Carbon Steel

Prices

No Guesswork, Just Answers

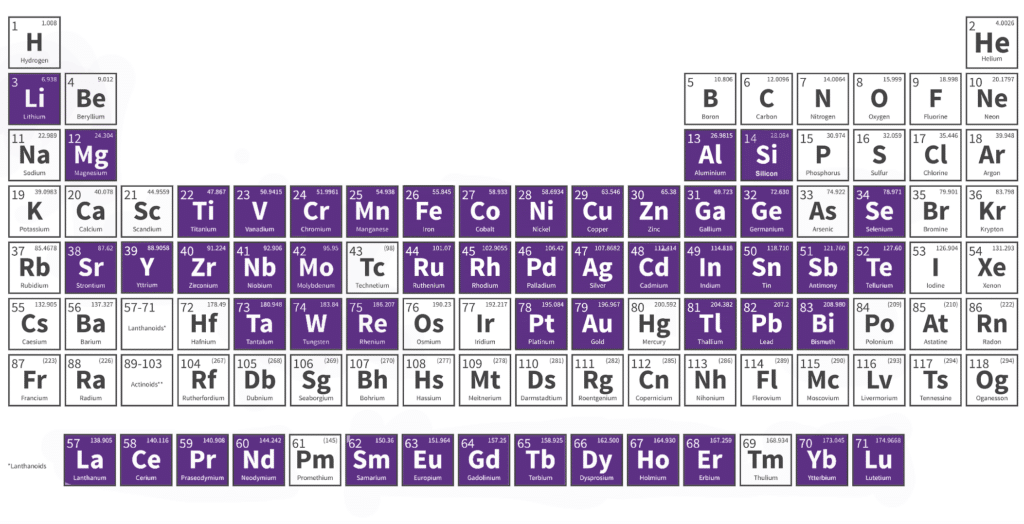

If you’re sourcing carbon steel, chances are you’re juggling a dozen variables. Raw material prices, regional fluctuations, mill extras and adders. Instead of just giving you base prices, MetalMiner Insights offers full-spectrum visibility: from aluminized and galvanized to galvalume, hot rolled coil, cold rolled coil, plate and electro-galvanized products, across North America, Europe, China, Japan and South Korea. But we go far beyond the numbers. MetalMiner arms your team with the “when,” the “how,” and the “how much.” With forward-looking price forecasts, real-time buying signals, and should-cost models that break down every add-on and coating surcharge, You receive sourcing strategy guidance that adapts with any type of market shift.

What are the Current HRC Steel Prices?

Metal:

Carbon Steel

Form:

Hot-Rolled Coil

Grade:

A36

Current Price:

$44.65/cwt

Mill-Direct

Not knowing what’s buried inside that final quote. Especially if you’re buying through service centers instead of mill-direct. That’s where MetalMiner’s should-cost models come in. We help you deconstruct every cost input—thickness adders, width premiums, coating charges, spec surcharges—tailored specifically for the North American market. You’re no longer guessing, you’re leading. That confidence translates into tighter budgets, smarter negotiations, and long-term supplier relationships built on transparency.

Should-Cost Models

Here's the Truth About Steel Pricing

Let’s be honest: steel pricing is rarely straightforward. Between supplier markups, shifting demand, and regional pricing quirks, knowing what you should be paying is half the battle.

That’s why MetalMiner’s should-cost models models go deep below the surface, breaking down everything from base prices to extras across a full range of grades including A36, CS, DS, and up to high-strength varieties like 80, 90 and 100. This level of granularity isn’t just “nice to have”, it’s essential when you’re managing high-stakes sourcing decisions across multiple regions and supply chains. With this data in your hands, you’re not just validating a quote, you’re steering the conversation.

Sample Should-Cost for Carbon Steel Prices

All Carbon Steel Prices

US/China/Europe HRC, CRC, HDG and Plate

Korean HRC, CRC, Rebar and Plate

HRC Comex

US Grade 50, Galvanized G30

Cold rolled A36

Aluminized DDS

Plate A36

Speaks for Itself

Ignore the noise, but know the trend. MetalMiner’s track record on carbon steel price forecasts, by calling a bullish market or a bearish market means buying organizations can always generate cost savings or cost avoidance.

Some may argue that timing an carbon steel purchase appears speculative. Spot buying, however, also means speculative buying! Merely having a specific price of steel via fundamental analysis (e.g. supply and demand) rarely equates to an actionable buying strategy, particularly with high market volatility. Understanding the steel prices from both a short-term and long-term perspective allows buyers to alter strategies in falling, sideways and rising markets, as well as save money.

For new procurement professionals or those that have the exciting responsibility of managing a steel category for the first time, this brief on the 5 Best Practices of Metal-Based Sourcing can help with upcoming supplier negotiations. This brief describes how to use cost breakdowns to separate out the conversion/processing costs from metal prices, why one should buy by the weight vs. the each, the importance of “3” in supply awards and two other best practices all designed to help reduce cost of goods sold.

Have an upcoming negotiation for steel? Make sure you know how your service centers will negotiate the steel prices with you. It doesn’t matter what form of steel you purchase, a strong understanding of which part of your steel buy moves with an index and which elements should remain fixed will help mitigate market volatility.

Always stay ahead of metal market shifts by getting weekly…

- Metal price trends

- Commodity market shifts

- Featured articles/metal industry news

- Updates on MetalMiner product developments

- Free resources and sourcing tips

MetalMiner Insights: Your Competitive

Edge in Steel Sourcing

In a volatile market shaped by tariffs, supply chain disruptions and geopolitical uncertainty, reacting to price changes isn’t enough. MetalMiner Insights combines real-time should-cost analytics with historical data-driven forecasts and strategy tools that let you take control of your spend with confidence. Whether you’re sourcing steel, aluminum, or copper, our insights aren’t just data, they’re a compass. You’ll know when to buy, how much to budget, and what to push back on with steel prices, all backed by an expert team that’s as obsessed with metal markets as you are with margins.

Ready to Learn More? Schedule a Talk With Us.

Learn How We Partner With Our Clients

We’re always looking for input, as well as opportunities to expand our offerings to help buying organizations purchasing metal. Interested in steel metal prices and market trends? What about advice on copper prices, negotiations and cost-downs? Reach out to us and let us know!

What We Offer?

The goal of MetalMiner is to help manufacturers better manage margins. In addition to this, MetalMiner also assist companies in generating cost savings and cost avoidance, smoothing out volatility and meeting profitability targets. We use data – data science, data analysis, artificial intelligence, statistical analyses as well as technical analysis to provide buying organizations with specific actionable buying guidance. When used consistently, MetalMiner’s buying guidance affords companies both cost savings and cost avoidance opportunities.