The May MMI Report: LME Aluminum Price Wobbles Around Sanctions Announcements

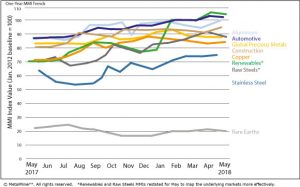

In case you missed it, our latest round of Monthly Metals Index (MMI) reports is in the books.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Last month was a busy one, as countries scrambled to win exemptions from the U.S.’s Section 232 steel and aluminum tariffs. South Korea, Australia, Argentina and Brazil won long-term exemptions. The E.U., Canada and Mexico, meanwhile, received 30-day extensions on their temporary exemptions, pushing the deadline for implementation vis-a-vis their exports to June 1.

In addition, the announcement of sanctions against Russian companies and their owners — including Russian aluminum giant Rusal — saw the aluminum price surge to a more than seven-year high amid concerns about supply. The price, however, came back down to earth after the U.S. Treasury extended its deadline for businesses to wind down operations with the Russian firms on their initial list and opened the door to the easing of sanctions if oligarch Oleg Deripaska steps down from his role with Rusal.

In other MMI highlights:

-

- The Aluminum MMI picked up six points for a May reading of 100.

- U.S. imports of grain-oriented electrical steel (GOES) dipped significantly in April compared with the previous month.

- LME copper prices also continued to bounce back after a short-term downtrend in Q1.

- Gold demand in Q1 was at its lowest level in 10 years, according to the World Gold Council.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Read about all of the above and much more by downloading the May MMI report below.

[s3medialinksafe title=”Download the Report Here” file=”MMIReport_May2018.pdf” expireseconds=”300″ target=”_blank” /]

Leave a Reply