Raw Steels MMI: As steel prices fall, steelmakers look to scrap

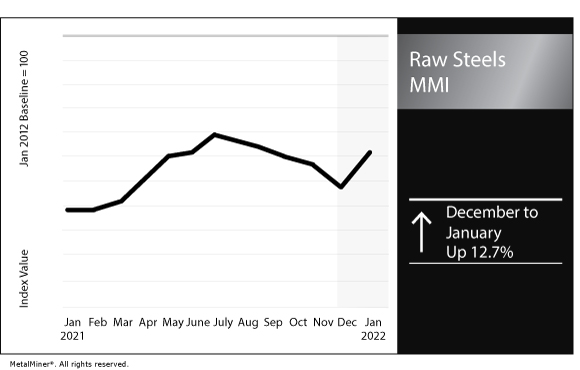

The Raw Steels Monthly Metals Index (MMI) rose by 12.7% month over month to 121, as scrap prices made gains this past month.

U.S. steel prices continue to retreat from their 2021 peaks. At the start of the year, hot rolled coil prices sat almost 18% below the October high.

US steelmakers invest in scrap processing

As electric arc furnace (EAF) capacity expands, U.S. steelmakers are working to secure steel scrap supply, as the Wall Street Journal explained in a recent report.

In November, Cleveland-Cliffs purchased Ferrous Processing & Trading Co. for $775 million. The company represents 15% of the U.S. prime market. As Cleveland-Cliffs is the largest steel supplier to the auto sector, the acquisition will allow Cleveland-Cliffs to negotiate scrap collection from its own customers.

Also in November, North Star BlueScope purchased steel-scrap processing operations and the Delta Yard for $240 million from MetalX.

These recent purchases follow Nucor’s own acquisitions of both Garden Street Iron and Metal Inc. and Grossman Iron and Steel Co. Nucor currently operates 65 scrapyards. Its newest additions will serve to feed its forthcoming or expanding mills.

In total, investments from top steelmakers in scrap processors exceeded $1 billion in 2021.

EAFs, which are fed by scrap, currently account for roughly 70% of U.S. steel production. That share is expected to grow in the coming year as even more capacity comes online. Around 8 million tons of flat-rolled steel capacity was added over the past few years and an additional 10 million tons will be added by the end of 2024. North Star BlueScope alone will grow its own steel capacity by around 40% in 2022.

Scrap prices have grown alongside domestic demand, as MetalMiner Insights data indicate. While prices have retraced from their summer peak, U.S. No. 1 Prompt Industrial Comp. (i.e., #1 Busheling) prices remain more than 54% above where they entered 2021.

Are you under pressure to generate steel cost savings? Make sure you are following five best practices.

Iron ore futures drop amid China’s climate efforts, property decline

Dalian iron ore futures closed the year with a 12% drop, Reuters reported. This marks the first annual decline in the last three years, as China’s most actively traded iron ore futures contract price had quadrupled in 2019 and tripled in 2020.

Prices continued to surge and hit an all-time high by May 2021. Prices began to fall during the second half of the year, however, upon government cuts to the steel sector to reduce carbon emissions, limit pollution and manage the energy crisis.

Estimates for 2022 project further declines, Bloomberg reported. Steel output remains constrained ahead of the Winter Olympics in February. While no additional Olympics-related cuts are expected, Reuters reported, the curbs will remain in place until mid-March. Furthermore, China’s Covid-Zero policy adds future risks of lockdowns, both for the omicron variant as well as any future strains. China’s overleveraged property sector continues to cause concern over the future of demand.

Additionally, China remains unwavering in its carbon emissions ambitions.

In its recent five-year plan, goals include cuts to energy intensity for steel production by 2%, curbs to coal consumption in the steel sector and potentially staggered production in the steel sector. The plan also included closures or relocations for steel mills that don’t meet the state’s pollution standards.

While the document made no mention of specific carbon emissions targets for steel, the sector accounts for roughly 15% of China’s carbon emissions. As such, continued control measures over steel output appear likely.

Mexico steel return

Amid high global steel prices and recovering demand, Mexico’s steel sector returned to pre-pandemic production levels in 2021. In total, Mexico’s steel output for the year is expected to reach just under 19 million metric tons. This follows totals of 18.4 million metric tons and 16.8 million metric tons in 2019 and 2020, respectively.

Production is expected to grow in 2022 as new capacity comes online. The forthcoming capacity includes a new 4.4 million metric ton per year rolling mill from Ternium. The new mill is expected to begin production in March and reach 90% of its capacity by June or July.

Actual metals prices and trends

Chinese slab prices fell 1.41% month over month to $776 per metric ton as of Jan. 1. Meanwhile, the Chinese billet price fell 1.88% to $672 per metric ton.

Chinese coking coal prices dropped by a mere 0.95% to $457 per metric ton.

U.S. three-month HRC futures declined 4.8% to $1,190 per short ton. Meanwhile, the spot price declined by 10.5% from $1,780 to $1,594 per short ton. U.S. shredded scrap steel prices rose by 5.2% to $531 per short ton.

All the metals intelligence — including steel prices, analysis, support and resistance levels, and much more — you need in one user-friendly platform with unlimited usage. Request a MetalMiner Insights platform demo.

Leave a Reply