Rare Earths MMI: DOE awards rare earths funding; Lynas reports quarterly output

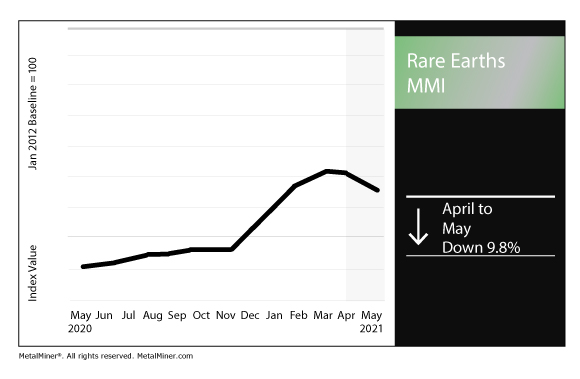

The Rare Earths Monthly Metals Index (MMI) fell by 9.8% for this month’s reading.

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

Biden’s DOE awards $19M in funding for rare earths, critical minerals production initiatives

As MetalMiner contributor Sohrab Darabshaw explained this week, the Department of Energy has awarded $19 million toward 13 initiatives geared toward rare earths and critical minerals production.

“The very same fossil fuel communities that have powered our nation for decades can be at the forefront of the clean energy economy by producing the critical minerals needed to build electric vehicles, wind turbines, and so much more,” Secretary of Energy Jennifer M. Granholm said. “By building clean energy products here at home, we’re securing the supply chain for the innovative solutions needed to reach net-zero carbon emissions by 2050 – all while creating good-paying jobs in all parts of America.”

The DOE’s Office of Fossil Energy’s National Energy Technology Laboratory (NETL) will manage the 13 projects.

The projects cover 12 areas of interest. They correspond to “selected U.S. basins that have the potential to produce rare earth elements and critical minerals.”

The project leaders include Pennsylvania State University, Virginia Polytechnic and State University, the New Mexico Institute of Mining and Technology, and the University of North Dakota, among others.

Electrification and cobalt

Earlier this month, MetalMiner’s Stuart Burns delved into the shift toward electrification in the automotive market.

Namely, he zoomed in on rising EV demand’s impact on materials prices — particularly for critical battery metals, like cobalt. Cobalt prices, like many other metals, surged in Q1 2021.

As we’ve noted before in this space, a majority of the world’s cobalt comes from the Democratic Republic of the Congo.

“Some buyers, such as China’s CATL, have no reservations about investing in countries that face allegations of child labor. The firm recently invested $138 million in an undeveloped copper and cobalt resource in the country.

“Others are voting with their wallets. Those companies are restricting contracts to suppliers in Russia, Australia, Philippines and even, in the case of BMW, from Morocco.

“Producers are trying to diversify battery chemistry and technologies to avoid materials like cobalt. China, in particular, has a number of producers and EV manufacturers using non-cobalt battery technologies. However, range suffers as a result. The decision to substitute is made more due to cost than reservations about suppliers.”

Regardless, the question remains, for cobalt and a wide variety of other metals and minerals of the future: will there be enough supply to power the green industrial revolution?

IEA report highlights supply challenges

In a report this month, titled “The Role of Critical Minerals in Clean Energy Transitions,” the International Energy Agency sounded the alarm on the issue.

“Today, the data shows a looming mismatch between the world’s strengthened climate ambitions and the availability of critical minerals that are essential to realising those ambitions,” said Fatih Birol, executive director of the IEA. “The challenges are not insurmountable, but governments must give clear signals about how they plan to turn their climate pledges into action. By acting now and acting together, they can significantly reduce the risks of price volatility and supply disruptions.”

The IEA report notes a typical electric car requires six times the mineral inputs of a conventional car. Meanwhile, an onshore wind plant requires nine times more mineral resources than a similarly sized gas-fired power plant.

“Unlike oil – a commodity produced around the world and traded in liquid markets – production and processing of many minerals such as lithium, cobalt and some rare earth elements are highly concentrated in a handful of countries, with the top three producers accounting for more than 75% of supplies,” the report continues.

Simply put, the report adds today’s “supply and investment plans are not yet ready for accelerated energy transitions.”

Lynas cites ‘favorable market conditions’ in latest quarterly production report

Australian firm Lynas Rare Earth Ltd., the largest rare earths miner outside of China, released its quarterly production report late last month.

Lynas reported rare earth oxide output of 4,463 metric tons for the quarter ending March 31. That marked an increase from 3,410 metric tons the previous quarter.

Meanwhile, production of neodymium and praseodymium (NdPr) totaled 1,359 metric tons, down from 1,367 metric tons the previous quarter.

As the pandemic continues, the miner said it is holding a “cautiously optimistic” view of the market. The firm added the “rare earths market appears to be recovering well.”

Actual metals prices and trends

The Chinese yttrium price rose 1.3% month over month to $33.21 per kilogram as of May 1.

Meanwhile, terbium oxide fell 14.5% to $1,259 per kilogram. The neodymium oxide price fell 10.9% to $84,947 per metric ton.

Europium oxide jumped by 6.5% to $31.66 per kilogram. Dysprosium oxide fell 6.3% to $436.32 per kilogram.

More MetalMiner is available on LinkedIn.

Leave a Reply