Monthly Metals Index Report: Price Trends and Indexes - January 2026

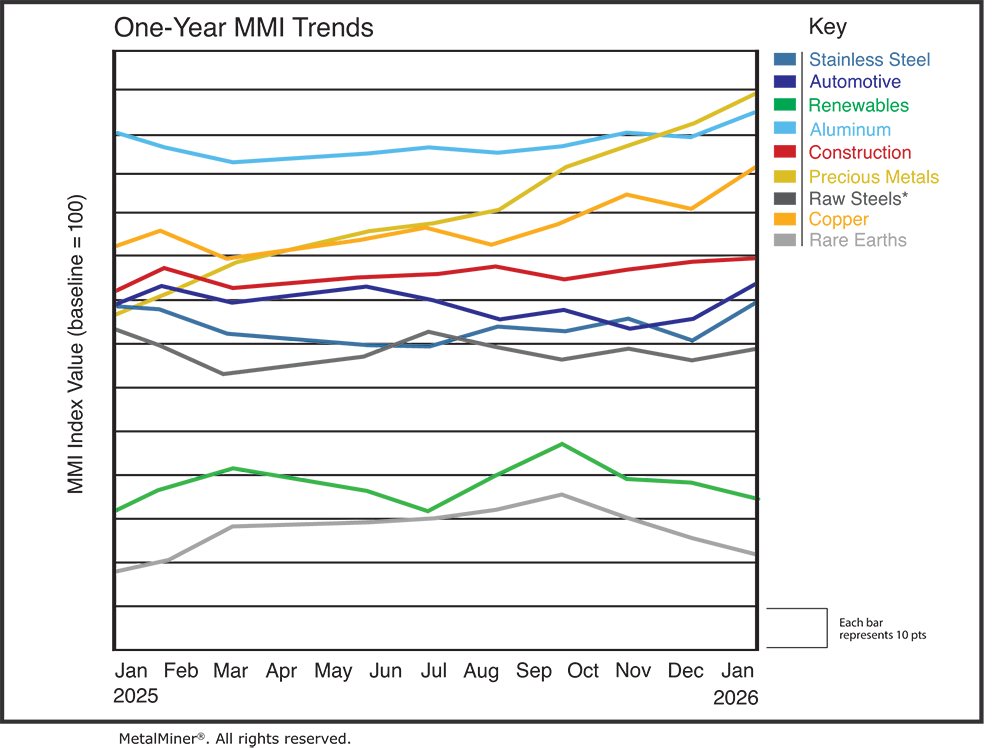

To help you understand month-to-month metal price trends across different industries and within specific metal markets, MetalMiner issues the Monthly Metals Index (MMI) report. These metal price charts are first made available to MetalMiner customers, followed by a public release later in the month. The seven indices the MMI includes are:

- Aluminum

- Copper

- Stainless

- Raw Steels

- Automotive

- Global Precious Metals

- Rare Earths

This Report Helps Metal Purchasing Companies...

Track monthly inflation for each metal industry category, including copper, stainless steel, aluminum, steel and precious metals.

Access an additional contracting mechanism that can be used when negotiating with suppliers.

Understand how they are performing against the wider market and their competitors.

The Challenge: Unpredictable

Metal Prices

Volatile metal prices prove a constant headache. Metal costs can swing wildly month to month, throwing budgets and production plans into disarray. Procurement teams struggle with questions like: When is the right time to buy? How do we avoid paying peak prices? Without the right data, many manufacturers end up paying too much when prices rise, or missing out on cost reductions when prices fall.

These price surprises erode profit margins, complicate quoting and pricing of products, and make it hard to forecast costs.

The Solution: MetalMiner’s Monthly Metals Index Report

The Monthly Metals Index (MMI) Report metal price charts are free and translate complex metal markets into a simple, actionable index format. Each month, MetalMiner’s experts analyze pricing trends across 7 key metal categories and deliver a concise report with 10 metal price indexes and charts, covering everything from carbon steel and stainless steel to aluminum, copper, rare earths, automotive alloys and precious metals.

In every report, you’ll see whether prices for each category moved up, down, or moved sideways compared to the previous month, along with by-how-much and expert commentary on why.

How You Can Use the MetalMiner Monthly Metals Index (MMI) Report

Use this report and metal price charts as an economic indicator, much like the ISM Purchasing Managers Index (PMI) or the BLS Producer Price Index (PPI), for contracting, forecasting, predictive analytics and tracking which commodities have the greatest volatility. The MetalMiner Monthly Metal Index report offers news and analysis for 7 key metal group price trends, including aluminum, steel and copper.