Nickel’s Critical Role in Stainless Steel and EV Batteries

Nickel plays a vital role in producing stainless steel and powering electric vehicle batteries. In recent years, the metal’s close ties to the burgeoning electric vehicle market have helped push it into the global spotlight. However, rapid shifts in demand, supply and pricing have created both challenges and opportunities in the nickel sector, depending on where you sit along the supply chain.

Make sourcing decisions based on real market movement, not guesswork, with weekly expert guidance on metals affecting the electric vehicle market. Sign up for MetalMiner’s weekly newsletter.

Indonesia’s Latest Move Shocks the Electric Vehicle Market

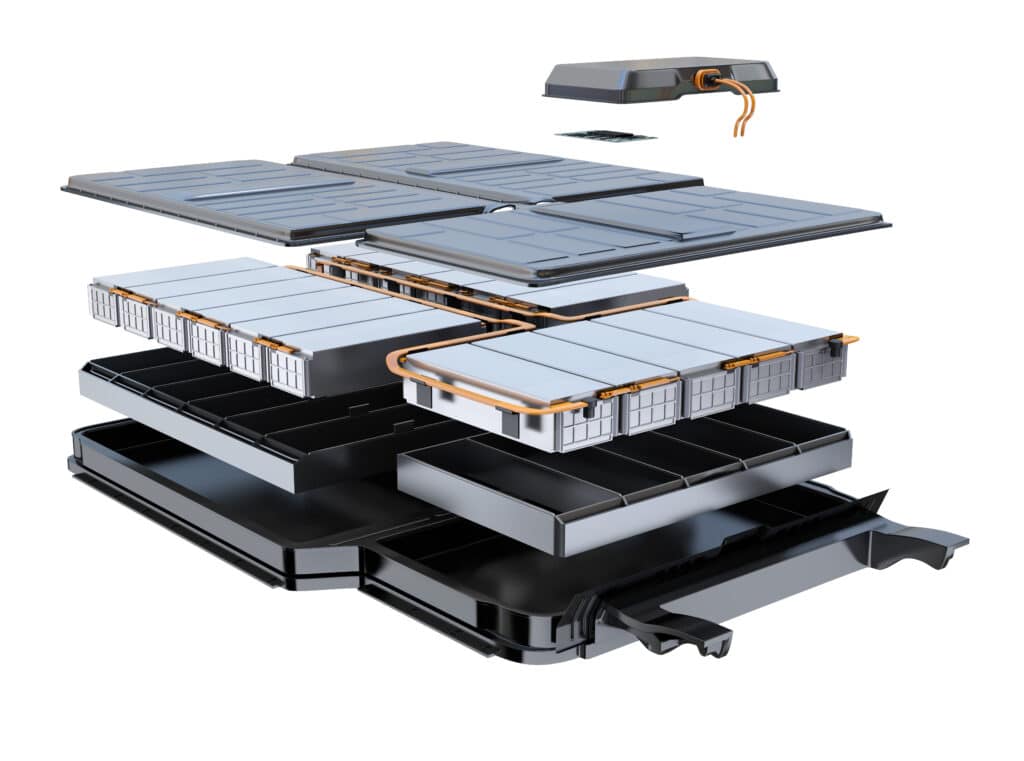

Nickel is such a huge component of the electric vehicle market because it boosts EV battery energy density. This helps to improve vehicle range, which is an essential feature for a world shifting from fossil fuels to cleaner alternatives. In stainless steel production, this ductile metal enhances resistance to rust and corrosion, especially in harsh environments associated with marine and chemical sectors.

It also increases steel’s strength and durability across extreme temperatures. Moreover, nickel stabilizes the austenitic crystal structure of stainless steel, giving it non-magnetic properties and making it easier to weld and shape.

As demand for nickel rises, experts emphasize the urgent need to increase supply and avoid potential shortages. However, just days ago, Indonesia, one of the world’s top suppliers of both mined and refined nickel, revoked the licenses of four major mining companies operating in the Raja Ampat archipelago.

The government was responding to environmental complaints after a Greenpeace report exposed how more than 500 hectares of forest were lost and soil runoff was threatening the local ecosystem. President Prabowo Subianto intervened and canceled the permits himself. Greenpeace welcomed the decision, but also insisted it did not go far enough.

