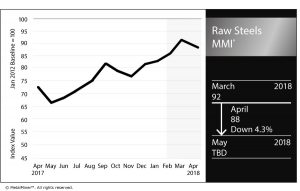

Raw Steels MMI: Domestic Steel Price Momentum Picks Up

The Raw Steels MMI (Monthly Metals Index) fell four points this month, dropping to 88. Despite the drop in the Raw Steels MMI, domestic steel price momentum has been on a tear throughout March. All prices for the main forms of flat-rolled steel products have reached more than seven-year highs.

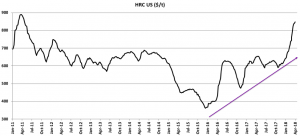

Domestic steel prices accelerated their pace of increases in such a way that HRC domestic prices have risen from the $600-$650/st level to around $850 in the last three months.

The steel price increase comes as a result of several factors. First, the long-term trend that started in 2016 created upward movement for steel prices. Second, the delayed steel sector cyclicality (seasonality) has pushed the steel price slope even steeper.

Historically, prices usually increase during Q4 as many companies renegotiate their annual agreements as part of the budgeting season for the following year. However, this year, steel price increases didn’t occur until later. Prices appeared to wait for the Section 232 outcome (with its corresponding tariffs), which acted as a support for domestic steel prices.

However, domestic steel prices seem closer to the end of this latest price rally. Based on historical steel price cyclicality, lower Chinese steel prices and decreasing raw material prices, domestic steel prices may fall in the coming months.

The Divergence in Steel Prices

Chinese steel prices and U.S. steel prices usually trade together. However, the short-term trend sometimes shows some divergences.

Short-term trends may be created by local uncertainty or sudden disruptions with local supply. But these short-term trends tend to correct, and return to their historical pattern.

When looking at Chinese and U.S. HRC prices in tandem, the price divergence observed this month leaves no one surprised.

U.S. HRC prices skyrocketed, while Chinese HRC prices continue to fall. It is true that Chinese HRC prices increased sooner in 2017 (starting June 2017), supported by the steel industry cuts in China. The spread between Chinese and domestic steel prices dropped in Q3 2017, as U.S. domestic steel prices traded sideways. The recent drop in Chinese steel prices may create downward price pressure for domestic steel prices.

Global Steel Market

Chinese steel production cuts continue. The city of Handan ordered steel mills to cut around 25% of their steel production to continue the pollution curb measures. These cuts will be extended from April to mid-November. The coking coal industry will also cut production by around 25% over that period. The cuts started on April 1.

According to the Mexican government’s official gazette, the Mexico economy ministry has formally imposed anti-dumping duties on carbon steel pipe imports from South Korea, Spain, India and Ukraine.

Raw Materials

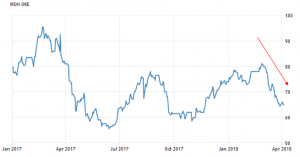

After the prior raw material price increases at the end of 2017, raw material dynamics seem to have slowed down.

Iron ore prices fell sharply in March. Iron ore prices increased slightly at the beginning of this month. However, the sharp decrease in prices last month may not support the current highs in domestic steel prices.

Coal prices also fell in March. Coal prices seem to be increasing slightly again this month, even if current prices remain far away from the $110/mt highs in January 2018.

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit to mid- and long-term purchases. Buying organizations looking for more clarity on when to buy and how much to buy of their steel products may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends

The U.S. Midwest HRC 3-month futures price dropped this month by 3.65%, falling to $817/st. Chinese steel billet prices decreased by 10.50%, while Chinese slab prices fell just by 0.5%, dropping to $659/mt. The U.S.shredded scrap price closed the month at $361/st, increasing by 3.14% from last month.

Leave a Reply