Last month MetalMiner made the following statement: “The impact on Grain Oriented Electrical steel buying organizations, MetalMiner believes, will not exactly mirror the broader impact of the tariffs on commonly purchased steel forms, alloys and grades.”

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

We don’t always get it right but indeed, GOES M3 prices fell last month in comparison to across-the-board price increases for all or nearly all other carbon flat rolled product categories.

Meanwhile, although MetalMiner knows of one buying organization pursuing an exclusion request via the recently published exclusion process, no company has yet to file one (at least as of April 11). That will change as GOES imports continue to arrive.

This month import levels jumped, as did Japanese imports, in particular.

[caption id="attachment_91308" align="aligncenter" width="580"]

Of note, Chinese imports remain negligible (240 tons) and no imports came from South Korea.

What About the Section 301 Investigation?

A quick search revealed that the 301 investigation also includes grain-oriented electrical steel with HTS Codes: 72261110, 72261190, 72261910 and 72261990 — basically “alloy silicon electrical steel (grain-oriented) of various widths.”

However, the 301 investigation does not include either transformer parts (8504.90.9546) or wound cores (8504.90.9542), both of which could come into the U.S. under current prevailing market treatment.

MetalMiner will update readers when/if President Trump publishes a proclamation on the 301 investigation.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month

Category: Premium

Stainless Steel MMI: LME Nickel Prices Fall But Stainless Steel Surcharges Rise

The Stainless Steel MMI (Monthly Metals Index) inched one point higher in April. The current reading is 76 points.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The index’s increase was driven by the rise in stainless steel surcharges, despite slightly falling LME nickel prices this month. Other related metals in the stainless steel basket increased.

LME Nickel

In April, nickel price momentum appears to have recovered from its previous pace.

LME nickel prices dropped in March, along with other base metals. However, the drop appears less sharp than for aluminum or copper.

[caption id="attachment_91260" align="aligncenter" width="580"]

LME nickel prices remain high and far away from 2017 lows back in May or June, when MetalMiner recommended buying organizations buy some volume forward. Prices back at that time were around $8,800/mt versus the current $13,200/mt price level.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month.

The 316/316L-coil NAS surcharge reached $0.96/pound. Therefore, buying organizations may want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

[caption id="attachment_91261" align="aligncenter" width="580"]

The pace of stainless steel surcharge increases appears to have slowed this month. However, surcharges have increased from 2017. The 316/316L-coil NAS surcharge is closer to $0.96/pound.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, with steel prices skyrocketing.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

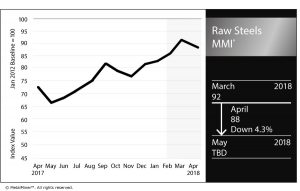

Raw Steels MMI: Domestic Steel Price Momentum Picks Up

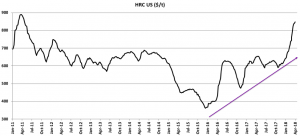

The Raw Steels MMI (Monthly Metals Index) fell four points this month, dropping to 88. Despite the drop in the Raw Steels MMI, domestic steel price momentum has been on a tear throughout March. All prices for the main forms of flat-rolled steel products have reached more than seven-year highs.

Domestic steel prices accelerated their pace of increases in such a way that HRC domestic prices have risen from the $600-$650/st level to around $850 in the last three months.

[caption id="attachment_91239" align="aligncenter" width="580"]

The steel price increase comes as a result of several factors. First, the long-term trend that started in 2016 created upward movement for steel prices. Second, the delayed steel sector cyclicality (seasonality) has pushed the steel price slope even steeper.

Historically, prices usually increase during Q4 as many companies renegotiate their annual agreements as part of the budgeting season for the following year. However, this year, steel price increases didn’t occur until later. Prices appeared to wait for the Section 232 outcome (with its corresponding tariffs), which acted as a support for domestic steel prices.

However, domestic steel prices seem closer to the end of this latest price rally. Based on historical steel price cyclicality, lower Chinese steel prices and decreasing raw material prices, domestic steel prices may fall in the coming months.

