Aluminum Consumers Pose a Not-Unreasonable Question: How High Can Prices Go?

Higher is the simple answer. The world with the exception of China was in deficit before U.S. sanctions against Oleg Derispaska and his aluminum company Rusal.

So when the three million tons of primary metal Rusal exports outside of Russia are taken out of a market already worried by the recent partial closure of Norsk Hydro’s Alunorte alumina plant and Albras primary smelter, one should not be surprised by price increases and panic.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

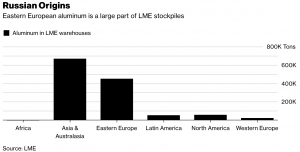

Not only is the market deprived of new deliveries by the sanctions, but according to Bloomberg some 36% of global stockpiles on the LME and up to one million tons of metal held in inventories outside of China supporting financing deals is currently in limbo as buyers, traders, banks and brokers refuse to handle it for fear of falling foul of sanctions.

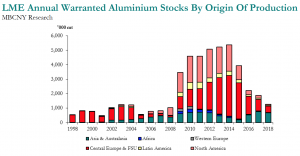

Part of the problem is that a large percentage of Rusal’s metal is traded and resides in stock financing deals, compared to top metal from other producers like Norsk Hydro and Alcoa. This is a legacy of the flood of metal that started to swamp the global market from the 1990s onwards after the collapse of the Soviet Union.

Technically there is no legal restriction on buying metal produced and sold by Rusal before the sanctions were applied, according to Bloomberg. Even so, the products have become less desirable in the U.S. and Europe as consumers are unsure of the status.

In addition, this week the LME has banned any further deliveries into its system, raising the question of what Rusal is going to do with with the three million tons of metal it is churning out every year. There will be buyers out there, especially in Southeast Asia, but they will demand a discount to handle the brand. With restrictions of sales of its alumina, Rusal could simply cut production rather than try to dump metal into less well regulated overseas markets.

Maybe more of a risk is the fate of Rusal’s alumina production as the firm supplies other smelters than just its own, potentially depriving alternative producers from supplying an already tightening market. Alumina prices have surged to over $600/ton as the LME primary metal settlement prices have risen to over $2,500 per ton.

So where to now? Have buyers missed the boat? It’s impossible to say. There could well be a short-term correction, but Bloomberg quotes CRU analysts as saying that prices could reach $2,800-3,000/ton, levels not seen since 2008.

Alunorte’s alumina production cuts, forced following allegations of river pollution, could be resolved later this month like the resulting cuts at downstream Albras. But that would only return the primary plant from 230,000 tons to its capacity of 460,000 tons, a drop in the ocean next to Rusal’s three million tons. Brace yourselves: aluminum remains firmly in bull territory.

Leave a Reply