Metal prices demonstrated increasingly-bearish short-term movement over the past couple of weeks. HRC, for instance, continues to trend downward while nickel faces extensive bearish pressure. But while prices may continue to decline in the short-term, will the long-term trend continue? Nickel in a Bearish Market Nickel prices fell more than 20% in the first three […]

Tag: raw steels

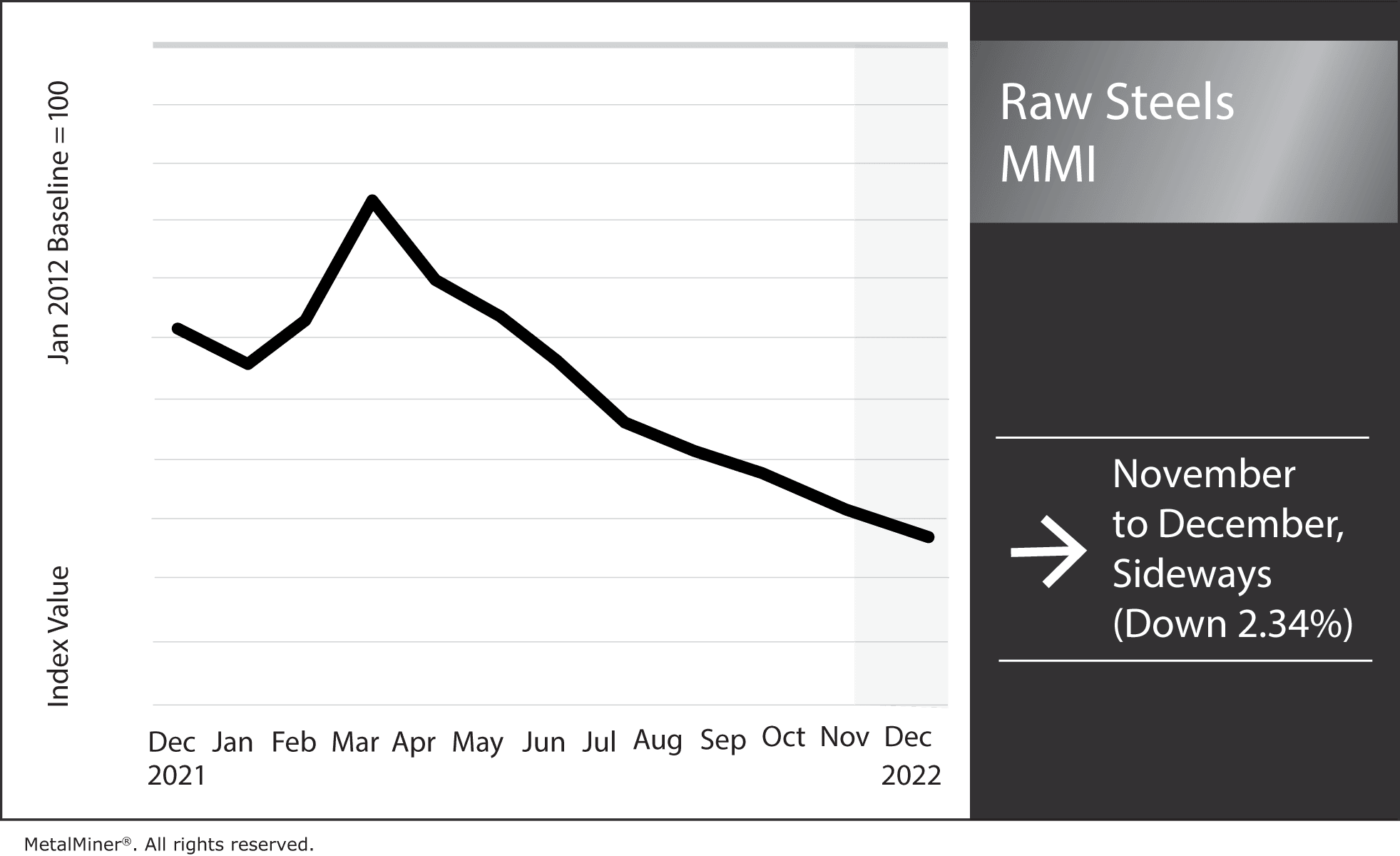

Raw Steels MMI: Where is the Bottom for Falling Steel Prices?

The Raw Steels Monthly Metals Index (MMI) fell by 2.34% from November to December. Ultimately, U.S. steel prices remain decidedly bearish. Meanwhile, hot rolled coil prices saw the most substantial decline, falling 12.6% month over month. Plate prices, on the other hand, mainly remained sideways but continued to edge slowly downward with a 2.9% decline. […]