Articles & Metals Market Trends

Copper MMI: Price of Copper Continues its Uptrend

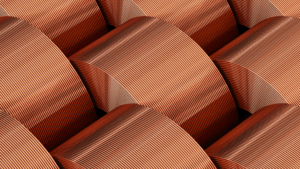

The Copper Monthly Metals Index (MMI) moved sideways, with a modest 1.09% decline. The price of copper ended 2025 with bullish momentum. However, is it

Stainless MMI: Demand Woes Plague Stainless Market, U.S. Prices Flat

The Stainless Monthly Metals Index (MMI) moved sideways, sliding a modest 0.54% from October to November. Nickel prices and the overall stainless steel market faced

China’s Iron Ore Gambit

In a landmark move that could reshape global commodity markets and impact iron ore prices BHP Billiton has agreed to settle 30% of its iron

Europe’s HRC Market Braces for Shock as EU Eyes Deep Quota Cuts and 50% Tariffs

Hot rolled coil prices in Europe have remained largely unchanged in the past two weeks. However, a proposal by the European Union to slash import

America’s Rare Earths Pivot: Why Australia is Now Central to Beating China’s Mineral Grip

While geopolitical tensions continue and rare earths supply chain vulnerabilities deepen, the United States is quietly redrawing the global map of critical mineral sourcing, and

Global Precious Metals MMI: What’s Driving the Precious Metals Bull Run?

The Global Precious Metals MMI (Monthly Metals Index) saw a sharp rise in price action, jumping by 14.44%. This comes as all four major precious

Automotive MMI: Critical Mineral Restrictions Shake US Auto Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways, rising a slight 1.39%. As a whole, the US automotive market is facing a number of challenges necessitating

Stainless MMI: Stainless Mill Hold Prices Ahead of Contracting

The Stainless Monthly Metals Index (MMI) showed little volatility during the month as all of its elements, including nickel prices, moved sideways. This translated to

Will a 15% U.S. Tariff on EU Autos Reshape Global Car Trade?

In a move with major implications for the global automotive industry, the U.S. federal government has implemented a 15% import tariff on auto imports from

Copper MMI: Copper Prices Drift Upward Despite Stock Surplus

The Copper Monthly Metals Index (MMI) broke above range, with a 3.7% rise from September to October. This comes as copper prices, along with many

Aluminum MMI: Mill Fire Adds Fuel to U.S. Aluminum Prices

The Aluminum Monthly Metals Index (MMI) remained sideways, rising by a modest 0.5% from September to October. Meanwhile, the price of aluminum remains in an

Rare Earths MMI: U.S. Rare Earth Strategy: What’s Behind the Latest Moves?

The Rare Earths MMI (Monthly Metals Index) moved sideways from September to October, rising by 2.13%. Over the last two weeks, U.S. officials have signaled

Raw Steels MMI: Will Mill Outages Halt Bearish Steel Prices?

The Raw Steels Monthly Metals Index (MMI) remained sideways, with a modest 0.82% rise from September to October. U.S. Steel Prices Remain in Search of

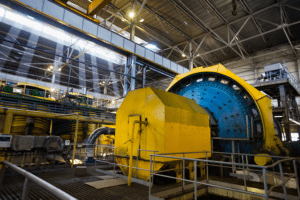

Global Copper Deficit Balloons as Grasberg Collapse Joins Year of Disruptions

The global copper market has had quite the year. On September 8, approximately 800,000 tons of wet material flooded multiple levels of the Grasberg Block

World Takes First Steps in Breaking China’s Stranglehold on Rare Earth Magnets Supply

Resource security when it comes to rare earth magnets is something the modern-day world has been desperately trying to get right. This is primarily due

Forecast

Look at Our Forecast Track Record & Metals Market Trends

Ignore the noise, but know the trend. MetalMiner’s track record on aluminum price forecasts by calling a bullish market or calling a bearish market means buying organizations can always generate cost savings or cost avoidance.