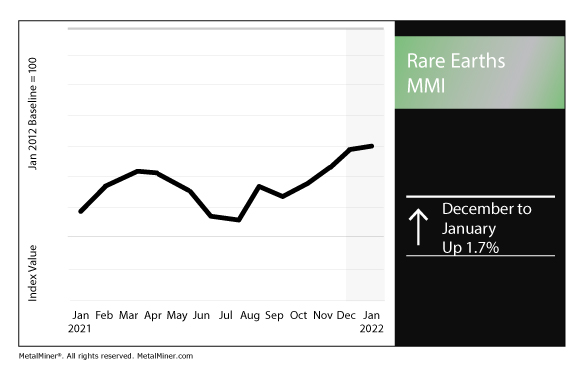

The Rare Earths Monthly Metals Index (MMI) rose by 1.7% for this month’s reading.

We’re offering timely emails with exclusive analyst commentary and some best practice advice. Sign up here.

China consolidates trio of rare earths units

As Beijing has sought to control its domestic metals production in the form of state-directed company consolidation, it has also done so in the rare earths sector.

According to the state-run Xinhua, China established the China Rare Earth Group Co., Ltd. late last month in the country’s Jiangxi province.

Aluminum Corporation of China, China Minmetals Corporation and Ganzhou Rare Earth Group Co., Ltd. established the new company jointly.

Companies aim to develop REE-making technology

Last month, Energy Fuels Inc., the U.S.’s top producer of uranium, announced a memorandum of understanding with Nanoscale Powders LLC to develop novel technology for the production of rare earth element metals.

“We believe this Technology, which was initially developed by NSP, and will be advanced by the Company and NSP working together, has the potential to revolutionize the rare earth metal making industry by reducing costs of production, reducing energy consumption, and significantly reducing greenhouse gas emissions,” Energy Fuels said in its announcement. “Producing REE metals and alloys is a key step in a fully integrated REE supply chain, after production of separated REE oxides and before the manufacture of neodymium iron boron magnets used in electric vehicles, wind generation and other clean energy and advanced technologies.”

Among its other operations, Energy Fuels produces mixed rare earth element carbonate. It also recovers uranium from natural monazite sands.

“The Company is also moving quickly toward producing REE Oxides at the Mill using proven solvent extraction technologies,” the firm added. “The Mill has over 40 years of experience producing uranium and vanadium oxides using SX technology.”

Companies, industry groups weigh in on Section 232 neodymium magnet probe

Last September, the Department of Commerce announced the initiation of a Section 232 investigation covering neodymium magnets.

“Critical national security systems rely on NdFeB permanent magnets, including fighter aircraft and missile guidance systems,” the Department of Commerce said in September 2021. “In addition, NdFeB permanent magnets are essential components of critical infrastructure, including electric vehicles and wind turbines.”

Per the Section 232 statute, Secretary of Commerce Gina Raimondo has 270 days from the initiation of the investigation to provide the president with a full report and recommendations. As such, that deadline falls on June 18, 2022.

“While Energy Fuels does not currently produce NdFeB permanent magnets at the White Mesa Mill, we believe having a secure domestic supply of separated RE oxides, metals, and alloys is likely to spur domestic production of the rare earth magnets that are the subject of the Department’s investigation,” said Mark Chalmers, president and CEO of Energy Fuels, in a submitted comment relating to the investigation.

“Energy Fuels supports the Department’s efforts to ensure that imports of NdFeb permanent magnets are not harming US national security.”

Meanwhile, General Motors urged the government to consider plans to boost development of domestic sources for NdFeB magnets.

“Supply chains for mining, extracting, and processing rare earth elements in the U.S. are currently underdeveloped,” said Omar Vargas, vice president and head of global public policy for GM. “Domestic policy incentives – and sufficient lead times for development – for mineral mining, extraction, and processing, as well as EV component production (e.g., magnets, motors, drive units, batteries), at the federal, state, and local level are also essential for developing resilient U.S. EV battery supply chains.”

Sticking with automotive, the Motor Equipment and Manufacturers Association submitted a comment expressing opposition to any potential new duties on neodymium magnets.

“In sum, MEMA urges the Department of Commerce and BIS to not recommend the imposition of any Section 232 actions against neomagnets – both standalone neo-magnets and finished goods with neo-magnets embedded,” the association said. “Tariffs, quotas, or any similar action would only compound an already stressed supply chain and increase costs for manufacturers – the very manufacturers needed to keep the U.S. globally competitive on key, transformational vehicle technologies as we transition to an increasingly electrified and automated vehicle fleet. Moreover, no suitable alternatives for neo-magnets exist at this time, or for the foreseeable future, until the U.S. builds its own capacity, which may take decades.”

The American Automotive Policy Council also expressed opposition to potential duties.

“Consequently, AAPC and its member companies strongly recommend that the Biden Administration work with the U.S. auto industry to ensure that any applied tariffs do not raise costs for domestically manufactured EVs, batteries, drive units, and other key components,” the AAPC commented. “If this were allowed to happen, it would undermine other critical objectives of the Administration that are aimed at incentivizing, and thereby increasing the uptake of EVs by U.S. consumers, as well as the environmental benefits that would result.”

Actual metals prices and trends

The Chinese terbium oxide price rose 2.94% month over month to $1,786 per kilogram as of Jan. 1. Terbium metal increased 14.5% to $2,446 per kilogram.

Meanwhile, neodymium oxide rose 12.7% to $153,177 per metric ton.

Praseodymium oxide rose 5.5% to $145,843 per metric ton.

More MetalMiner is available on LinkedIn.

Leave a Reply