Stainless Steel Prices/Nickel Prices

Want More Stainless Market Transparency?

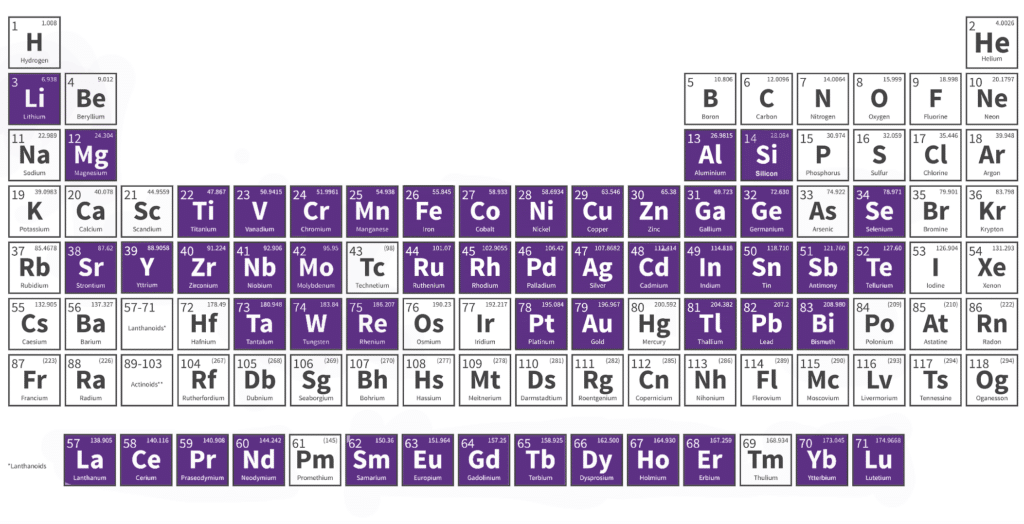

Sourcing stainless steel involves navigating a complex landscape of fluctuating prices, surcharges and supplier-specific add-ons. MetalMiner Insights simplifies this process by providing comprehensive pricing data for grades like 304, 201, 301, 316, 321, 430, 409, 439 and 441. Our platform offers access to LME nickel price forecasts and global stainless steel price forecasts from Europe, China and North America. Beyond just numbers, we equip your procurement team with should-cost models, buying signals and price forecasting on a monthly, quarterly, and annual basis.

What are Current Stainless Steel & Nickel Prices?

Metal:

Stainless Steel

Grade:

304

Finish:

2B

Current Price:

(Spot Price)

$1.84 Lb.

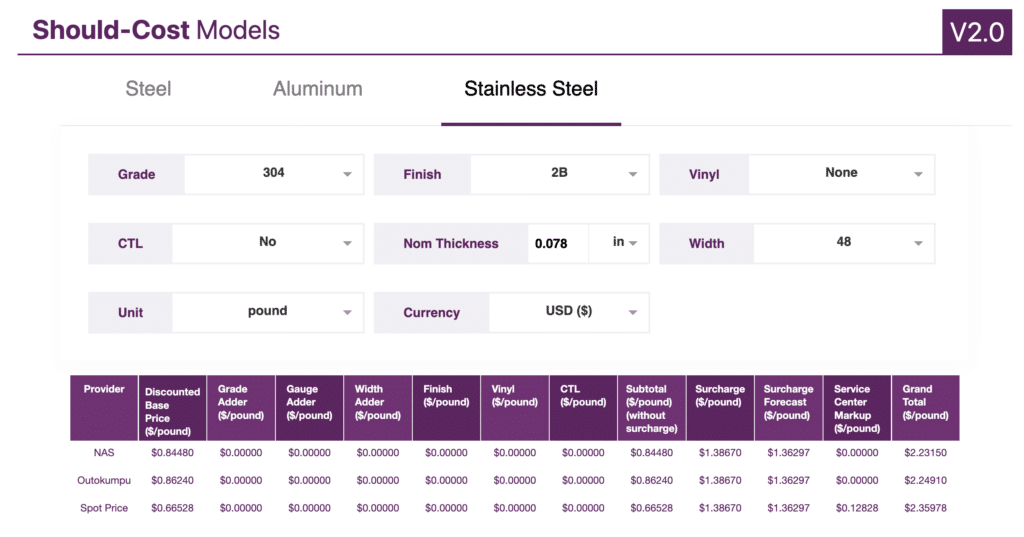

Understanding the base price and surcharges for stainless steel is only half the battle. Much of the cost often stem from additional factors like vinyl coatings, polishing and cut-to-length services. MetalMiner provides a granular view of total costs, extending beyond base nickel prices. This detailed insight offers your organization at least 45% more visibility into the actual expenses incurred, enabling more accurate budgeting and strategic negotiations with suppliers.

