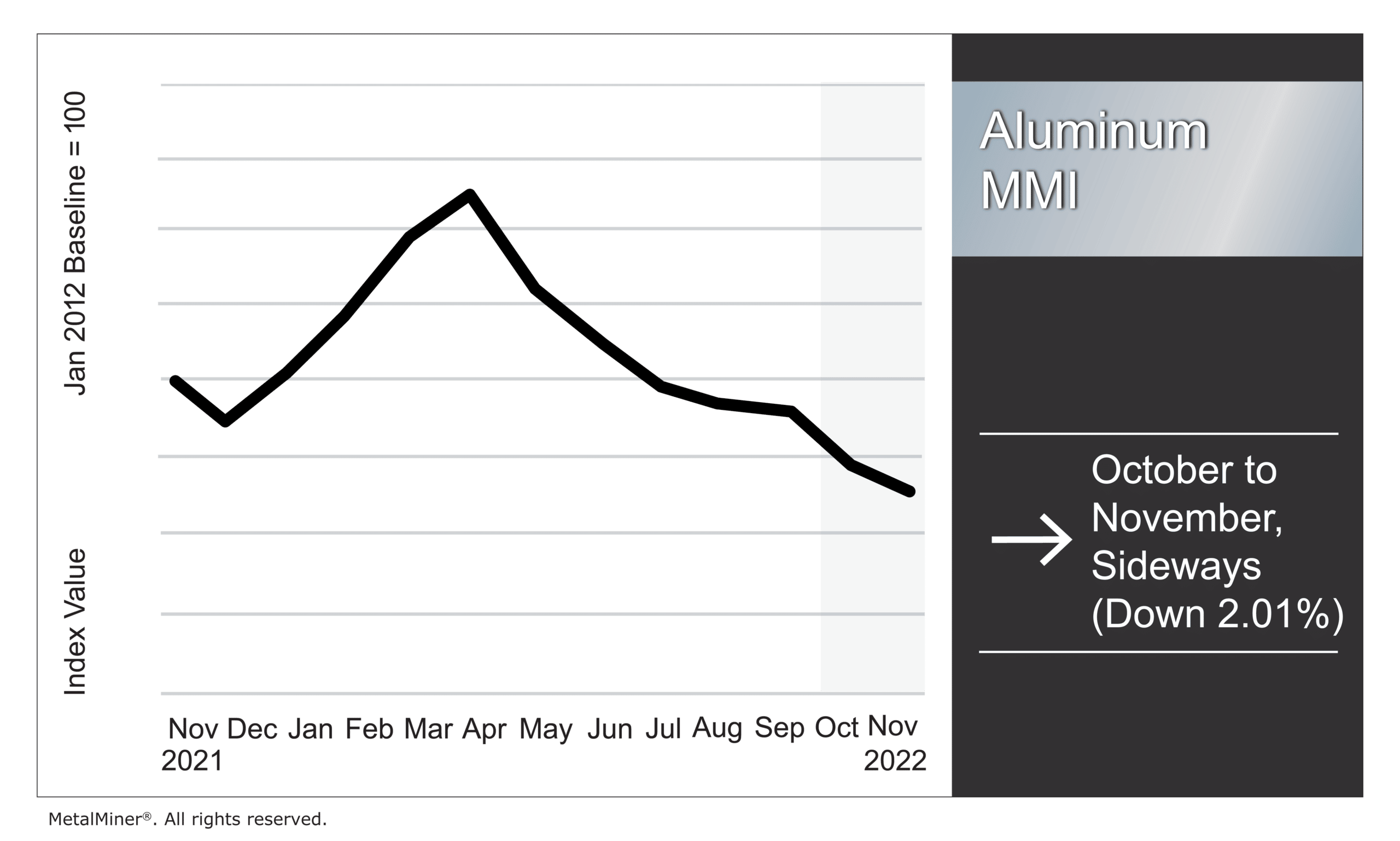

Aluminum prices consolidated last month within a range formed between late September and early October. The index’s unclear direction posed a higher risk to buyers, as prices could either reverse to the upside or continue downward. However, by early November, prices seemingly turned bullish. Shortly after, they enjoyed a steady climb toward the top of […]

Category: Industry News

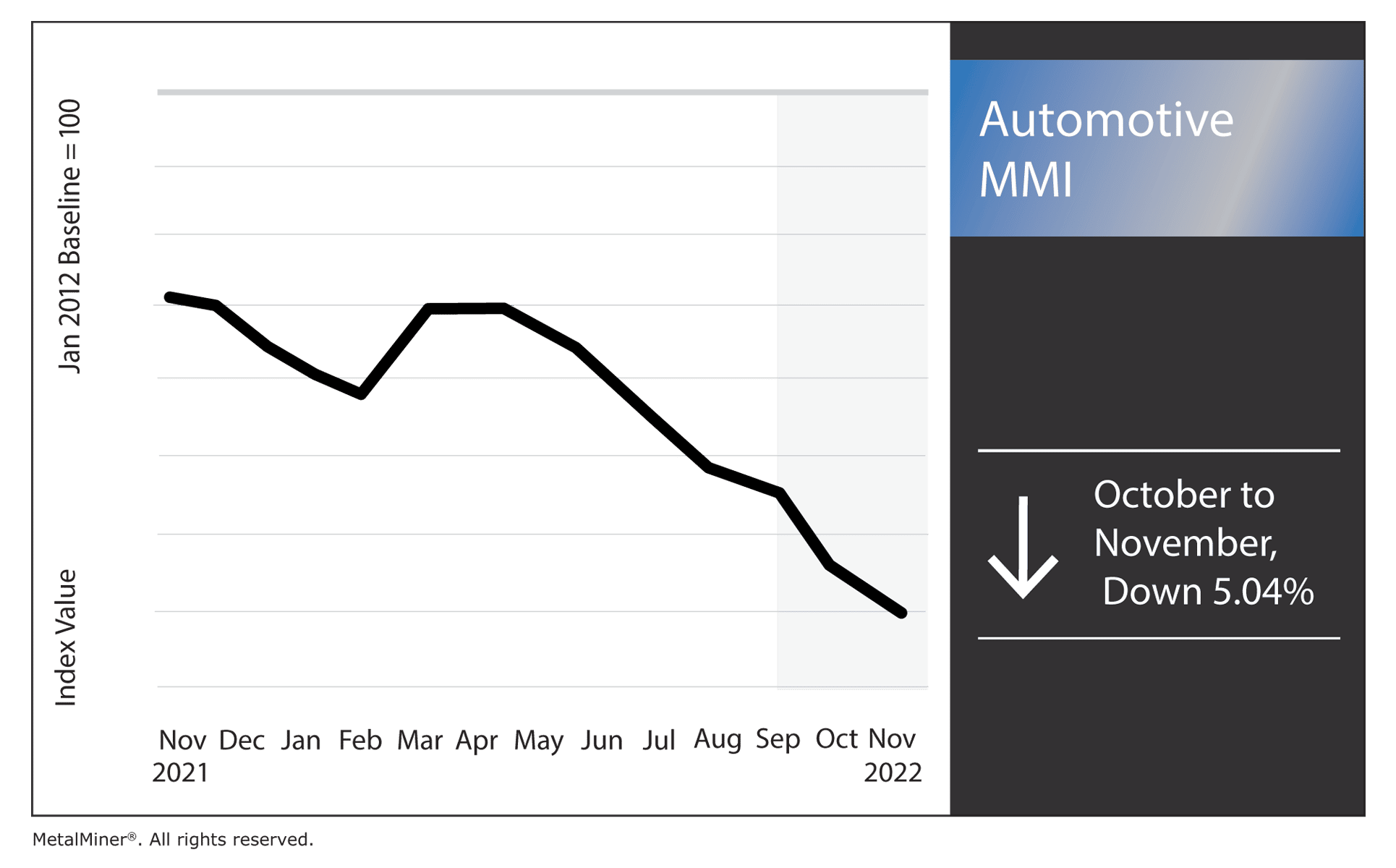

Automotive MMI: Consumer Demand High, Manufacturing Materials Low

The November Automotive MMI (Monthly MetalMiner Index) continued its long-term downward trend, falling by 5.04%. The drop is surprising to some extent, considering the demand for cars remains high in the U.S. and backlogs are keeping sales lucrative. However, obtaining raw materials for part manufacturing remains a problem. For instance, steel prices are still on […]

Indonesia Considering Downstreaming to Retain Processed Tin Domestically

The Indonesian government has plans to shake up the tin market over the next few months. One analyst told MetalMiner that the Southeast Asian country aims to expand downstreaming opportunities for refined tin rather than continue exporting the majority of its supply. According to the analyst, the government wants to attract end-users, such as solder […]

Double Digit Cost Savings on The Table For 2023

2023 Budgets Should Reflect Declines in Metal Prices Most metal prices experienced considerable drops from price levels seen just a year ago. Indeed, excluding lead, all non-ferrous and ferrous metal prices appear considerably below price levels seen in 2021. Most suppliers continue to stay quest amidst this decline, opting to place the onus of cost […]

Glencore Slows Energy-Intensive Zinc Smelting

Glencore plans to place the zinc smelting line at its Nordenham plant in northern Germany on care and maintenance starting November 1. This represents yet another major blow to European metal manufacturing, which continues to see shutdowns amid the continent-wide energy crisis. In an October 5 memo, the London and Johannesburg-listed company’s supervisory board chairman, […]

