Stainless Steel Prices/Nickel Prices

What does this data mean?

MetalMiner Insights includes prices for 304 stainless steel plus many other common grades including: 201, 301, 316, 321, 430, 409, 439 and 441. Capabilities include: LME nickel and global stainless steel price points from Europe, China and North America, should-cost models, buying signals, price forecasting (monthly, quarterly and annually), sourcing strategy recommendations and 100+ price feeds. MetalMiner Insights shows companies how to buy, when to buy and what to pay.

Stainless Steel & Nickel Prices

Metal:

Stainless Steel

Grade:

304

Finish:

2B

Current Price:

(Spot Price)

$1.99/Lb

Some Details

304 Stainless Steel + 201, 301, 316, 430, 409, 439 and 441

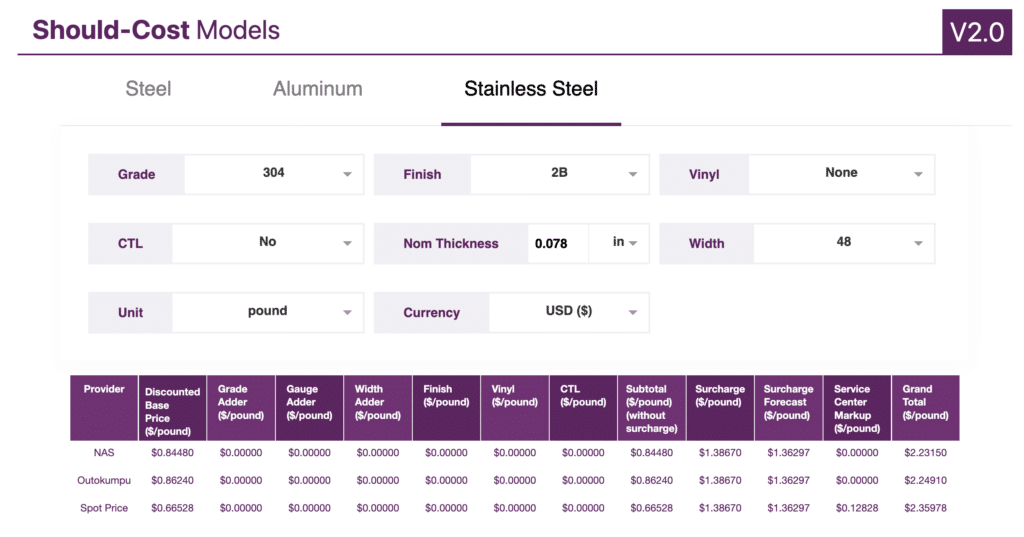

It’s not enough to merely know the base price and surcharge for stainless steel. Plenty of cost comes from all of the adders and extras (e.g. vinyl, polish, cut-to-length etc). MetalMiner provides a more granular view of total cost (beyond the base nickel prices), giving the buying organization at least 45% more visibility into the total costs they actually pay.

Should-Cost Models

Some Details About This Table

Depending on whether or not a company buys mill-direct or through service centers, having access to a comprehensive models for stainless steel and nickel prices remains elusive. The MetalMiner Insights should-cost models for stainless steel and nickel prices factor in all elements of stainless costs including: base prices, gauge, width adders, prevailing discounts applied and all adders and extra costs for a full range of commercially available stainless grades.

Sample Should-Cost for Stainless Steel

All Stainless Steel & Nickel Prices

LME Primary 3 Month

LME Primary Cash

Indian Nickel

China Nickel

US Grades 201, 304, 304L, 316, 430 Flat Rolled

US Grades 409, 439, 441 (Both Automotive and Appliance)

European Grades 304, 430 Flat Rolled

European Grades 304 Round and Square Bar

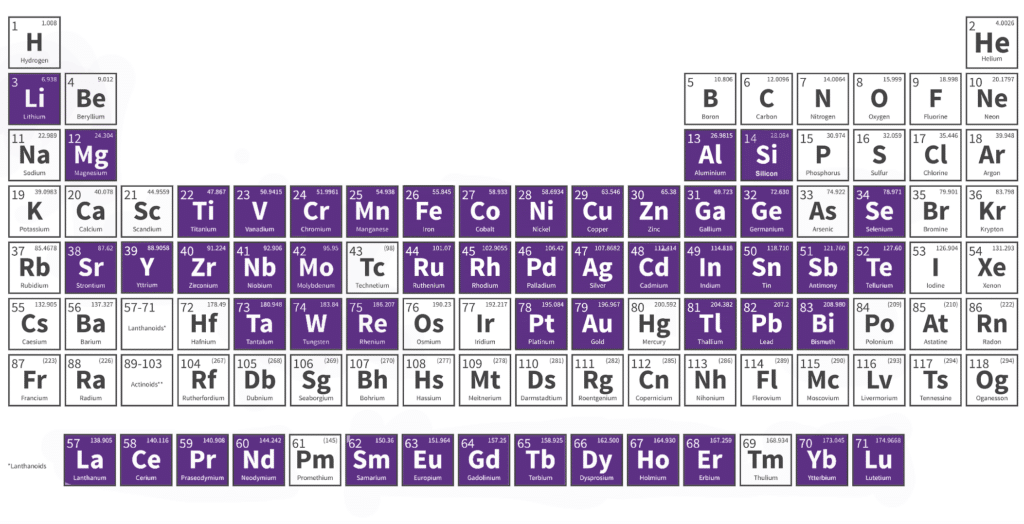

Periodic Table of the Elements

Don’t see your specific metal?

Here’s the full list of what we cover.

Forecast

Look at Our Forecast Track Record

Ignore the noise, but know the trend. MetalMiner’s track record on stainless steel price forecasts as well as stainless surcharges, by calling a bullish market or a bearish market means buying organizations can always generate cost savings or cost avoidance.

Never second-guess your metal buying decisions again.

Stainless Steel Insights

Stainless MMI: Stainless Steel Prices, a Bearish Market, Outokumpu Expects Quarterly Improvement

Read More »

Stainless MMI: Stainless Demand Muted, Nickel Price Falling as Market Enters Seasonal High Point

Read More »

Stainless MMI: Stainless Market Bearish, Nickel Prices Prove Worst-Performing Base Metal of 2023

Read More »Some may argue that timing an aluminum buy appears speculative. Spot buying, however, also means speculative buying! Merely having a specific price of aluminum per pound via fundamental analysis (e.g. supply and demand) rarely equates to an actionable buying strategy, particularly with high market volatility. Understanding the aluminum price from a short term and long term perspective allows buyers to alter strategies in falling, sideways, and rising markets – as well as save money by timing the buy.

For new procurement professionals or those that have the exciting responsibility of managing an aluminum category for the first time, this brief on the 5 best practices of metal-based sourcing can help with upcoming supplier negotiations. This brief describes how to use cost breakdowns to separate out the conversion/processing costs from metal prices, why one should buy by the weight vs. the each, the importance of “3” in supply awards and two other best practices all designed to help reduce cost of goods sold.

Have an upcoming negotiation for aluminum sheet or coil? Make sure you know how your service centers will negotiate the aluminum price. Whether you buy 3003 aluminum sheet or 6061 extrusions, a strong understanding of which part of the aluminum price moves with an index and which elements should remain fixed will help mitigate market volatility.

MetalMiner Insights: the only metals

procurement platform.

How to buy, when to buy and what to pay.

MetalMiner serves as the leading metal market price intelligence brand. The company’s SaaS platform, MetalMiner (SM) Insights, provides forecasts, analysis and solutions for global manufacturers and other individuals in the industrial metals industry. Interested in steel prices today? What about copper prices? MetalMiner Insights provides a competitive advantage for buyers. It combines actionable should-cost models (real-time), AI-driven price forecasts, technical analysis and sourcing strategy recommendations.

Ready to Learn More? Schedule a Talk With Us.

Learn How We Partner With Our Clients

We’re always looking for input, as well as opportunities to expand our offerings to help buying organizations purchasing metal. Interested in steel metal prices and market trends? What about advice on copper prices, negotiations and cost-downs? Reach out to us and let us know!

What We Offer?

The goal of MetalMiner is to help manufacturers better manage margins. In addition to this, MetalMiner also assist companies in generating cost savings and cost avoidance, smoothing out volatility and meeting profitability targets. We use data – data science, data analysis, artificial intelligence, statistical analyses as well as technical analysis to provide buying organizations with specific actionable buying guidance. When used consistently, MetalMiner’s buying guidance affords companies both cost savings and cost avoidance opportunities.