The Automotive MMI (Monthly Metals Index) moved sideways, inching up by 2.29%. While the index has maintained a mostly sideways trend over the past year, short-term volatility may be on the way. President Trump recently announced a 50% tariff on imported copper, a move expected to impact U.S. automotive manufacturing firms that source the red […]

Category: Metal Prices

Copper MMI: Copper Prices Chase All-Time High as 50% Tariff Looms

The Copper Monthly Metals Index (MMI) moved sideways with an upside bias, rising 2.69% from June to July. Comex Copper Prices Nearing All-Time High on 50% Tariff Reports Comex copper prices resumed their uptrend, ending a brief pause witnessed in early June. As of July 7, the price of copper on the exchange stood $266/mt […]

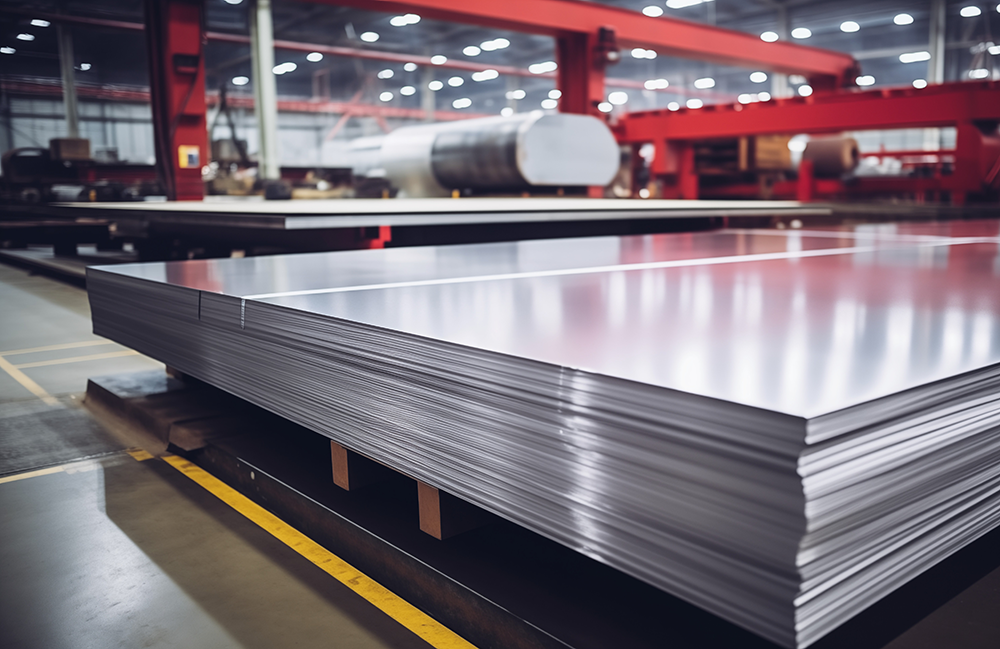

Raw Steels MMI: Steel Prices Steady Ahead of Trade Deals

The Raw Steels Monthly Metals Index (MMI) trended sideways, with a 1.37% increase from June to July. With a few exceptions, steel prices remained largely steady as long-awaited trade deals with the U.S. began to materialize. Nippon Officially Acquires U.S. Steel After an arduous 18-month process, Nippon Steel officially acquired U.S. Steel. Initially blocked by […]

Rare Earths MMI: US–China Trade Deal Eases Rare Earth Export Controls

The Rare Earths MMI (Monthly Metals Index) moved sideways, rising a modest 0.66%. Meanwhile, prices for rare earths may experience short-term stabilization in the upcoming months, primarily due to President Trump reaching an agreement with China to ease restrictions on critical mineral exports. Track macroeconomic signals, pricing pressure, and supply shifts before they hit your […]

Global Precious Metals MMI: Prices See Rally & Gold Close to New Highs

The Global Precious Metals MMI (Monthly Metals Index) saw a strong rally from mid-May to mid-June. Precious metals prices like gold, silver, platinum and palladium all climbed on a potent mix of safe-haven investment flows and robust industrial demand. Geopolitical tensions, notably the recent flare-up in the Middle East between Israel and Iran, have only […]