Should-Cost Models: Your Strategic Tool

for Stainless Cost Management

Whether purchasing mill-direct semi-finished stainless steel products or through service centers, accessing comprehensive price intel for stainless steel and nickel prices is challenging. MetalMiner’s should-cost models fill in this gap by factoring in all elements of stainless costs, including base prices, gauge, width adders, prevailing discounts and additional costs for a full range of commercially available stainless grades. These models serve as a strategic tool, allowing you to benchmark supplier quotes, identify cost-saving opportunities and make informed purchasing decisions with confidence.

Sample Should-Cost for Stainless Steel

All Stainless Steel & Nickel Prices

LME Primary 3 Month

LME Primary Cash

Indian Nickel

China Nickel

US Grades 201, 304, 304L, 316, 430 Flat Rolled

US Grades 409, 439, 441 (Both Automotive and Appliance)

European Grades 304, 430 Flat Rolled

European Grades 304 Round and Square Bar

Forecasting Track Record

Speaks for Itself

Markets are noisy and headlines flip constantly. But MetalMiner’s forecasting track record speaks for itself. By consistently calling bullish and bearish trends before they happen, our forecasts help sourcing teams skip the panic and focus on strategy. Whether it’s avoiding a cost spike or locking in a low before prices rebound, our trend insights translate into real cost savings. Download our forecasting track record.

Some may argue that timing a stainless buy is speculative. Spot buying, however, also means speculative buying! Merely having a specific price of stainless steel via fundamental analysis (e.g. supply and demand) rarely equates to an actionable buying strategy, particularly with high market volatility. Understanding stainless prices from a short-term and long-term perspective allows buyers to alter strategies in falling, sideways, and rising markets, as well as save money.

For new procurement professionals or those that have the exciting responsibility of managing stainless purchases for the first time, this brief article on the 5 Best Practices of Metal-Based Sourcing can help with upcoming supplier negotiations. This brief describes how to use cost breakdowns to separate out the conversion/processing costs from metal prices, why one should buy by the weight vs. the each, the importance of “3” in supply awards and two other best practices all designed to help reduce cost of goods sold.

Have an upcoming negotiation for stainless steel sheet or coil? Make sure you know how your service centers will negotiate with you. It doesn’t matter which form, polish or finish of stainless steel you purchase, having a strong understanding of which parts of your stainless steel buys move an index and which elements should remain fixed will help mitigate market volatility.

MetalMiner Insights: Your Competitive

Edge in Stainless Steel Sourcing

With nickel prices, having a reliable partner to guide your stainless steel sourcing strategy is invaluable. MetalMiner Insights uses historical data and expert insights to provide comprehensive forecasts for nickel prices. Our expert insights provide actionable intelligence for your stainless procurement team. Whether you’re dealing with price volatility, supply chain disruptions or tariff impacts, our platform equips you with the tools to navigate challenges and capitalize on opportunities.

Learn How We Partner With Our Clients

We’re always looking for input, as well as opportunities to expand our offerings to help buying organizations purchasing metal. Interested in steel metal prices and market trends? What about advice on copper prices, negotiations and cost-downs? Reach out to us and let us know!

What We Offer?

The goal of MetalMiner is to help manufacturers better manage margins. In addition to this, MetalMiner also assist companies in generating cost savings and cost avoidance, smoothing out volatility and meeting profitability targets. We use data – data science, data analysis, artificial intelligence, statistical analyses as well as technical analysis to provide buying organizations with specific actionable buying guidance.

When used consistently, MetalMiner’s buying guidance affords companies both cost savings and cost avoidance opportunities.