The Divergence in Steel Prices

Chinese steel prices and U.S. steel prices usually trade together. However, the short-term trend sometimes shows some divergences.

Short-term trends may be created by local uncertainty or sudden disruptions with local supply. But these short-term trends tend to correct, and return to their historical pattern.

[caption id="attachment_91240" align="aligncenter" width="580"]

When looking at Chinese and U.S. HRC prices in tandem, the price divergence observed this month leaves no one surprised.

U.S. HRC prices skyrocketed, while Chinese HRC prices continue to fall. It is true that Chinese HRC prices increased sooner in 2017 (starting June 2017), supported by the steel industry cuts in China. The spread between Chinese and domestic steel prices dropped in Q3 2017, as U.S. domestic steel prices traded sideways. The recent drop in Chinese steel prices may create downward price pressure for domestic steel prices.

Global Steel Market

Chinese steel production cuts continue. The city of Handan ordered steel mills to cut around 25% of their steel production to continue the pollution curb measures. These cuts will be extended from April to mid-November. The coking coal industry will also cut production by around 25% over that period. The cuts started on April 1.

According to the Mexican government’s official gazette, the Mexico economy ministry has formally imposed anti-dumping duties on carbon steel pipe imports from South Korea, Spain, India and Ukraine.

Raw Materials

After the prior raw material price increases at the end of 2017, raw material dynamics seem to have slowed down.

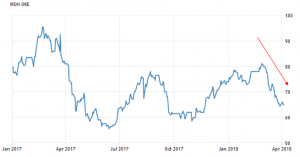

Iron ore prices fell sharply in March. Iron ore prices increased slightly at the beginning of this month. However, the sharp decrease in prices last month may not support the current highs in domestic steel prices.

[caption id="attachment_91243" align="aligncenter" width="580"]

Coal prices also fell in March. Coal prices seem to be increasing slightly again this month, even if current prices remain far away from the $110/mt highs in January 2018.

[caption id="attachment_91244" align="aligncenter" width="580"]

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit to mid- and long-term purchases. Buying organizations looking for more clarity on when to buy and how much to buy of their steel products may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends

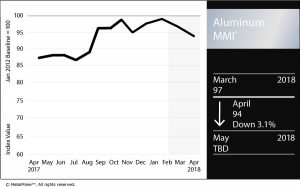

Aluminum MMI: LME Aluminum Continues Downtrend

The April Aluminum MMI (Monthly Metals Index) fell three points. A weaker LME aluminum price led to the price retracement. The current Aluminum MMI index stands at 94 points, 3% lower than in March.

LME aluminum price momentum slowed again this month. LME aluminum prices remain in a current two-month downtrend.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_91252" align="aligncenter" width="580"]

Though some may want to declare a bearish market for aluminum, prices are still over the $1,975 level, when MetalMiner recommended buying organizations buy forward. Prices may retrace back toward that level. However, if prices fall below the blue-dotted line, aluminum prices could shift toward bearish territory.

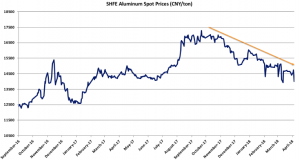

SHFE Aluminum

SHFE aluminum spot prices also fell this month. The degree of the decline appears less sharp than for LME prices. However, SHFE aluminum spot prices started to fall in October 2017.

[caption id="attachment_91253" align="aligncenter" width="580"]

Shanghai Futures Exchange (SHFE) aluminum stocks fell in March for the first time in more than nine months. Decreasing stocks sometimes point to falling inventories of aluminum in China, the world’s biggest aluminum producer and consumer. SHFE stocks dropped by 154 tons in March, according to exchange data released at the beginning of April. However, SHFE aluminum stocks still stand at 970,233 tons.

