Aluminum MMI: LME Aluminum Prices Lead the Way

The June Aluminum Monthly Metals Index (MMI) increased one point. The current Aluminum MMI index now stands at 101 points.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

LME aluminum prices showed strength in May, and are continuing to increase this month.

Aluminum has led the base metals complex due to U.S. tariffs and sanctions. These actions, in turn, create all sorts of ripple effects that impact global supply.

LME aluminum prices have reached 2012 levels. The base metal began its long-term uptrend in early 2016. Buying organizations need to identify buying dips to avoid costs and mitigate aluminum price risk.

Global Aluminum Industry

U.S. sanctions on some Russian aluminum companies raised concerns regarding global aluminum supply.

The sanctions increased volatility and moved LME aluminum prices to $2,716/mt (maximum value reached during a trading day). Sanctions eased, as the time frame moved out to October. Prices retraced, but remain high.

Other countries suspended aluminum buys from Russian companies, to supply aluminum products to the U.S. As an example, Japan’s UACJ Corporation, a major manufacturer of rolled aluminum products, suspended all of its aluminum purchases from Russia’s Rusal. The company claimed it found alternative supplies, but has not declared the sources.

Aluminum smelters have scheduled restarts, taking advantage of higher LME aluminum prices and supply concerns.

A Rio Tinto aluminum smelter in New Zealand will expand output this year after securing a new energy deal. The restart will take around six months, and will add 85 tons of daily production. This results in a 9% increase of annual output. Aluminum products will include aluminum ingot, billet and rolling block. Alumina comes from Australian refineries, and around 90% of the production in this region goes toward exports.

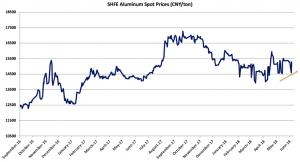

SHFE Aluminum

Last month, MetalMiner reported a possible increase in aluminum and aluminum product Chinese exports due to the shortages outside China.

Semi-finished Chinese aluminum exports increased by 20.5% in Q1 2018 and, if they maintain this pace, could hit a record. Therefore, SHFE aluminum prices may see some price increases in the short term.

Chinese SHFE prices rose by 4.8% in May. The increase appears higher than LME aluminum prices, but still follows the main long-term uptrend. SHFE aluminum prices have also increased this month.

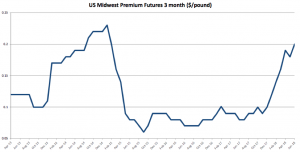

U.S. Domestic Aluminum

As a result of the ongoing uncertainty in the aluminum market, U.S. aluminum Midwest Premiums increased again in June to $0.20/pound, climbing to a more than four-year high. Last month, the U.S. Midwest Premium fell for the first time since November 2017.

What This Means for Industrial Buyers

LME aluminum price trends suggest a continuation of the bull market that started last year.

Tariffs, sanctions and the latest tariff non-exemptions to Canada, Mexico and the E.U. add support to increasing prices, both for LME aluminum and the U.S. Midwest Premium.

Adapting the right buying strategy becomes crucial to reducing risks. Buying organizations that want to start doing so now may want to take a free trial to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

The Aluminum MMI basket generally increased this month.

LME aluminum prices rose this month by 2.7%, with a closing price in May of $2,286/mt. Meanwhile, Korean Commercial 1050 sheet increased by 3.72%.

Chinese aluminum primary cash prices fell by 0.7%, while China aluminum bar remained flat. Chinese aluminum billet prices also traded flat this month, at $2,453/mt.

The Indian primary cash price rose by 1.76% to $2.31/kilogram.

Leave a Reply