Raw Steels MMI: Steel Picks Up Speed as Industry Awaits Section 232 Outcome

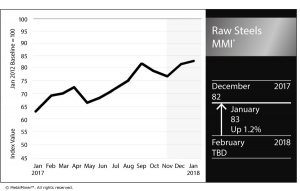

The Raw Steels MMI (Monthly Metals Index) jumped another 1.3% this month, reaching 83 points in January.

Steel momentum seems to have recovered this month. All forms of steel prices in the U.S. increased sharply. Steel momentum typically begins during the middle of Q4, but the increase occurred later this past year. January’s numbers also look bullish.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

In the U.S. market, January will prove to be a decisive month.

The U.S. Secretary of Commerce Wilbur Ross has until mid-January to conclude his Section 232 probes and release a report to the Trump administration, after which the president has 90 days to act.

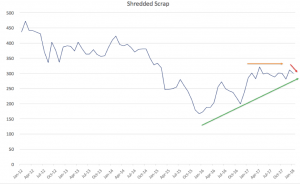

Shredded Scrap

The long-term shredded scrap price uptrend appears to have turned into a short-term sideways trend. Despite steel price increases in December, January scrap prices decreased.

Decreasing domestic scrap prices do not currently support steel prices. However, steel prices appear to be on a sustainable upward trend. Therefore, scrap prices could follow steel prices this month and continue their long-term uptrend.

Chinese Prices Still Strong

Chinese steel prices and U.S. prices usually tend to move similarly. Thus, when one reveals a strong upward or downward movement, the other could follow within that month.

Chinese prices were stronger than U.S. steel prices during November and December 2017. After the latest increase in U.S. steel prices, Chinese prices also continued rising.

Chinese steel prices have found support from the curtailment campaign in the country. Therefore, steel prices could continue increasing. Chinese Q4 GDP data, expected to show strength, also support Chinese steel prices. Chinese GDP data has come in over annual growth targets for the country.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to buy some volume. Buying organizations will want to pay close attention to Chinese price trends, lead times and whether domestic mill price hikes stick.

Buying organizations who have concerns about the Section 232 outcome and its impact on the steel industry may want to take a free trial now to our Monthly Metal Buying Outlook. Our February Monthly Outlook will include a detailed analysis of the Section 232 outcome.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Raw Steel Prices and Trends

The U.S. Midwest HRC 3-month futures price increased again this month by 3.9%, reaching $660/short ton. Chinese steel billet increased by 2.4%, while Chinese slab prices increased by 0.34% to hit $631/metric ton. The U.S. shredded scrap price closed the month at $300/st.

Leave a Reply