The recent rise in aluminum, copper, and nickel price have created some short-term uncertainty as companies finalize their long-term contracts for 2023. Earlier this month, all three metals rose on the back of rumors that China might begin easing zero-COVID restrictions. In addition, the USD index has dropped from its September peak of 114. As […]

Tag: nickel price

Vladimir Potanin Sanctioned by the UK and Nickel Price Impact

The UK government has added Vladimir Potanin, Norilsk Nickel’s president and chairman of the management board, to its list of sanctioned individuals. The LME nickel price remains in question. A June 29 update notification from HM Treasury’s Office of Financial Sanctions Implementation (OFSI) noted Potanin’s addition. The stated reason was that he would benefit from […]

Stainless MMI: Nickel Prices Fall and Start Consolidating

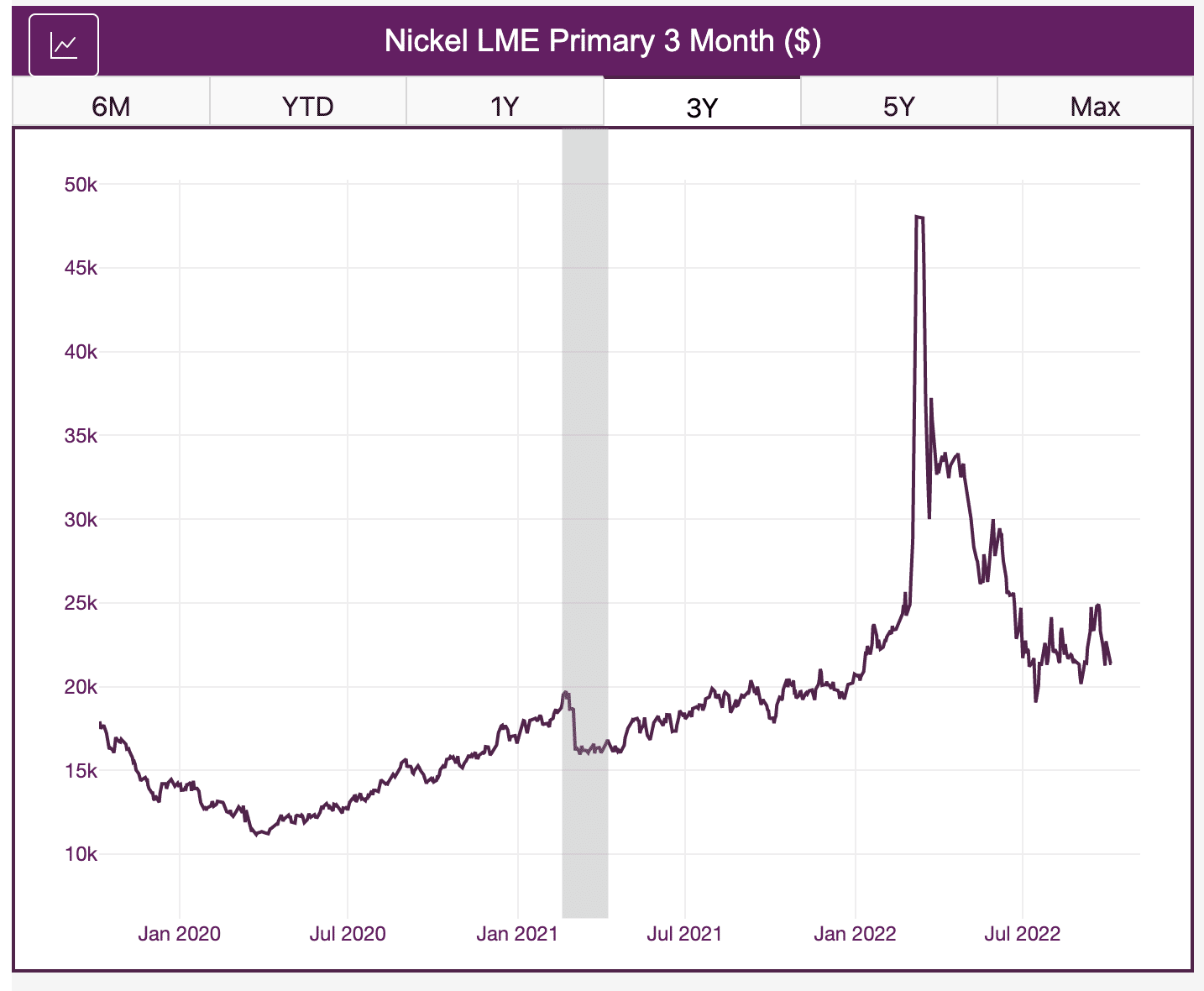

Nickel prices appeared to hit a bottom in mid-May, but the trend remains down. Moreover, recent price action showed few signs of any bullish structures on a weekly scale. All in all, the Stainless Monthly Metals Index (MMI) dropped 9.4% from May to June. LME Faces Nearly $500 Million in Lawsuits The nickel crisis returned […]

Is the Battery Metals Gold Rush Really Over?

The term battery metals typically refers to lithium, nickel, and cobalt. The name stems from the fact that the three metals are frequently used in the production of all types of modern batteries. Since 2021, these metals have enjoyed a rather lengthy bull run. This has proved profitable for investors and provided some much-needed predictability […]

Nickel Prices: LME Nickel Contract Continues to Lack Liquidity, Harming Price Discovery

Nickel prices are seeing a lot of attention due to an overall lack of liquidity on the LME contract. But what exactly does this mean? Moreover, what does it mean for buyers looking to mitigate price problems in the face of global supply problems? The metals market moves fast. Sign up for the weekly MetalMiner […]

MetalMiner Q&A: LME nickel turmoil, volume volatility and what’s next for the exchanges

The MetalMiner team has broken down the significant fluctuations in the LME nickel contract this month. But now that a few weeks have passed since the LME first suspended trading, it’s time to take a look at some other interesting trends at play on the LME and elsewhere. In this question-and-answer session, MetalMiner’s Stuart Burns […]

LME nickel hits the buffers again

You must wonder what would have happened if the LME had left the nickel market alone — after nickel prices embarked on a meteoric rise March 7 — and allowed the short covering price spike to work out. Yes, the shorts would have been badly burned. That would have included not just Tsingshan Holding Group […]

The LME nickel price debacle continues

Well, if you thought the London Metal Exchange’s unprecedented suspension of trading last week took the steam out of the nickel market and nickel prices, and that the world would revert to orderly conduct Wednesday when the LME resumed trading, you would have been wrong. Nickel price chaos The LME had set trading limits of […]

Stainless MMI: Trading halted following nickel price spike

The Stainless Monthly Metals Index (MMI) rose by 7.6% from February to March, as the skyrocketing nickel price prompted LME intervention Tuesday. LME suspends trading due to short squeeze Russia accounts for roughly 7% of global nickel supply. So, the possibility for supply disruptions, on the back of mounting sanctions from the West, adds pressure […]

LME suspends nickel trading due to short squeeze

The London Metal Exchange (LME) halted nickel trading effective 8:15 a.m. London time today. The contract will remain suspended for the remainder of today. According to the LME, the price movement in Asia overnight combined with the situation between Russia and Ukraine led to the decision to halt trading. Furthermore, the LME said it would […]