According to new reports, China exports of graphite may be in for some major changes. Graphite, that unassuming mineral often relegated to the humble pencil, is actually a superstar in the high-stakes world of battery production. This dark horse of the mineral kingdom is crucial in all types of batteries, strutting its stuff across various […]

Category: Industry News

Construction MMI: Steel Prices Drop, High Energy Prices Could Impact Construction Output

Month-over-month, the Construction MMI (Monthly Metals Index) narrowly missed trading completely flat, ultimately moving sideways with just a 0.2% increase. Meanwhile, steel prices, specifically h-beam steel and steel rebar costs, either dropped or traded sideways, as did bar fuel surcharges. Energy have risen at an astounding rate since 2021 due to high inflation and geopolitical […]

Aluminum MMI: Aluminum Prices Lose Last Month’s Gains as U.S. and EU Discuss Tariffs

Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, with a modest 1.92% rise from September to October. Indeed, a short-lived spike at the end of September saw aluminum prices rise over 6% month over month. However, prices began to retrace throughout October. They not only lost all of last month’s gains but returned to […]

Automotive MMI: Index Moves Down, UAW Strike Escalates

The United Auto Workers strike finally began to take its toll on the Automotive MMI (Monthly Metals Index) as well as month-over-month steel prices. Regarding price drops, hot-dipped galvanized managed to suffer the most. And with the strike continuing to escalate, negotiations stagnating, and more and more layoffs occurring nationwide, the index faces massive bearish […]

Copper MMI: Copper Prices Fall to Lowest Level Since November 2022 Amid Surplus Forecast

Although some moved sideways with more modest declines, all components within the overall index saw copper prices trade lower during the month. As a result, the Copper Monthly Metals Index (MMI) declined 2.34% from September to October. Subscribe to MetalMiner’s free weekly newsletter now and generate the most ROI possible within falling copper markets. Copper […]

Copper Price Roller Coaster a Wild Ride in 2023: From Highs to Lows and Back Again

It’s safe to say that the copper price index witnessed an interesting 2023 thus far. Indeed, the market’s been volatile, so there were more than the usual ups and downs. Mid-year, prices registered a major tumble because of the fumble in China’s economy. However, soon after, they began clawing back to a respectable level. Prices […]

Glencore Acquires 56.25% Stake in Mara Copper and Gold Project

Multinational commodity trader and mining group Glencore will acquire a 56.25% stake in the Mara copper and gold project in Argentina. The Swiss-headquartered group struck the Deal with Canada’s Pan America. In a boost for Glencore stock, this agreement gives them sole ownership of the site. The deal stipulates that Glencore will pay Pan American […]

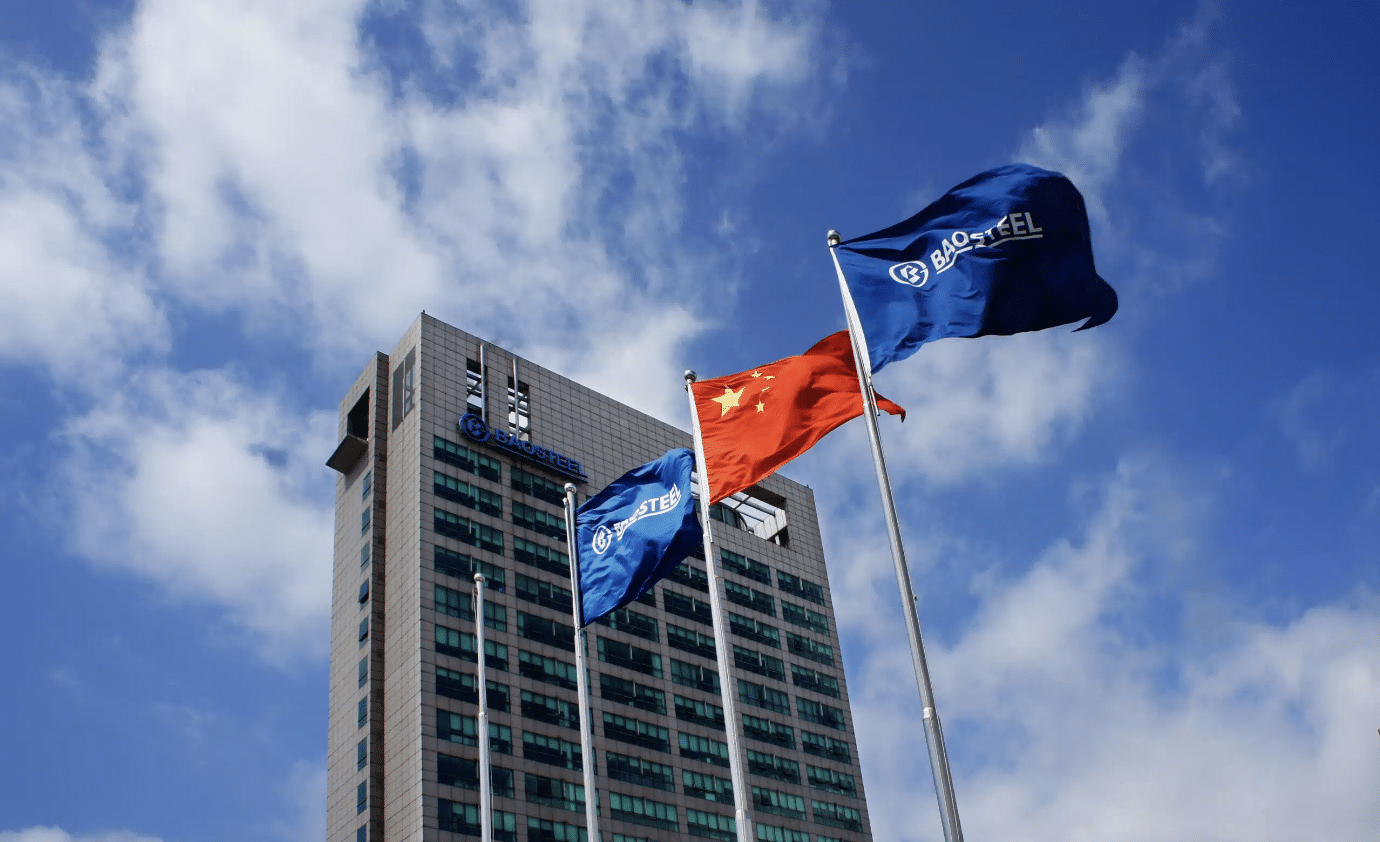

Amid Declines, China Tops Global Steel Production Charts Again

China was the largest end-user of steel in 2022. According to the World Steel Association’s (Worldsteel) “2023 World Steel Report,” the country consumed 51.7% of the 1.78 million metric tons of finished products rolled last year. That percentage was unchanged from the previous year. At that time, China’s apparent steel consumption was 954 million metric […]

Stainless MMI: LME Riddled With Challenges, Nickel Prices Rebound

The Stainless Monthly Metals Index (MMI) broke to the downside from May to June, with stainless steel prices falling 10.15% After falling over 14% throughout May, nickel prices began to rebound during the first half of June. Since prices remain within their short-term range without an established trend, uncertainty and volatility may increase in the […]

Aluminum MMI: Aluminum Prices Sideways Amid LME’s Russia Problem

Aluminum prices continue to lack enough strength to form either bearish or bullish trends. Since aluminum prices have yet to break out of range meaningfully and there is no established uptrend or downtrend, the market remains highly risky. Altogether, the Aluminum Monthly Metals Index (MMI) dropped 3.19% from May to June. Russian Aluminum in LME […]