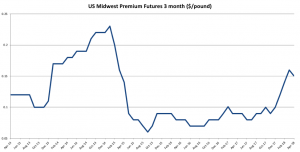

MW Aluminum Premiums

Meanwhile, U.S. Midwest aluminum premiums fell for the first time since November 2017. The $0.01/pound drop at the beginning of April comes after a sharp uptrend in the premium. Despite the lower premium this month, the pace of the increases may continue for some time.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

However, as prices are currently trading lower, buying organizations may want to wait until the market shows a clearer direction. Therefore, adapting the “right” buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to take a free trial now to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Global Precious MMI: Palladium, Platinum Prices Continue Holding Under $1,000/Ounce

Last month, in our headline for the monthly update article on the Global Precious MMI, we called out the fact that platinum and palladium prices had dropped. Then we asked: “Will it continue?”

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Well folks, if our Magic 8-Ball were to answer, it’d say — signs point to yes.

At least for this month’s index reading.

With losses in U.S. platinum and palladium pricing leading the way, our Global Precious Monthly Metals Index (MMI), tracking a basket of precious metals from across the globe, floated down yet again for April — dropping 1.1% and settling into a two-month downtrend.

(Last month, we had initially reported that before March’s drop, the index had been in a two-month uptrend. Correction: it had in fact been in a four-month uptrend at that point.)

Both stock markets and commodities markets have been in a bit of turmoil lately, with President Trump implementing tariffs on steel, aluminum and potentially 1,300 categories’ worth of additional Chinese imports mid-last month, and China coming back with retaliatory tariffs on a number of non-metal U.S. commodity exports.

It wouldn’t be a stretch to say that knock-on effects are being seen in the precious metals markets.

PGMs Lead the Way

Gold prices in the U.S., China and India were slightly up on the month (with the Japan price holding relatively steady), and even silver prices in China and India increased.

Yet platinum and palladium prices told a different story.

Both platinum and palladium bar prices dropped across all geographies (U.S., Japan, China) — the U.S. platinum bar price sunk 3.5% and the U.S. palladium bar price fell 3.2%.

The longer-term picture for platinum as a crucial component of industrial manufacturing continues to get murkier.

According to a Reuters interview with Bart Biebuyck, executive director of the European Commission’s fuel cell and hydrogen joint undertaking, “the volume of platinum used in fuel cell-powered cars could be cut to ‘micro levels’ within three years and eradicated altogether in a decade’s time, making these environmentally-friendly vehicles much cheaper to buy.”

He said the amount of platinum in the next generation of fuel cell cars had already been cut to levels similar to that used in the catalytic converters of diesel vehicles, which industry estimates put at 3-7 grams, according to Reuters.

With the automotive industry — which accounts for about 40% of platinum demand — looking to cut costs, that 3-to-7-gram range for diesel vehicles may steadily but surely decrease in coming years. That’s because, as we reported last month, the gradual but very real retirement of diesel engines across the European continent continued.

A German court ruled that cities have the right to ban diesel cars from driving the roads in certain areas. Of course, the Volkswagen scandal and its aftermath proved to be a big blow for diesel cars, as well.

If more diesel engines go extinct, with them will go corresponding PGM consumption for catalytic converters.

For more efficient carbon steel buying strategies, take a free trial of MetalMiner’s Monthly Outlook!

Key Price Movers and Shakers

Copper MMI: LME Copper Prices Fall

The Copper MMI (Monthly Metals Index) traded lower again this month, falling two points to 85. The Copper MMI dropped to December 2017 levels, driven by falling LME copper prices.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

When looking at the long-term trend, copper prices have held above the dotted blue line since September 2016. Although prices dipped a bit below the blue dotted line at the end of March, the line represents the current copper floor. Prices falling below the dotted line could suggest a short-term price correction.

[caption id="attachment_91215" align="aligncenter" width="580"]

Meanwhile, trading volume appears to be about the same as last month, when selling volume appeared weak. As the selling volume remains weak, the downtrend seems more like a short-term price correction than a change of trend.

Buying organizations may want to closely follow copper prices in the coming month or read our Monthly Metal Outlook in order to anticipate copper price movements.

Copper Stocks and Supply

LME copper stocks currently stand at 324,900 tons, up by 13,075 tons since the start of 2017 and 85,500 tons since the start of 2016.

According to the International Copper Study Group (ICSG), the provisional 2017 refined copper deficit was 163,000 tons. The situation for 2018 will also depend on the supply side, as many of the largest copper mines have upcoming labor contract negotiations still pending.

On top of that, the Caserones copper mine in Chile announced a shutdown this month in order to replace a leaking pipe. However, this shutdown is only partial and may not have a big effect on copper production.

Copper Scrap

Both Chinese copper scrap prices and LME copper prices typically trade together. In March, Chinese copper scrap prices fell to $6,035/mt. LME prices also fell but remain in a long-term uptrend. The same is true for copper scrap.

[caption id="attachment_91216" align="aligncenter" width="580"]

The spread between Chinese scrap copper prices and LME copper seems to be wider than it was back in 2016 and 2017. A wider spread may boost scrap copper demand for the applications that it are suitable due to its lower price.

What This Means for Industrial Buyers

Copper prices are currently approaching December support (at $6,530/mt) levels, when prices last dipped during the bullish rally.

Buying organizations bought some volume then. As long as copper prices remain bullish, buying organizations may want to buy on the dips. For those who want to understand how to reduce risks, take a free trial now to the MetalMiner Monthly Outlook.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Copper Prices and Trends

Automotive MMI: U.S. Auto Sales Rev Up for 6.3% Year-Over-Year Jump in March

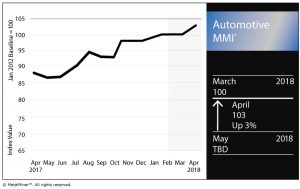

The Automotive Monthly Metals Index (MMI) jumped three points for an April reading of 103 after a month that saw the U.S. impose Section 232 tariffs of 25% and 10% on steel and aluminum imports, respectively, in addition to escalating trade tensions between the U.S. and China.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap jumped 3.1%, while LME copper continued its 2018 cooling down, dropping 2.5% month over month.

Chinese primary lead jumped 1.3%.

U.S. Auto Sales

According to monthly sales data release by Autodata Corp, it was a strong month for several of the top automakers in the U.S. market.

General Motors posted a 15.7% increase in sales year over year, and is up 3.8% in the year to date compared with the same time frame last year.

Ford Motor Co. saw its sales jump 3.5% year over year in March, but remains down 2.7% in the year to date.

Fiat Chrysler’s March sales jumped 13.6% year over year, and boasts an 0.8% increase for the year to date. Toyota’s sales jumped 3.5% in March year over year and is up 7.4% in the year to date. Honda also had a good month, posting a year-over-year sales increase of 3.8%; however, its year-to-date sales are down 0.8%.

Volkswagen, Mitsubishi and Mazda continued what has been a strong 2018 for each of them. Volkswagen’s March sales rose 13.5% year over year, while the German automaker’s year-to-date sales are up 9.9%. Mitsubishi jumped 21.7% in March and is up 22.7% in the year to date. Mazda, meanwhile, posted a 35.7% increase in March and is up 21.6% in the year to date.

In total, vehicle sales in March were up 6.3% year over year and are up 1.9% in the year to date. American consumers continue to prize light trucks, as sales of those vehicles rose 16.3% year over year in March and are up 9.8% for the year to date.

U.S.-China Trade Tensions Rise

Earlier this week, the Office of the United States Trade Representative released a list of 1,300 Chinese products that could be hit with tariffs (stemming from the administration’s Section 301 probe of Chinese trade practices).

Not long after, China announced it would place 25% tariffs on 106 U.S. products, including autos, Reuters reported.

Tesla and Tariffs

It’s been a rough couple of weeks for Tesla.

In late March, the fatal crash of a Tesla Inc. Model X led to a massive selloff, leading to an 8.2% drop in its stock and its lowest closing in almost a year, CNBC reported.

