Global Precious MMI: Gold prices rise; Fed continues tapering

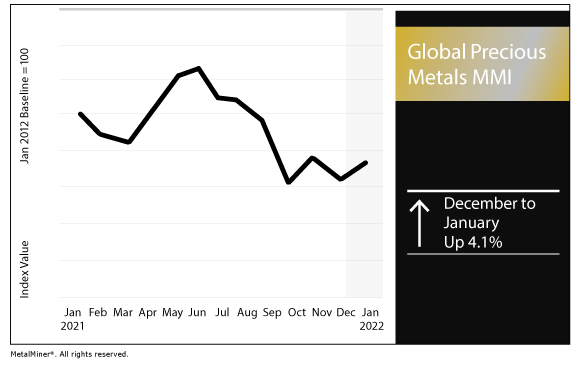

The Global Precious Monthly Metals Index (MMI) rose by 4.1% for this month’s reading.

Stay up to date on MetalMiner with weekly updates – without the sales pitch. Sign up now.

Gold prices make gains to close 2021

Gold prices picked up steam throughout the final month of 2021.

The U.S. gold spot price opened December at $1,774 per troy ounce, according to MetalMiner Insights data (MetalMiner Insights added a precious metals suite last year). The price rose to $1,818 per troy ounce to close the year.

Since then, the price has continued to rise, reaching $1,825 per troy ounce last week.

Meanwhile, the U.S. dollar, which typically has an inverse relationship with gold, moved mostly sideways in December. After opening December at just over 96, the U.S. dollar index fell marginally to just under 96.

Treasury yield rates rise in December

Elsewhere, U.S. Treasury yield curve rates picked up in December.

The 30-year rate rose from 1.77% on Dec. 1 to 1.90% on Dec. 31.

Meanwhile, the 10-year yield rate rose from 1.43% to 1.52% during the same period.

Fed to continue tapering

The Federal Reserve last month announced the continuation of asset tapering measures.

“In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities,” the Fed said last month. “Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage-backed securities by at least $20 billion per month.”

The Fed maintained the federal funds rate at 0-0.25%. However, expectations are it will hike rates multiple times in 2022.

Newmont forecasts rising gold output

The world’s top gold miner, Newmont Corporation, said it expects its gold output to rise in 2022.

The miner forecast gold production of 6.2 million ounces in 2022.

“Attributable gold production is expected to be stable at 6.0 to 6.8 million ounces across the five-year period,” the firm said of the 2022-2026 period. “The 2022 outlook of 6.2 million ounces increases from 2021 due to increased production at Boddington and Ahafo. Production is expected to remain between 6.0 and 6.6 million ounces in 2023.”

The company also offered updates on investment in projects around the world.

“We are entering a period of significant investment in our organic project pipeline, an important component in growing production, improving margins and extending mine life, and we remain focused on delivering long-term value to all of our stakeholders through our ongoing commitment to sustainable and responsible mining,” said Tom Palmer, president and CEO of Newmont.

Actual metals prices and trends

The U.S. silver price rose 6.18% month over month to $23.30 per ounce as of Jan. 1. Meanwhile, the U.S. gold price rose 3.05% to $1,830 per ounce.

Meanwhile, the U.S. palladium bars price rose 5.01% to $1,845 per ounce. The U.S. platinum bar price rose 3.22% to $963 per ounce.

The Chinese gold bullion price rose 1.59% to $58.43 per gram.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply