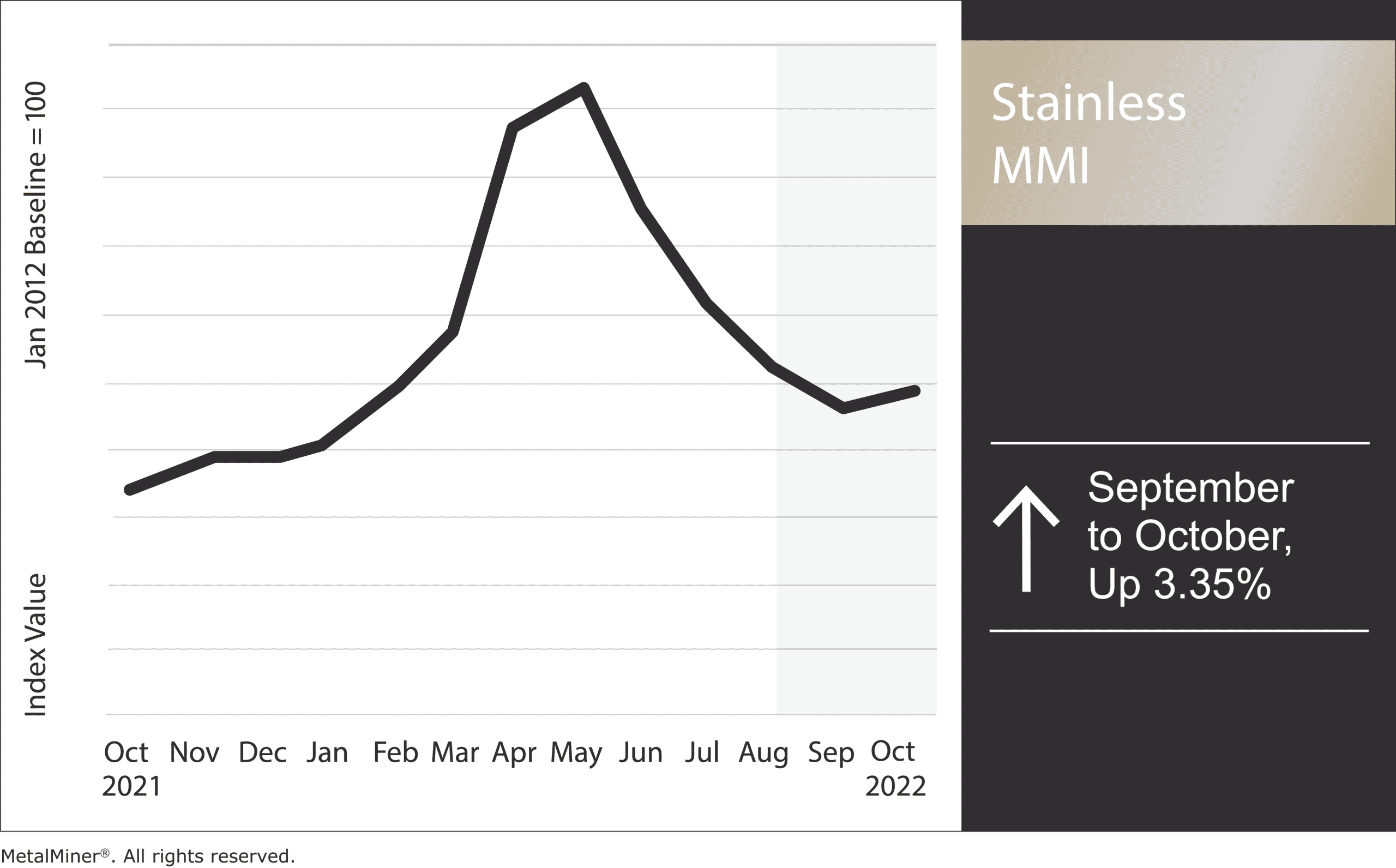

By: Nichole Bastin and Katie Benchina Olsen The Stainless Steel Monthly Metals Index (MMI) rose 3.35% from September to October. Last month, nickel prices traded up with a strong rebound during the first three weeks. However, prices soon fell back within range. These declines continued until the opening days of October, with prices mainly remaining […]