On top of that, the electric vehicle (EV) maker continues to struggle with the cold, hard reality of production timelines. CNBC reported that Tesla missed its quarterly goal of producing 2,500 Model 3s per week.

The stock price recovered Tuesday, but Wednesday’s news of $50 billion in tariffs from China — in retaliation to the U.S.’s own recent announcement regarding a potential $50 billion in tariffs on Chinese imports — is another hit to the EV firm.

According to Bloomberg, China accounted for 17% of Tesla’s 2017 revenue.

Actual Metal Prices and Trends

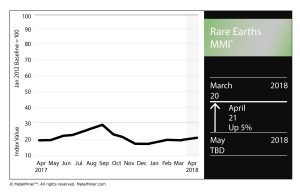

Rare Earths MMI: Metals Prices Move Up, Demand for Neodymium Grows

The Rare Earths Monthly Metals Index (MMI) picked up a point this month, rising from 20 for an April reading of 21.

The basket of metals posted price gains across the board this past month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Yttrium rose 1.2%, while terbium oxide rose 1.6%. Neodymium oxide rose 0.2%, europium oxide was up 1.3% and dysprosium oxide was up 0.8%.

Growing Demand for Neodymium

A move by Tesla to a magnetic motor for its Model 3 Long Range car, Reuters reported last month, will add pressure on an already constrained neodymium market.

According to the research group imarc, the market for the neodymium-iron-boron magnet used for the magnetic motors is now worth more than $11.3 billion, Reuters reported.

Global demand for neodymium exceeded supply by 3,300 tons, according to the report.

With the demand for electric vehicles growing more and more, so too will the demand for rare-earth metals like neodymium. Complicating the supply landscape, however, is China’s total dominance in the rare earths market. Given rising trade tensions, stemming from the Trump administration’s recent Section 232 steel and aluminum tariffs, plus the recent Section 301 announcement — the Office of the United States Trade Representative yesterday posted a proposed list of Chinese products that could be subject to tariffs — the neodymium supply market is something to be monitored.

As Reuters notes, China previously instituted a neodymium export ban, which was lifted in 2015 — could it happen again? That remans to be seen, but increasingly inflamed global trade relations certainly don’t do anything to tamp down the possibility.

Speaking of Trade Tensions…

Bloomberg speculated last month on ways China could retaliate against the U.S. should the latter eventually impose tariffs on Chinese goods amounting to potentially $50-$60 billion.

The article notes that in 2010, China stopped giving Japan export licenses for rare earth metals used in cars and electronics, as a result of tensions related to islands in the East China Sea.

Again, it remains to be seen what the rising tensions mean for the rare-earths market, but it is certainly worth monitoring going forward.

Searching from Above

In the search for new deposits of rare earths (and metals, in general), scientists are looking from a bird’s eye view — or, rather, a drone’s eye view.

According to a report in The Guardian, German scientists are using drones to scout out potential new sources of metals. The scientists are using drones, equipped with special cameras and sensors, to identify potential deposits based on the unique reflections of light various minerals produce, according to the report.

As noted above, the demand for rare earth materials is only going to increase, not just for application in electric vehicles, but also in other high-tech products.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Stainless MMI: LME Nickel Prices Drop While Stainless Surcharges Rise

The Stainless Steel MMI (Monthly Metals Index) traded flat in March after a big jump in February. The current reading is 75 points.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The index remained flat as LME nickel prices decreased slightly, while other elements of the stainless steel basket increased. Stainless steel surcharges jumped again this month, largely following the previous month’s LME nickel price movements.

LME Nickel

Nickel momentum appears to have slowed since the beginning of March. Prices retraced slightly. However, nickel prices remain in a strong, long-term uptrend.

[caption id="attachment_90804" align="aligncenter" width="580"]

Like copper prices, nickel prices remain above the blue dotted line above. In December, nickel prices rallied and started to trade with a sharper slope, following the purple dotted line.

However, these movements are often not sustainable in the long-term trend, and commonly correct. Therefore, nickel prices retraced to their long-term trendline, while trading volume remains supportive of the uptrend.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased further this month.