Aluminum MMI: Midwest Premium Finds a Peak

The Aluminum Monthly Metals Index (MMI) moved sideways as the global price of aluminum ticked modestly higher. Overall, the index rose 0.73% from May to June. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Aluminum Midwest Premium Finds A Peak The Midwest Premium found a peak in […]

Construction MMI: New 50% Aluminum and Steel Tariffs Squeeze U.S. Construction

The Construction MMI (Monthly Metals Index) moved sideways, dropping by 2.0% month-over-month. In early June 2025, new Trump tariffs doubled pre-existing steel and aluminum duties from 25% to 50%. As buyers scrambled, U.S. aluminum premiums immediately hit a record 60¢/lb. Meanwhile, the tariff surge is already squeezing the U.S. construction industry. Construction Input Inflation Construction […]

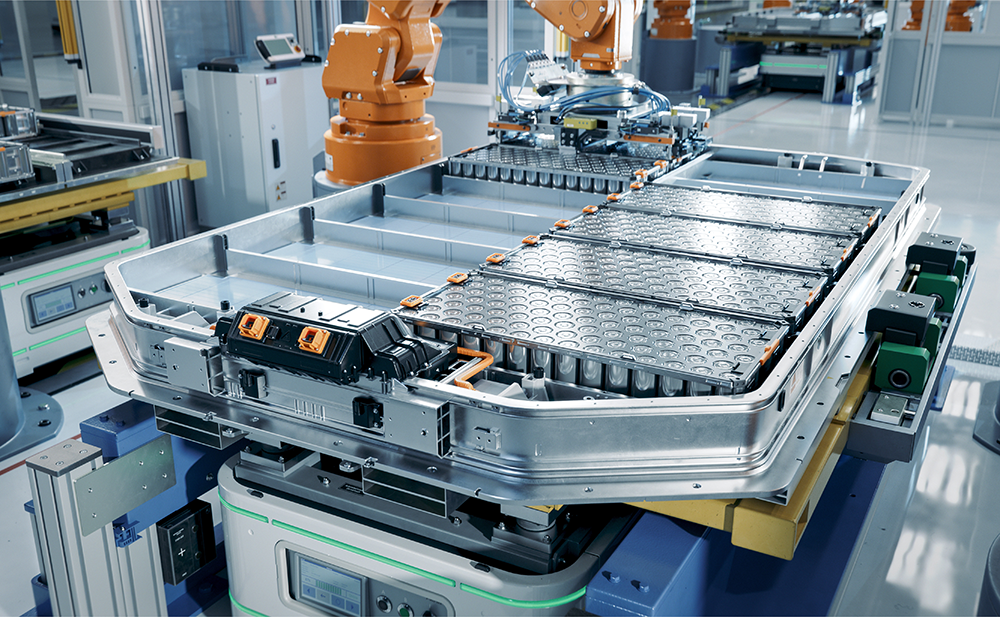

Automotive MMI: Automakers Scramble as Rare Earths Crunch and Tariffs Impact Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 0.70%. This comes as auto industry executives in the U.S. are confronting a whirlwind of trade and supply chain disruptions, not to mention the effects of the recent round of Trump tariffs. In the past month alone, high-stakes U.S.–China trade talks, critical mineral export […]

Copper MMI: Copper Prices Stable, but Volatility Looms

The Copper Monthly Metals Index (MMI) moved sideways, rising by a modest 1.45% from May to June. Though copper prices today appear mostly stable, significant opportunity for volatility remains. Copper Prices Open June With Uncertainty Comex copper prices appeared surprisingly stable in the first weeks of June as they took a pause from the heightened […]

Stainless MMI: Tariff Impacts on the Stainless Market

The Stainless Monthly Metals Index (MMI) moved sideways, rising by a modest 0.35% from May to June. However, the stainless steel price remains under pressure from several factors. Tariff Hike Rattles the U.S. Stainless Steel Market In a move few saw coming, President Trump doubled Section 232 tariffs on steel and aluminum imports from 25% […]