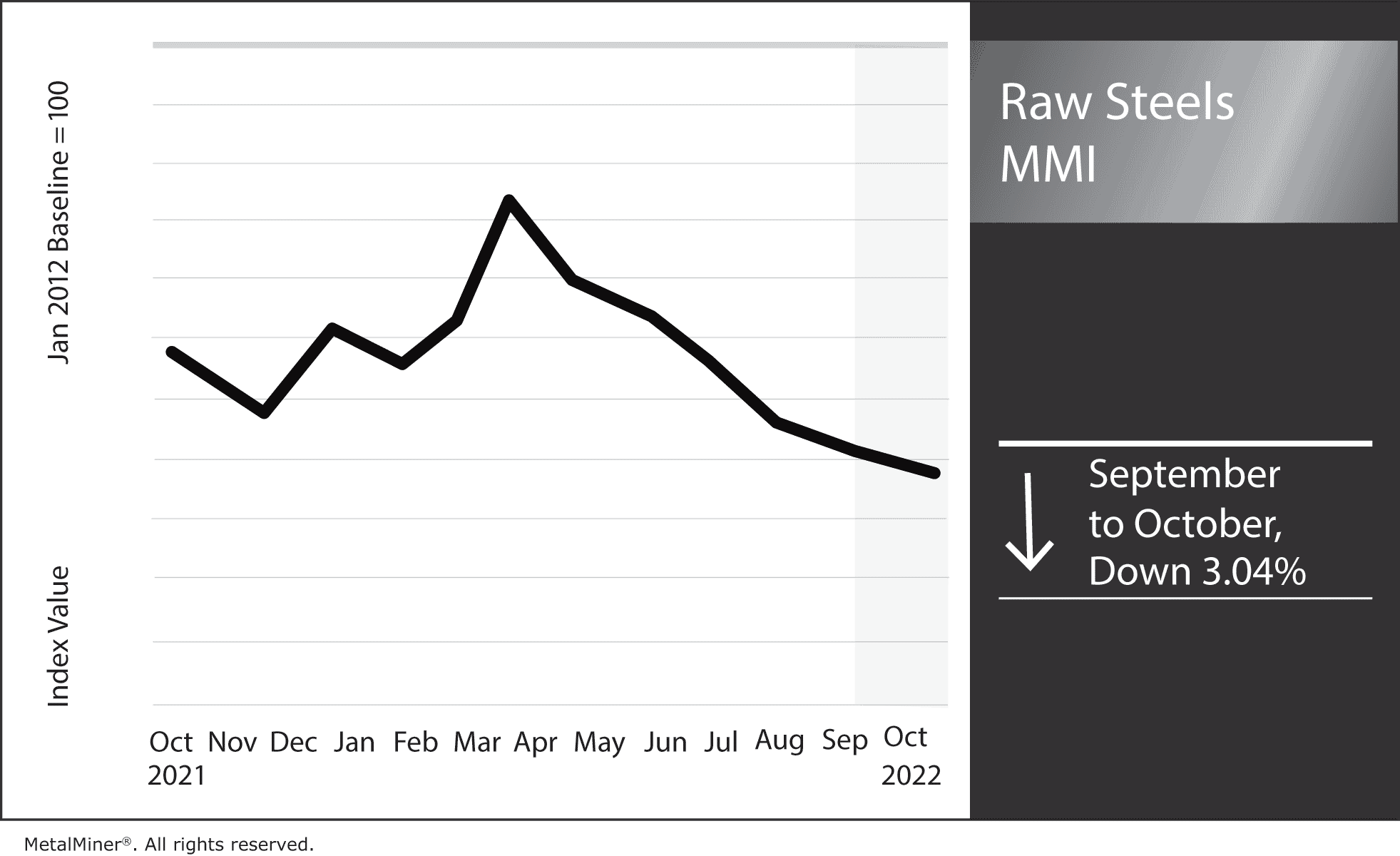

Raw Steels MMI: Steel Prices Flatten, Slowly Edge Downward

The Raw Steels Monthly Metals Index (MMI) fell by 3.04% from September to October. U.S. steel prices continued to drop throughout September. However, declines for both hot rolled coil prices and cold rolled coil prices slowed to a sideways trend. Plate prices, which have shown the most strength of steel prices, traded down for the […]

Renewables MMI: Battery Metal Markets Hold Sideways Trend

The October Renewables MMI (Monthly MetalMiner Index) dropped yet again, but by less than in previous months. All in all, prices fell by 3.28%. The demand for battery metals due to the growing EV market largely kept the index afloat. Still recovering from August’s steep drop, Cobalt traded sideways between September 1 and October 1, […]

ArcelorMittal Doubles Down on Indian Steel Manufacturing

ArcelorMittal appears quite bullish on India. In fact, the company recently announced its intention to double steel manufacturing at one of its primary plants. ArcelorMittal-Nippon Steel India Ltd. (AM/NS India) plans to spend US $5.1 billion at its Gujarat plant in western India. Betting on strong growth in domestic consumption, the company hopes to boost […]