The 316/316L-coil NAS surcharge breached its previous $0.8/pound ceiling. Stainless steel surcharges increased again rapidly. Therefore, buying organizations will want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

[caption id="attachment_90805" align="aligncenter" width="580"]

Tariffs Do Not End in the U.S.

The European Commision prolonged the already existing anti-dumping measures on Chinese imports of stainless steel seamless pipes and tubes for another five years. The duties imposed initially in 2011 ranged from 48.3% to 71.9%. These duties gave European stainless steel producers — like France, Spain and Sweden — some breathing room.

The review of these measures started again in December 2016 and showed the removal of duties on Chinese products would harm European producers.

Therefore, the European Commission agreed to maintain the current duties on pipes and tubes used in the chemical and petrochemical industries for another five years.

Although the Europeans have not enacted broad tariffs like the U.S. has done via Section 232 of the Trade Expansion Act of 1962, the issue of global overcapacity remains paramount as the E.U. continues to implement heavy duties on stainless steel products to limit imports.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, recovering from its previous weakness.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

Buying organizations who have concerns about the Section 232 impact on the steel industry may want to read our comprehensive Section 232 Report, which includes new data.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

GOES MMI: M3 Prices Rise with Section 232 Support

The impact of the president’s Section 232 proclamation applying a 25% import duty on all steel articles with HTS codes 7206.10 through 7216.50, will have a somewhat predictable impact on steel prices (they will increase, at least in the short term).

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The impact on grain-oriented electrical steel (GOES) buying organizations, MetalMiner believes, will not exactly mirror the broader impact of the tariffs on commonly purchased steel forms, alloys and grades.

But first, the reaction to the announcement of the steel tariffs from Roger Newport, the CEO of AK Steel, and the last remaining GOES producer in the U.S.: “We support President Trump for taking the bold action of imposing a 25% global tariff on steel to defend America’s steel industry and its workers from imports that threaten our national and economic security,” he said. “Nowhere is this threat more evident than in electrical steel where AK Steel is now the only domestic producer of electrical steel for electrical transformers. Years of surging imports and the subsequent market volatility caused the only other U.S. producer to exit the market in 2016. This action by the President could not come soon enough as the surge of electrical steel imports continued throughout last year, with imports nearly doubling in 2017 when compared to 2016.”

GOES Markets Are More Nuanced Than Other Flat Rolled Products Markets

GOES markets serve as an example of where and how certain sub-segments of the steel industry will attempt to carve out exceptions and/or exemptions from the tariff proclamation — specifically, under point 11 of Trump’s proclamation.

MetalMiner believes that Japanese producers, along with their importing partners and customers, will petition the Department of Commerce for an exception by proving that certain highly engineered grades of electrical steel are not in fact produced in the United States.

The president’s proclamation identifies the procedure by which exceptions can be made:

The Secretary, in consultation with the Secretary of State, the Secretary of the Treasury, the Secretary of Defense, the United States Trade Representative (USTR), the Assistant to the President for National Security Affairs, the Assistant to the President for Economic Policy, and such other senior Executive Branch officials as the Secretary deems appropriate, is hereby authorized to provide relief from the additional duties set forth in clause 2 of this proclamation for any steel article determined not to be produced in the United States in a sufficient and reasonably available amount or of a satisfactory quality and is also authorized to provide such relief based upon specific national security considerations. Such relief shall be provided for a steel article only after a request for exclusion is made by a directly affected party located in the United States.

Clearly, the impact of imports on the domestic GOES market has come on the back of rising and significant Japanese imports. China and South Korea are non-players for GOES into the U.S.

[caption id="attachment_90783" align="aligncenter" width="580"]

The real question involves whether or not customers of Japanese products will be able to prove that the materials they are buying from Japan, are indeed not produced in the U.S.

The president has mandated that the secretary of commerce issue procedures for requests for tariff exclusions within 10 days of the proclamation date (which was March 8).

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month