Market Signal

Wrecking Volatility, Save Budgets

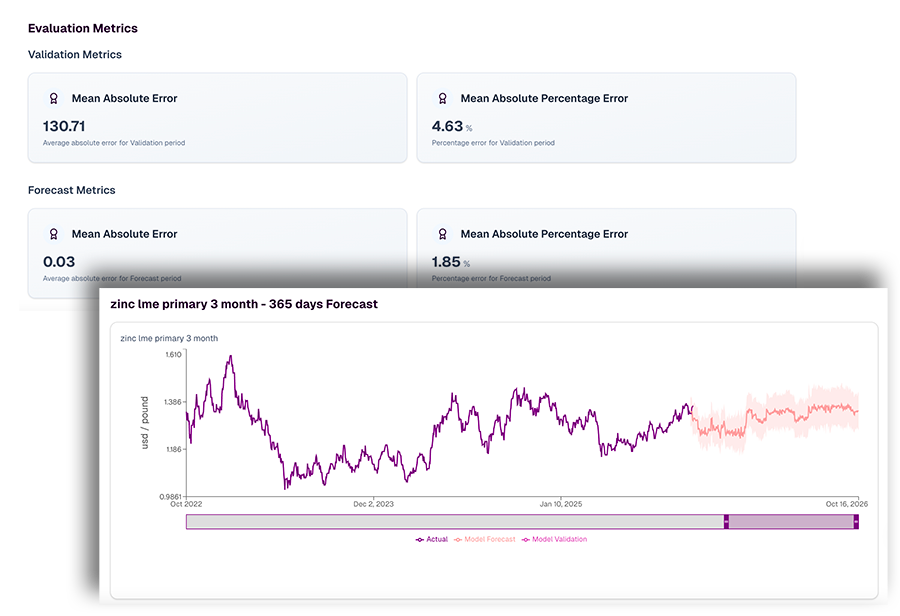

Market Signal, a 12-month commodity price forecasting capability designed for U.S. finance and procurement leaders, was originally built under a government-funded critical minerals program. Functionally, it delivers highly accurate metal price projections (typically around 95%). Using this platform, CFOs, CPOs, procurement, supply chain and finance teams get a stable, data-driven outlook for budgeting, hedging and strategic planning.

Ready to budget with confidence?

Is Metal Price Volatility Shredding Your Budget?

Commodity cost swings can upend budgets and margins overnight. When metal prices suddenly spike or crash, products can become unprofitable. Meanwhile, margins get squeezed and require quick fixes before investors lose confidence. Market Signal removes this stress by providing highly accurate 12-month outlooks.

- Stay ahead of cost curves.

- Time contracts and capex confidently.

- Present reliable financial forecasts to boards and investors.

- React to price swings after they’ve already hit.

- Delay capex decisions due to material cost uncertainty.

- Hedge too late and sacrifice margin.

Why Spot Purchases Leave Companies Exposed

Hedging is a key tool for managing price risk, but reacting too late is when you lose money. Many companies only hedge after costs spike, or not at all, which means the buying organization is actually speculating vs. managing the risk. Research shows that a well-planned hedging program can reduce earnings volatility by 20–25%, but only if you act at the right time.

Market Signal predicts the prices of industrial metals like steel, aluminum, copper, nickel, and more, typically with 95-99% accuracy, so your budget doesn’t suffer.

With Market Signal, we flag forward price movements and allow you to visually see optimal windows to hedge before it’s too late.

Gain the ability to map out capital expenditures, contract renewals, and M&A with forecasted cost increases or drops.

You’ll have the data-backed visibility needed to confidently speak with your board, lenders and stakeholders.

How Does Raw Material Uncertainty Affect Company Growth?

When raw material prices are unpredictable, big spending freezes up. CFOs may delay capital projects, expansions, or M&A until they understand costs. Delaying growth or acting too late can waste resources and hurt ROI.

Problem

Uncertainty in commodity costs stalls investments and hinders expansions.

Solution

Market Signal provides clear, forward-looking price trends so uncertainty vanishes. With a reliable 12-month forecast, you can time major decisions to coincide with favorable cost windows.

What Makes Market Signal Forecasts so Accurate?

- Forecasts are regularly retrained when they fall outside a 6% error rate.

- Built under a government-funded program focused on critical supply chain intelligence.

- Helps reduce cost, volatility, protect margins, and improve forecast accuracy across the finance function.

- Cuts hedging reactivity, improving timing and cost-efficiency.

- Enhances cash flow planning by reducing COGS volatility.

Ready to See Market Signal in Action?

Curious how Market Signal will work with your current data setup? Get a personalized walkthrough.

How Companies Can Use Market Signal: A Case Study

MetalMiner Insights SV sets a new standard for procurement and supply chain leaders by combining our proven metal commodities data and forecasts with N-Alpha’s cutting-edge business process automation and analytics. This partnership underscores our commitment to empowering companies to mitigate volatility, manage margins, and drive cost savings with unparalleled accuracy.

Aerospace Supplier (Capital Allocation)

A tier-one aerospace supplier delays a plant expansion due to uncertainty in titanium and nickel costs, stalling growth. Forecast visibility allows CFOs to time investments with favorable cost trends, ensuring ROI targets are met and boards gain confidence.

Consumer Goods Producer (Margin Protection)

Exposure to aluminum packaging costs pressure margins during price rallies. Suppliers demanded contract premiums, limiting negotiation power. Forecast-backed insights help CFOs anticipate dips, lock favorable contracts, and protect margins worth hundreds of millions.

What Results Can CFOs and Procurement Teams Expect?

When raw material prices are unpredictable, big spending freezes up. CFOs may delay capital projects, expansions, or M&A until they understand costs. Delaying growth or acting too late can waste resources and hurt ROI.

- Market Signal’s 12-month forecasts almost always stay within a max 6% error range. Finance teams use this visibility to stabilize quarterly earnings.

- By knowing about potential price swings in advance, CFOs move hedging from reactive to proactive.

- When uncertainty is tamed, working capital flows more easily. Projecting volatility means companies no longer have to over-finance inventory.

- Powered by 5,000+ data points, Market Signal builds forecasts on a transparent, auditable foundation. This rigor, borne from a defense-level research effort, gives companies confidence that their procurement strategies rest on secure, high-quality information.

What Does Market Signal Integrate With?

Market Signal Fits Into Numerous Systems That Finance Teams Already Use:

Market Signal offers API-ready data feeds that can plug forecasts directly into platforms like SAP, Oracle, Anaplan or Workday Adaptive.

Market Signal’s data exports easily into Excel, Power BI, Tableau and many other analytics tools.

Market Signal complements procurement suites (like Coupa or Jaggaer) by adding the missing forward-looking layer. It works alongside your purchase order and contract systems.

Implementation is modular. Typically, you just grant API access or data feed credentials and we handle the rest. There’s no lengthy installation or workflow overhaul.