The E.U.’s steel safeguard mechanism should work to prevent a “surge of imports” but should not “close the market,” European Steel Association (EUROFER) Director General Axel Eggert said Monday. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook “The safeguard mechanism should be broad, but the purpose is not to close the […]

Tag: L9

Best Friends Donald Trump and Saudi Arabia Are at Odds Over the Oil Price

President Donald Trump has signaled his displeasure at aspirations expressed by Saudi Arabia at a recent OPEC meeting with respect to an extension in the current supply deal between OPEC and non-OPEC members for continued supply constraints with a view to higher prices. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook […]

Aluminum Consumers Pose a Not-Unreasonable Question: How High Can Prices Go?

Higher is the simple answer. The world with the exception of China was in deficit before U.S. sanctions against Oleg Derispaska and his aluminum company Rusal. So when the three million tons of primary metal Rusal exports outside of Russia are taken out of a market already worried by the recent partial closure of Norsk […]

Indian Officials Meet With Assistant USTR to Talk Trade

India found itself on the back foot in the first meeting of trade representatives from India and the United States in the Indian capital, New Delhi, last week. It was held to discuss the latest U.S. trade tariffs on steel and other metal imports. Need buying strategies for steel? Try two free months of MetalMiner’s […]

Aluminum Associations Around the World Want G20 Forum on Overcapacity

Several aluminum associations around the world penned a joint letter in which they urged G20 leaders to hold a forum on global aluminum overcapacity. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook “In light of the conclusions reached last July at the G20 Summit in Hamburg, Germany, and the publication of the Global […]

The April MMI Report: LME Metals Fall While U.S. Steel Gets a Boost

Our latest round of Monthly Metal Index (MMI) reports is in, snapshotting what was a particularly busy month in the world of metals. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Last month, the Trump administration enacted Section 232 tariffs on steel and aluminum imports, which had been a topic of […]

GOES MMI: No Exemption Requests on Grain-Oriented Electrical Steel

Last month MetalMiner made the following statement: “The impact on Grain Oriented Electrical steel buying organizations, MetalMiner believes, will not exactly mirror the broader impact of the tariffs on commonly purchased steel forms, alloys and grades.”

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

We don’t always get it right but indeed, GOES M3 prices fell last month in comparison to across-the-board price increases for all or nearly all other carbon flat rolled product categories.

Meanwhile, although MetalMiner knows of one buying organization pursuing an exclusion request via the recently published exclusion process, no company has yet to file one (at least as of April 11). That will change as GOES imports continue to arrive.

This month import levels jumped, as did Japanese imports, in particular.

[caption id="attachment_91308" align="aligncenter" width="580"]

Of note, Chinese imports remain negligible (240 tons) and no imports came from South Korea.

What About the Section 301 Investigation?

A quick search revealed that the 301 investigation also includes grain-oriented electrical steel with HTS Codes: 72261110, 72261190, 72261910 and 72261990 — basically “alloy silicon electrical steel (grain-oriented) of various widths.”

However, the 301 investigation does not include either transformer parts (8504.90.9546) or wound cores (8504.90.9542), both of which could come into the U.S. under current prevailing market treatment.

MetalMiner will update readers when/if President Trump publishes a proclamation on the 301 investigation.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month

Stainless Steel MMI: LME Nickel Prices Fall But Stainless Steel Surcharges Rise

The Stainless Steel MMI (Monthly Metals Index) inched one point higher in April. The current reading is 76 points.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The index’s increase was driven by the rise in stainless steel surcharges, despite slightly falling LME nickel prices this month. Other related metals in the stainless steel basket increased.

LME Nickel

In April, nickel price momentum appears to have recovered from its previous pace.

LME nickel prices dropped in March, along with other base metals. However, the drop appears less sharp than for aluminum or copper.

[caption id="attachment_91260" align="aligncenter" width="580"]

LME nickel prices remain high and far away from 2017 lows back in May or June, when MetalMiner recommended buying organizations buy some volume forward. Prices back at that time were around $8,800/mt versus the current $13,200/mt price level.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month.

The 316/316L-coil NAS surcharge reached $0.96/pound. Therefore, buying organizations may want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

[caption id="attachment_91261" align="aligncenter" width="580"]

The pace of stainless steel surcharge increases appears to have slowed this month. However, surcharges have increased from 2017. The 316/316L-coil NAS surcharge is closer to $0.96/pound.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, with steel prices skyrocketing.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

Raw Steels MMI: Domestic Steel Price Momentum Picks Up

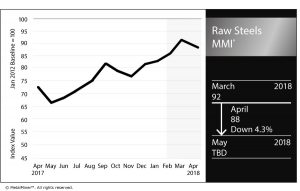

The Raw Steels MMI (Monthly Metals Index) fell four points this month, dropping to 88. Despite the drop in the Raw Steels MMI, domestic steel price momentum has been on a tear throughout March. All prices for the main forms of flat-rolled steel products have reached more than seven-year highs.

Domestic steel prices accelerated their pace of increases in such a way that HRC domestic prices have risen from the $600-$650/st level to around $850 in the last three months.

[caption id="attachment_91239" align="aligncenter" width="580"]

The steel price increase comes as a result of several factors. First, the long-term trend that started in 2016 created upward movement for steel prices. Second, the delayed steel sector cyclicality (seasonality) has pushed the steel price slope even steeper.