Caught off guard by unexpected metal price shifts? Subscribe now to MetalMiner’s Monthly Metals Index Report and stay prepared with timely insights into market changes across ten metal industries, helping you mitigate price risk.

Nickel Supply and Demand

The Indonesian license cancellations have triggered concerns among nickel buyers, especially tied to the growing electric vehicle market. Indonesia supplies about 65% of the global nickel demand—over two-thirds—and any disruption could significantly impact the sector. Countries like China, the U.S. and many in Europe rely heavily on Indonesian nickel, with the Philippines as a distant second among top global producers.

China holds around 4 million tons of nickel reserves, while Indonesia commands an estimated 21 million tons, or 22% of global reserves. Together, Indonesia and the Philippines meet about 90% of China’s laterite ore requirements. Meanwhile, nickel demand has surged over the past two decades, closely tracking with the global rise of EVs. According to one report, global demand grew from 1.1 million tons in 2000 to 3.7 million tons in 2023.

However, some experts argue that current mining growth cannot meet the expected demand of 5.5 million tons by 2030, which will be primarily driven by EV batteries, renewable energy storage and stainless steel production. The International Renewable Energy Agency warned that rising demand will challenge the supply chain, and others agree that supply imbalances may soon emerge.

Some Experts See Oversupply, Softening Demand

According to Grand View Research, the global nickel mining market reached $50.40 billion in 2022 and should grow at a CAGR of 6.6% through 2030. In 2022, the Asia Pacific region led the world in revenue share at over 57%. The growth stems from increasing demand from sectors like batteries, automotive, defense and petrochemicals. Additionally, trade sanctions against Russia following its invasion of Ukraine boosted nickel exports from the Philippines, filling gaps left by reduced Russian output.

That said, a recent Reuters report quoted analysts predicting an ongoing nickel oversupply. These analysts believe that slowing demand and increased production, particularly from Indonesia, have flooded the market. But with four of Indonesia’s five largest nickel producers sidelined by license cancellations, short-term supply disruptions are likely.

The two primary factors contributing to softening nickel demand are the growing popularity of lithium iron phosphate batteries and a regional slowdown in EV adoption. LFP batteries use lithium iron phosphate as the cathode and graphite as the anode, eliminating the need for nickel. China, which controls about 90% of LFP output, heavily promotes their use despite drawbacks like lower energy density and heavier weight, which make them less suitable for long-range EVs.

The EV Market’s Nickel Appetite

For now, the global electric vehicle market is keeping nickel demand strong. One recent report showed that EV sales surged past 7 million units in the first half of 2025, a 28% year-over-year increase. Meanwhile, the International Energy Agency (IEA) projects that full-year sales could approach 20 million units.

China continues to dominate global EV sales, accounting for 4.4 million units in the first half of 2025. According to the Federation of Automobile Dealers Associations, EVs made up over 4% of all Indian passenger car sales in May, an increase from 2.6% a year earlier.

Europe followed closely, posting a 27% year-over-year increase in EV sales thanks to favorable policies. North America came in third, showing mixed results for its electric vehicle market. Between January and May 2025, EV sales rose by 4% in the U.S. but dropped by 20% in Canada.

Notably, General Motors secured the No. 2 spot for EV sales during this period. In Germany, battery electric vehicle registrations surged by 43% in the first four months of 2025, totaling 158,503 units. This figure already represents more than 60% of all EV sales seen in 2024.

What Lies Ahead

In its Global Critical Minerals Outlook 2024, the IEA warned that both nickel mining and refining would become concentrated in just a few countries by 2030. Indonesia is expected to dominate mining with a 62% share, followed by the Philippines (8%) and New Caledonia (6%). Refining will also become more concentrated, with Indonesia leading at 44%, followed by China (21%) and Japan (6%).

As global demand for nickel accelerates, particularly from the electric vehicle market, the top three mining nations will control 83% of output, while the top three refining countries will process 73% of the supply. Experts argue that this over-reliance on a few producers raises serious concerns about supply chain security and stability. They believe the imbalance between soaring demand and geographically concentrated supply calls for diversified investment strategies and the development of more resilient global supply chains.

Need precise pricing without excess costs? With MetalMiner Select, acquire only the metal price data essential to your business, ensuring cost-effectiveness and better procurement planning.