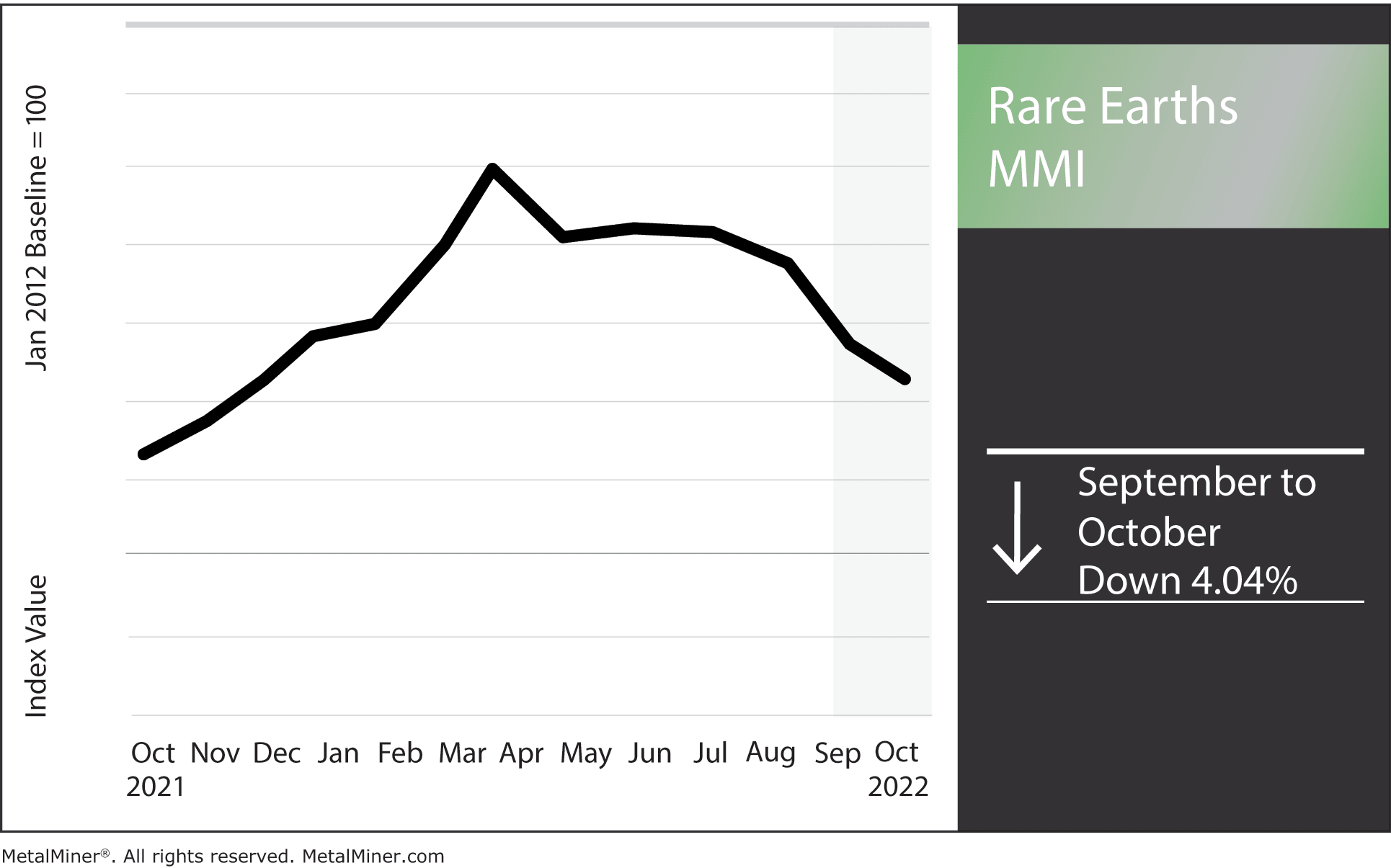

Rare Earths MMI: A Renewed Push for Rare Earth Independence

The Rare Earths MMI (Monthly MetalMiner Index) fell an additional 4.04% between September and October, less than half the decline seen the previous months. However, it does indicate that rare earth producers are still under pressure. Rare earth annual contract renewals are coming for 2023. Learn the best contract negotiation tactics in MetalMiner’s free October […]

Latest Updates on LME Aluminum: Potential Russian Prohibition

Last week, speculators bought up aluminum amid a $100/ton spike following news that LME aluminum may soon exclude Russian materials. The LME continues to review a ban that would keep Russian aluminum, nickel, and copper from the exchange. A Reuters post illustrated the seriousness of the move, stating that Russia’s Nornickel accounted for 7% of global […]