Historically, prices usually increase during Q4 as many companies renegotiate their annual agreements as part of the budgeting season for the following year. However, this year, steel price increases didn’t occur until later. Prices appeared to wait for the Section 232 outcome (with its corresponding tariffs), which acted as a support for domestic steel prices.

However, domestic steel prices seem closer to the end of this latest price rally. Based on historical steel price cyclicality, lower Chinese steel prices and decreasing raw material prices, domestic steel prices may fall in the coming months.

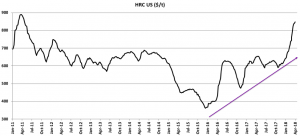

The Divergence in Steel Prices

Chinese steel prices and U.S. steel prices usually trade together. However, the short-term trend sometimes shows some divergences.

Short-term trends may be created by local uncertainty or sudden disruptions with local supply. But these short-term trends tend to correct, and return to their historical pattern.

[caption id="attachment_91240" align="aligncenter" width="580"]

When looking at Chinese and U.S. HRC prices in tandem, the price divergence observed this month leaves no one surprised.

U.S. HRC prices skyrocketed, while Chinese HRC prices continue to fall. It is true that Chinese HRC prices increased sooner in 2017 (starting June 2017), supported by the steel industry cuts in China. The spread between Chinese and domestic steel prices dropped in Q3 2017, as U.S. domestic steel prices traded sideways. The recent drop in Chinese steel prices may create downward price pressure for domestic steel prices.

Global Steel Market

Chinese steel production cuts continue. The city of Handan ordered steel mills to cut around 25% of their steel production to continue the pollution curb measures. These cuts will be extended from April to mid-November. The coking coal industry will also cut production by around 25% over that period. The cuts started on April 1.

According to the Mexican government’s official gazette, the Mexico economy ministry has formally imposed anti-dumping duties on carbon steel pipe imports from South Korea, Spain, India and Ukraine.

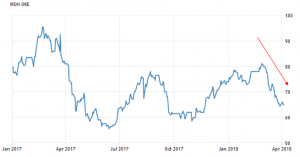

Raw Materials

After the prior raw material price increases at the end of 2017, raw material dynamics seem to have slowed down.

Iron ore prices fell sharply in March. Iron ore prices increased slightly at the beginning of this month. However, the sharp decrease in prices last month may not support the current highs in domestic steel prices.

[caption id="attachment_91243" align="aligncenter" width="580"]

Coal prices also fell in March. Coal prices seem to be increasing slightly again this month, even if current prices remain far away from the $110/mt highs in January 2018.

[caption id="attachment_91244" align="aligncenter" width="580"]

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit to mid- and long-term purchases. Buying organizations looking for more clarity on when to buy and how much to buy of their steel products may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends

Global Precious MMI: Palladium, Platinum Prices Continue Holding Under $1,000/Ounce

Last month, in our headline for the monthly update article on the Global Precious MMI, we called out the fact that platinum and palladium prices had dropped. Then we asked: “Will it continue?”

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Well folks, if our Magic 8-Ball were to answer, it’d say — signs point to yes.

At least for this month’s index reading.

With losses in U.S. platinum and palladium pricing leading the way, our Global Precious Monthly Metals Index (MMI), tracking a basket of precious metals from across the globe, floated down yet again for April — dropping 1.1% and settling into a two-month downtrend.

(Last month, we had initially reported that before March’s drop, the index had been in a two-month uptrend. Correction: it had in fact been in a four-month uptrend at that point.)

Both stock markets and commodities markets have been in a bit of turmoil lately, with President Trump implementing tariffs on steel, aluminum and potentially 1,300 categories’ worth of additional Chinese imports mid-last month, and China coming back with retaliatory tariffs on a number of non-metal U.S. commodity exports.

It wouldn’t be a stretch to say that knock-on effects are being seen in the precious metals markets.

PGMs Lead the Way

Gold prices in the U.S., China and India were slightly up on the month (with the Japan price holding relatively steady), and even silver prices in China and India increased.

Yet platinum and palladium prices told a different story.

Both platinum and palladium bar prices dropped across all geographies (U.S., Japan, China) — the U.S. platinum bar price sunk 3.5% and the U.S. palladium bar price fell 3.2%.

The longer-term picture for platinum as a crucial component of industrial manufacturing continues to get murkier.

According to a Reuters interview with Bart Biebuyck, executive director of the European Commission’s fuel cell and hydrogen joint undertaking, “the volume of platinum used in fuel cell-powered cars could be cut to ‘micro levels’ within three years and eradicated altogether in a decade’s time, making these environmentally-friendly vehicles much cheaper to buy.”

He said the amount of platinum in the next generation of fuel cell cars had already been cut to levels similar to that used in the catalytic converters of diesel vehicles, which industry estimates put at 3-7 grams, according to Reuters.

With the automotive industry — which accounts for about 40% of platinum demand — looking to cut costs, that 3-to-7-gram range for diesel vehicles may steadily but surely decrease in coming years. That’s because, as we reported last month, the gradual but very real retirement of diesel engines across the European continent continued.

A German court ruled that cities have the right to ban diesel cars from driving the roads in certain areas. Of course, the Volkswagen scandal and its aftermath proved to be a big blow for diesel cars, as well.

If more diesel engines go extinct, with them will go corresponding PGM consumption for catalytic converters.

For more efficient carbon steel buying strategies, take a free trial of MetalMiner’s Monthly Outlook!

Key Price Movers and Shakers